Power Your Compliance Stack with Intelligent, Integrated Capabilities

AI-powered features designed to streamline operations, enhance accuracy, and scale effortlessly across complex financial ecosystems.

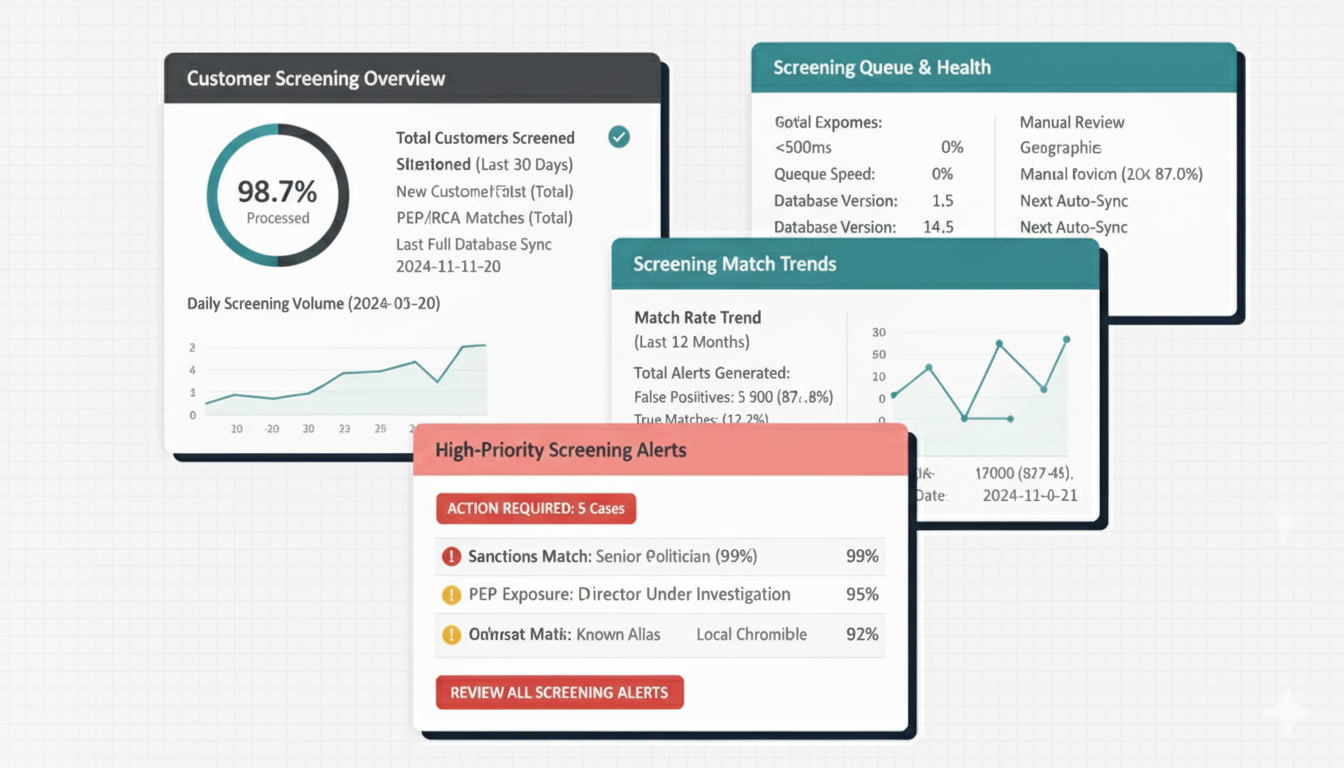

Customer Screening

Instantly screen individuals against global risk databases to prevent onboarding fraud, regulatory breaches, and reputational exposure.

