In compliance, “scalable” is often promised, but rarely delivered.

Most platforms can manage well enough when operations are small. However, as your user base grows, jurisdictions diversify, and transaction volume increases, many compliance systems begin to fail. This makes them sluggish, fragmented, or overly manual.

In 2025, scalability in compliance is no longer a technical bonus. It’s a business essential. Without it, you hit bottlenecks in onboarding, fall behind in reviews, and expose your business to regulatory risks.

So, what defines a “truly scalable” compliance platform?

Not value claims of being “cloud-native”, but specific capabilities that stand up to growth, complexity, and cross-border scrutiny.

Let’s explore the pillars of real-world scalability.

Pillar #1: Real-Time Performance At Any Volume

If your compliance tools slow down during peak onboarding times, or if sanctions screening takes hours to return results, you’re not operating at scale; you’re gambling with lag.

A scalable platform must deliver real-time screening, monitoring, and decision-making capabilities, regardless of the load. That means:

- Sanctions, PEPs, and watchlist checks that are completed in milliseconds

- Transaction monitoring that runs continuously, not in nightly batches

- Risk-scoring engines that recalculate dynamically as user behavior evolves

- System uptime and throughput that hold steady, even during peak spikes

Real-time performance ensures that your business grows without compromising the speed users expect or the responsiveness regulators demand.

Scalable = Instant, not delayed

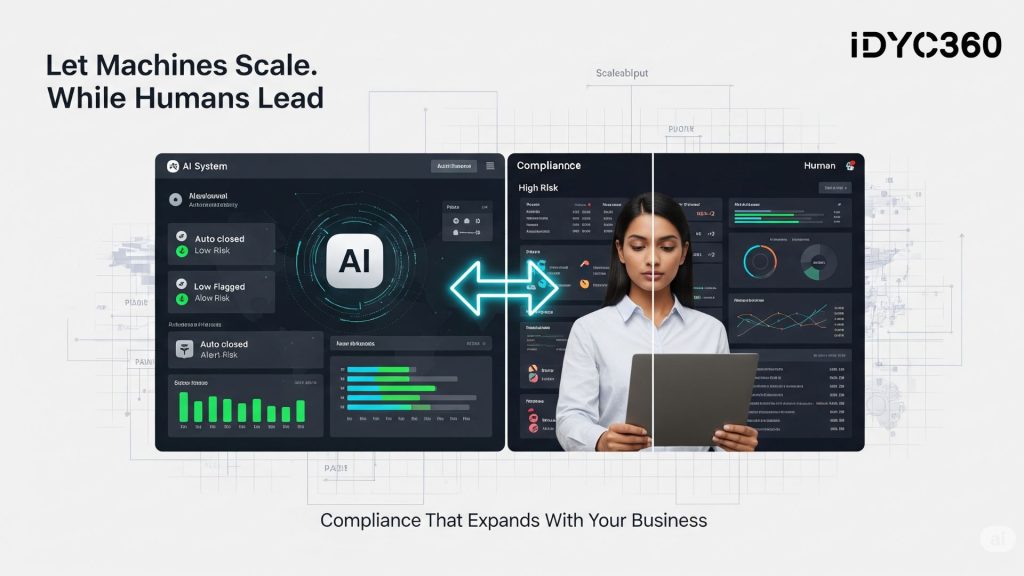

Pillar #2: Automation That Preserves Human Judgment

You can’t scale compliance by hiring endlessly. But full automation isn’t the answer either.

The real solution lies in intelligent automation, where machines handle the repetitive tasks and humans make complex calls.

A scalable platform should:

- Automatically triage low-risk alerts and suppress obvious false positives

- Trigger enhanced due diligence workflows only when risk thresholds are met

- Route edge cases to analysts, along with the full context they need

- Learn from analyst decisions over time to improve accuracy

This hybrid model maximizes efficiency without losing nuance and enables compliance teams to scale up without burning out.