Learn more

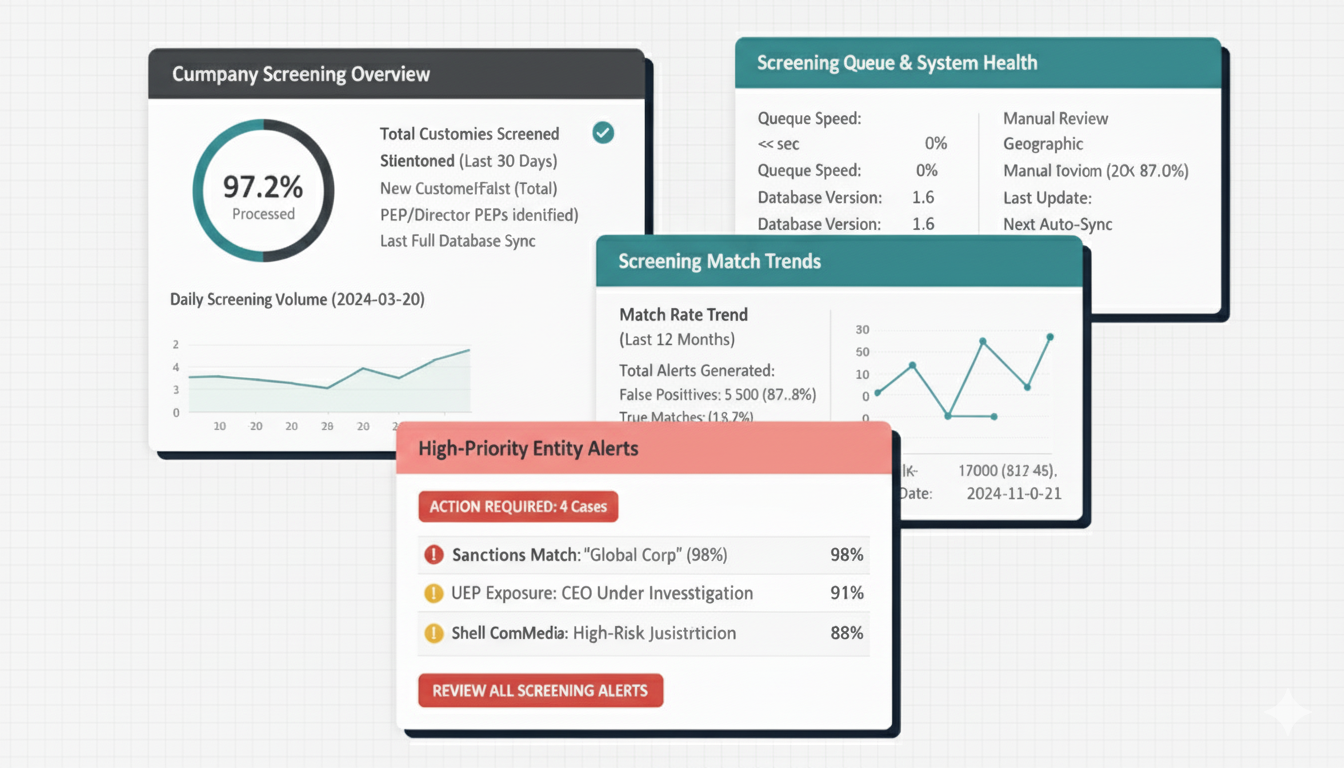

Entity Screening

Verify businesses with real-time KYB, sanctions, and UBO intelligence to mitigate third-party and entry-level compliance risk.

Learn more

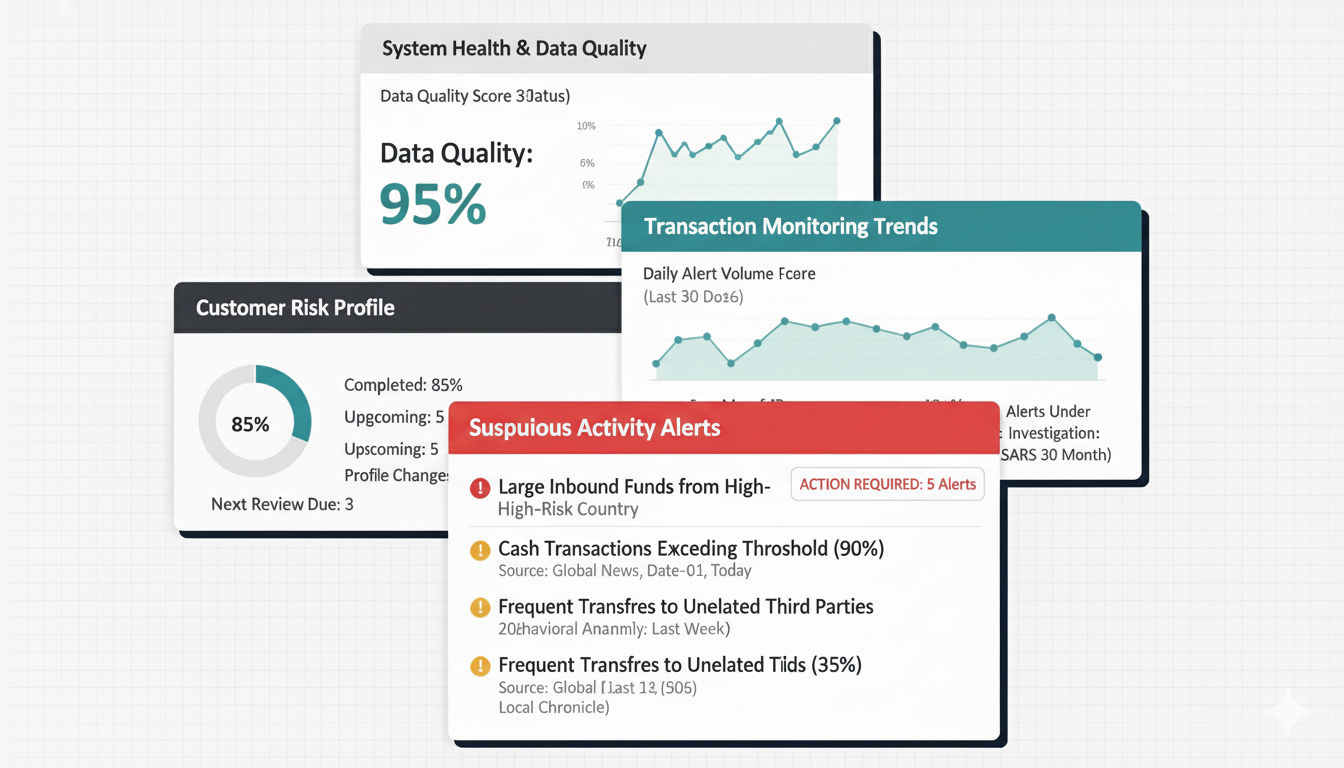

Transaction Monitoring

Monitor transactions in real-time using configurable risk rules to detect suspicious patterns, anomalies, and financial crime activity.

Learn more

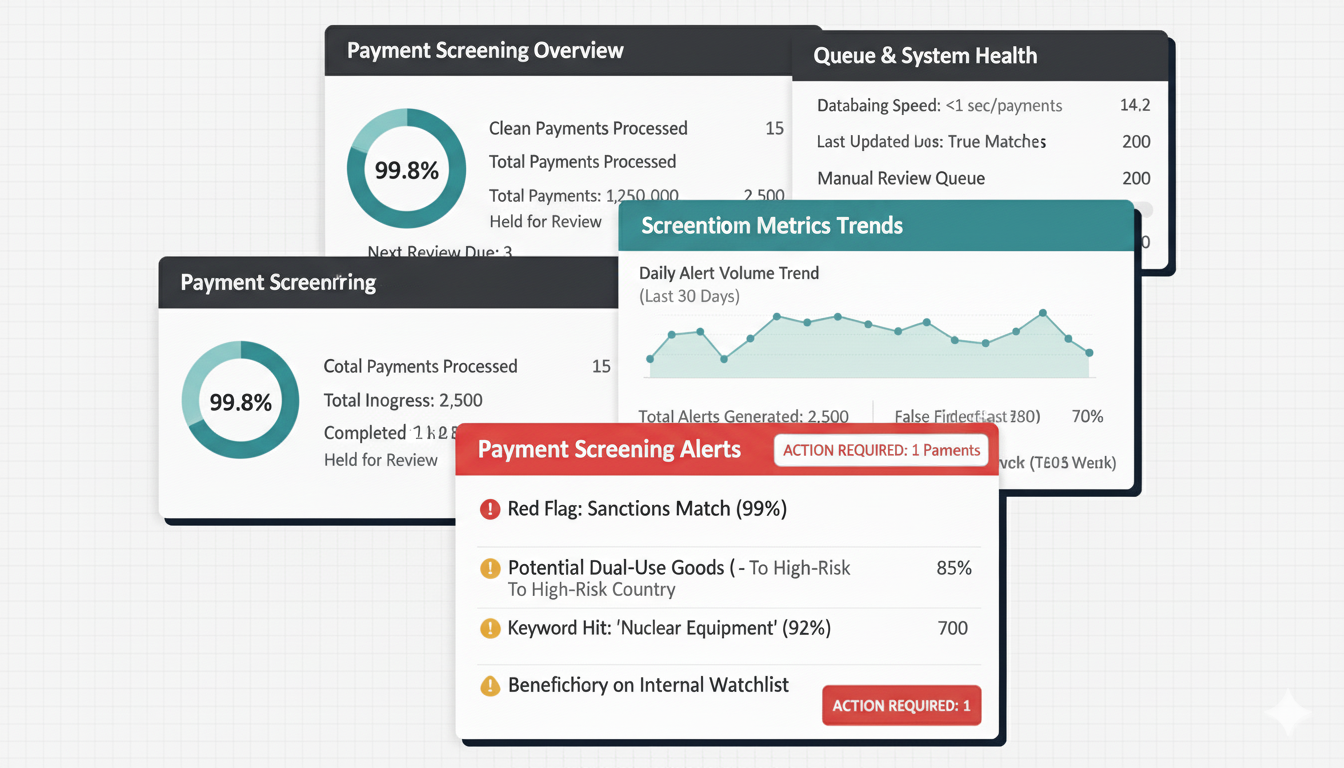

Payment Screening

Screen cross-border and domestic payments instantly to flag prohibited entities, embargoed jurisdictions, or compliance violations pre-settlement.

Learn more

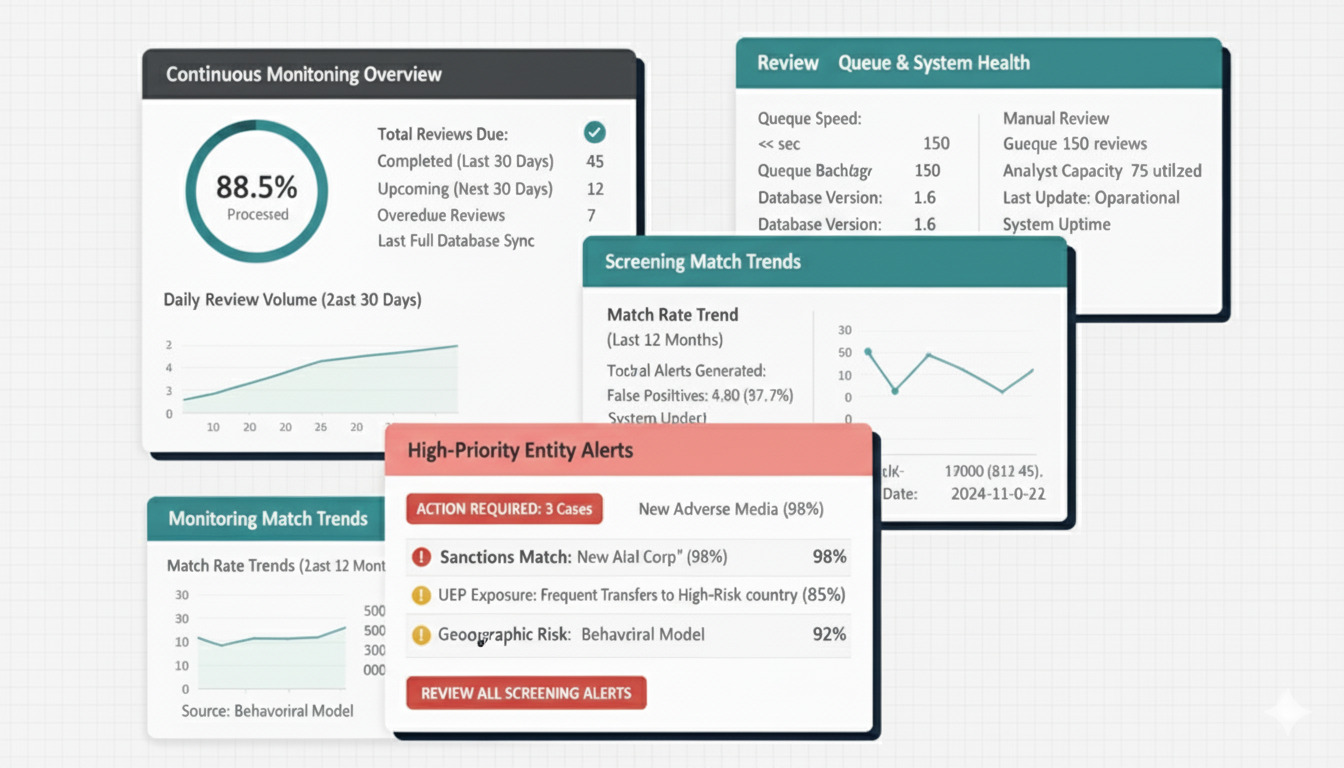

Continuous Monitoring

Track risk profile changes continuously to detect new threats, maintain compliance posture, and meet evolving regulatory expectations globally.

Learn more

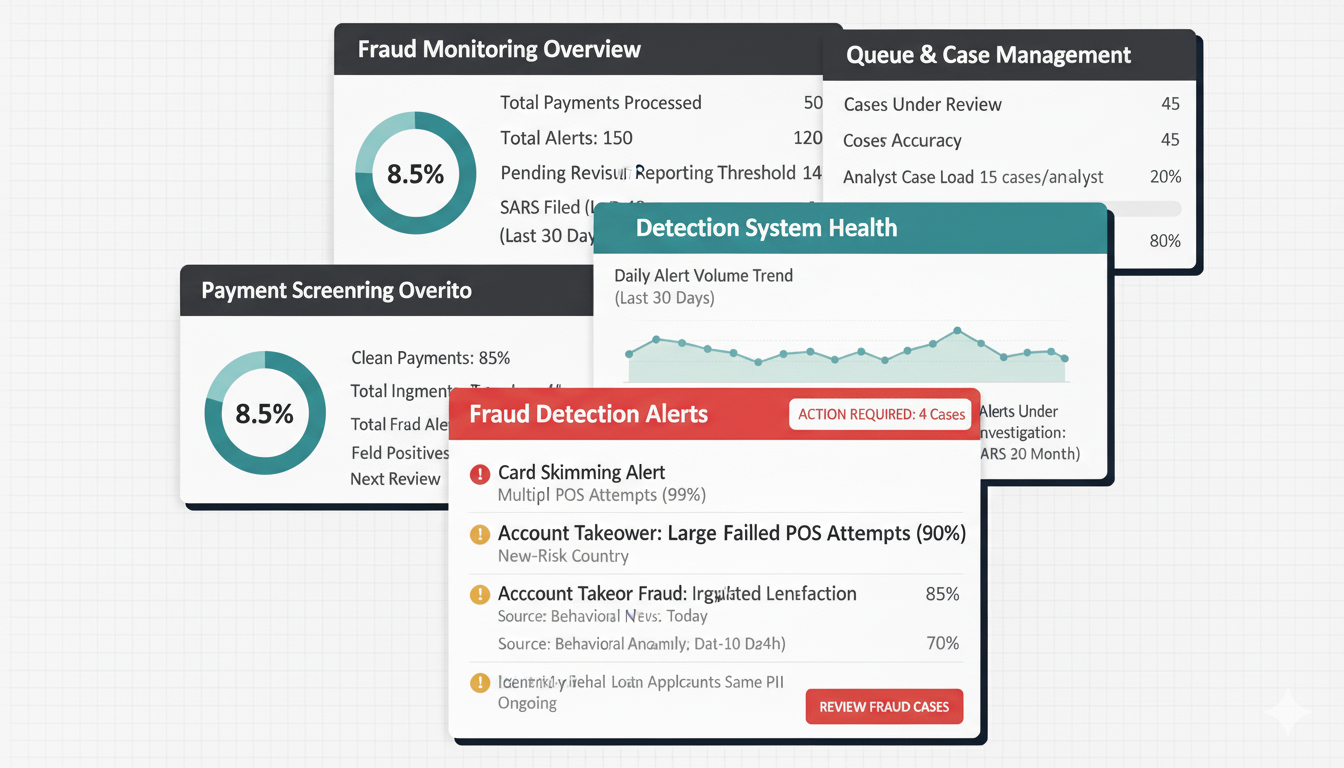

Fraud Detection

Detect and respond to synthetic IDs, account takeover attempts, and abnormal behavior using intelligent behavior-based fraud detection models.

Learn more

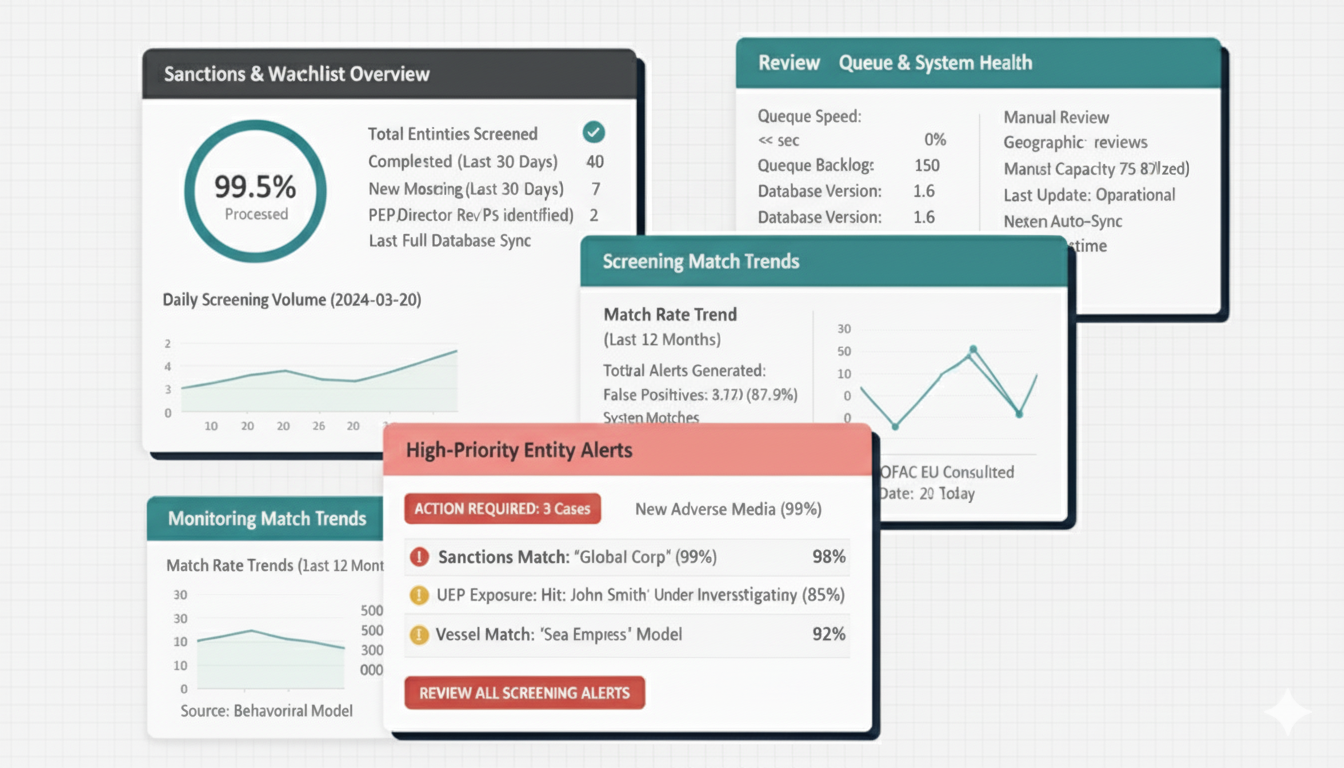

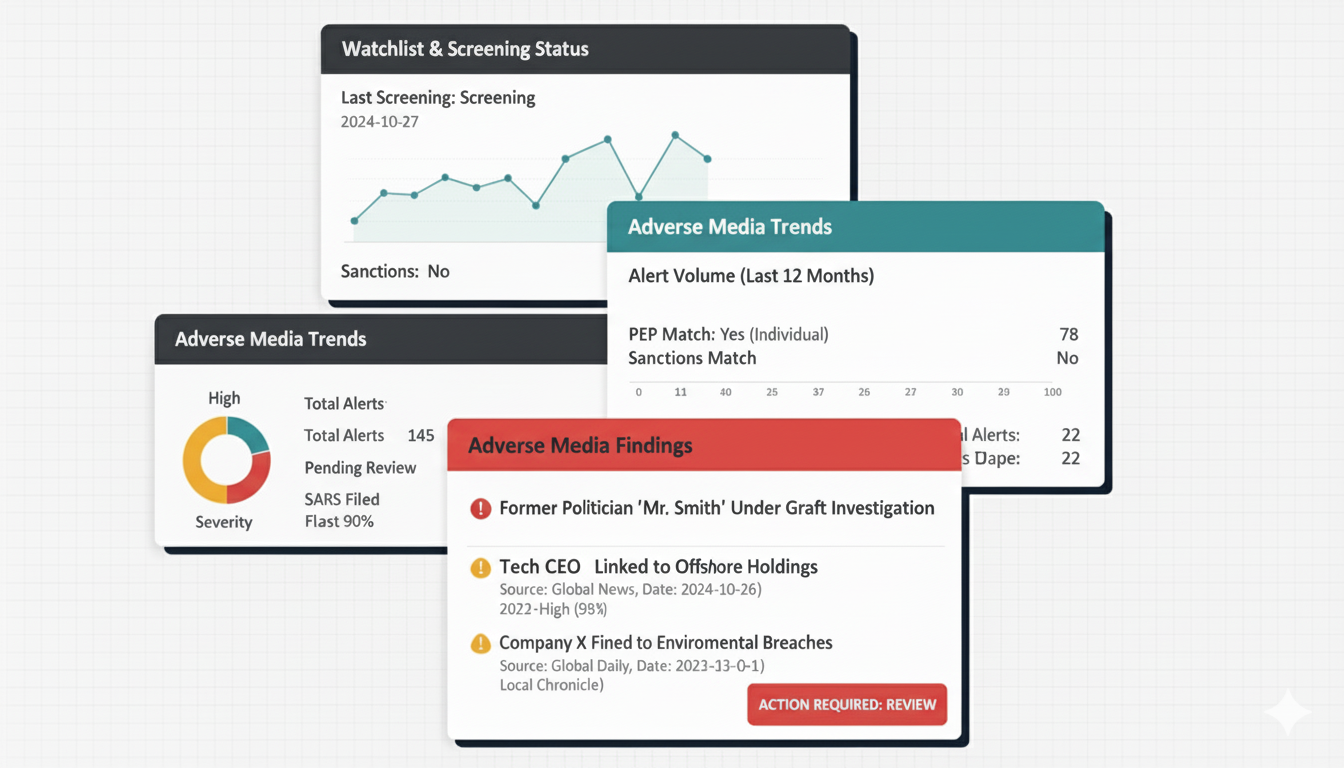

Sanctions & Watchlists

Automatically screen against OFAC, UN, EU, and 1,500+ global lists with real-time updates and zero coverage gaps.

Learn more

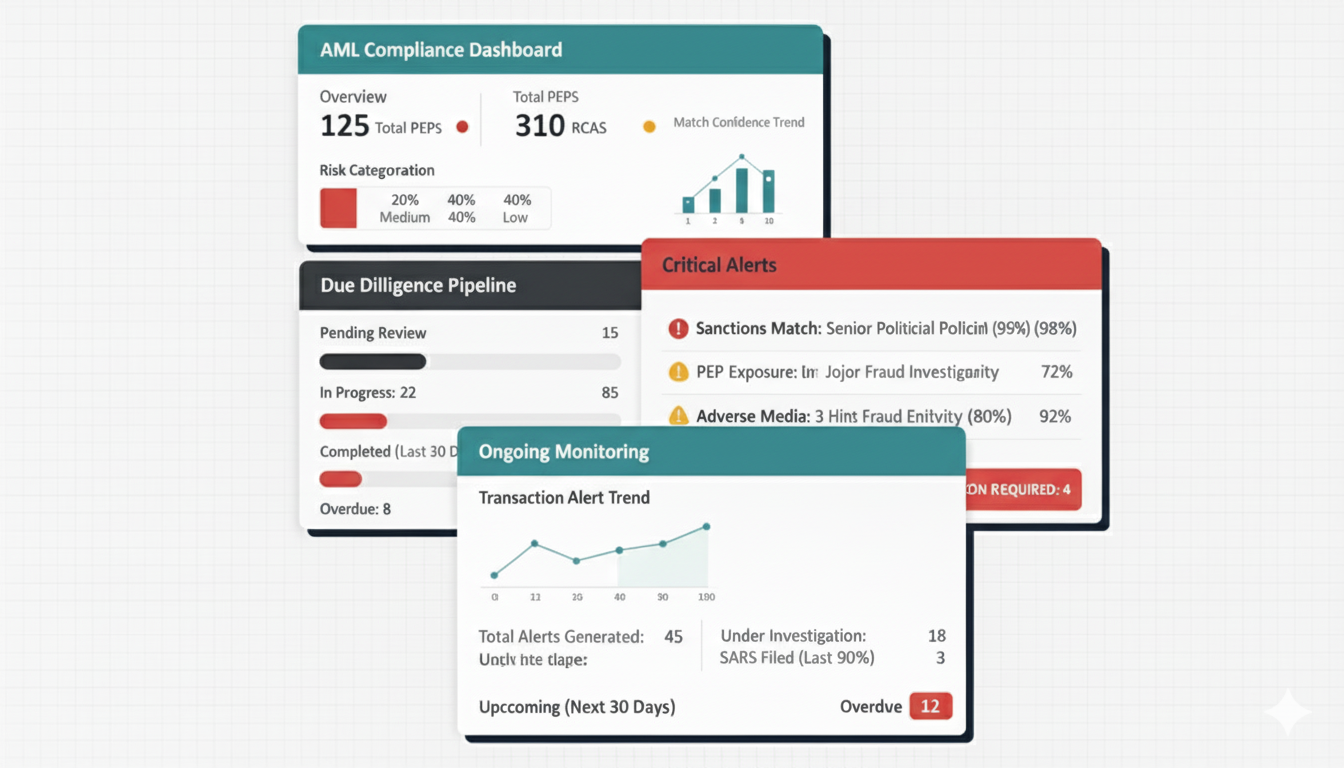

PEPs & RCAs

Identify politically exposed persons and related associates globally to manage reputational, regulatory, and jurisdictional onboarding risk effectively.

Learn more

Adverse Media

Identify reputational risk through AI-curated global news sources that surface fraud, litigation, and regulatory violations instantly.

Learn more

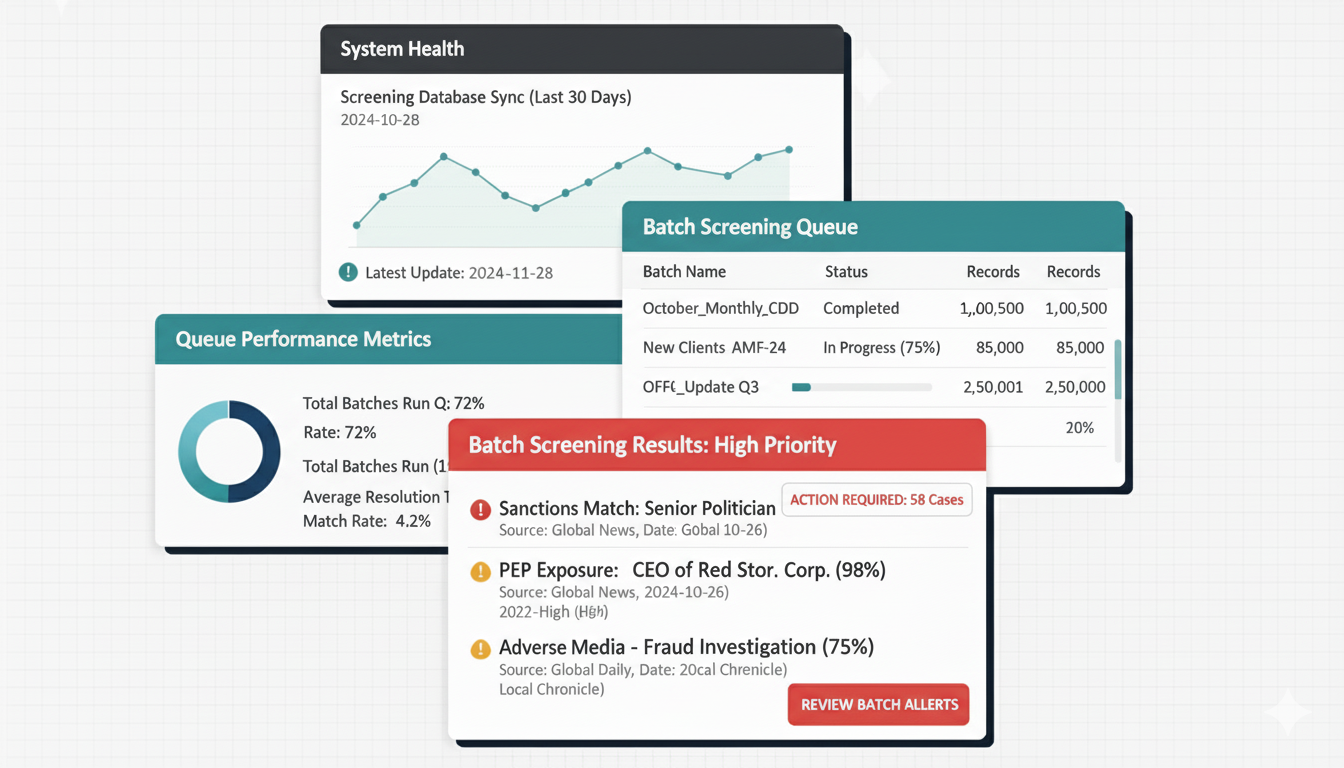

Batch Screening

Rapidly screen individuals, entities, and even crypto records in bulk for sanctions, PEPs, and high-risk exposures.

Learn more