Scalable = Automated where possible, humans where needed

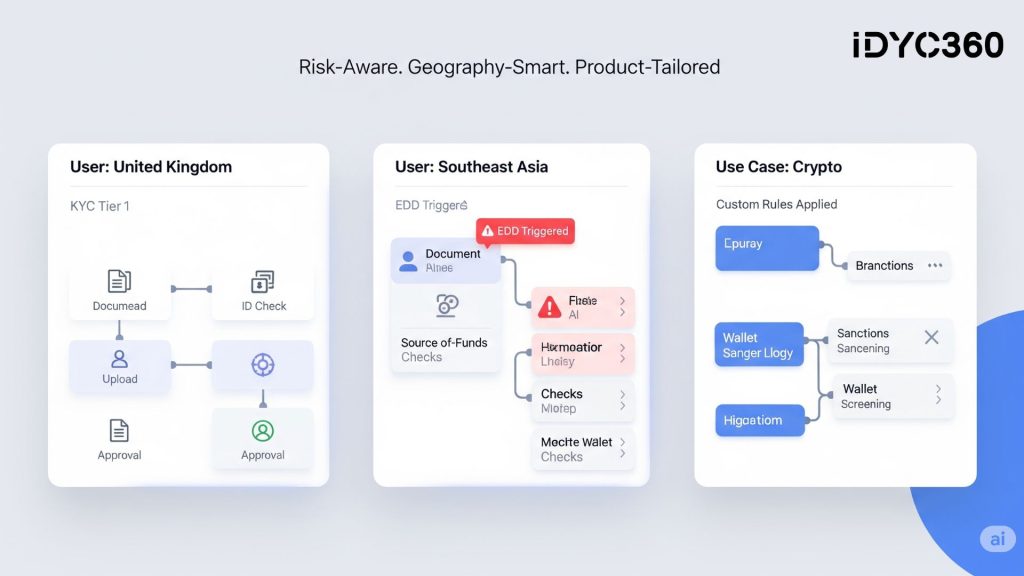

Pillar #3: Flexibility Across Markets, Products & Risk Profiles

As your business grows, so does your complexity. One day, you’re onboarding users in the UK, and the next, you’re launching in Southeast Asia. Compliance systems that can’t adapt to this reality become obsolete fast.

A scalable platform must offer:

- Jurisdiction-aware workflows that trigger different verification steps based on geography or regulation

- Risk-tiered onboarding flows that escalate KYC based on transaction intent, funding, method, or type

- Custom screening rules per product line, customer segment, or use case

- Language and document handling capabilities for diverse user bases

This flexibility allows compliance to keep pace with the business, rather than slowing it down with one-size-fits-all rules.

Scalable = Context-aware and globally adaptive

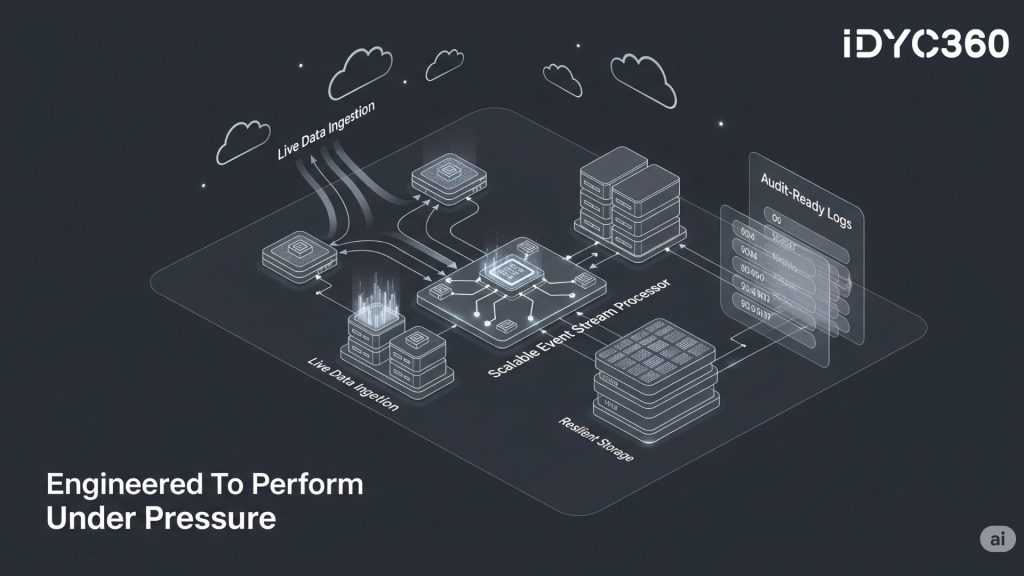

Pillar #4: Infrastructure Built for Data, Volume & Load

Behind every scalable compliance solution is a robust infrastructure that doesn’t buckle when things get busy. That means more than just cloud hosting; it means true backend resilience.

Key indicators of a scalable foundation include:

- High-speed data ingestion from sanction databases, news feeds, and internal systems

- Real-time processing of transaction events at scale; thousands per second if needed

- Indexing and storage that support fast retrieval for audits and investigations

- System reliability even under high concurrency and peak onboarding periods

If your system slows down as your business grows, you’re not scaling, you’re stalling.

Scalable: Engineered for high-throughput performance

Pillar #5: No-Code/Low-Code Configurability

A scalable platform doesn’t force you to rely on engineers every time you need to adjust a risk rule or modify an onboarding step. It gives compliance teams direct control, without compromising governance.

This means:

- Drag-and-drop rule builders to update screening logic or thresholds

- Editable onboarding workflows tailored to different user profiles.

- Configurable escalation matrices that match your internal structure

- Self-reporting service tools that generate audit-ready data in minutes

Configurability ensures your compliance operation stays aligned, regardless of growth or regulatory shifts.

Scalable: Build for compliance teams, not just developers

Pillar #6: Continuous Learning to Reduce False Positives

High alert volumes are inevitable in growth. But high false positive rates are not. A truly scalable compliance platform evolves, getting smarter, more accurate, and more efficient as it learns from real-world outcomes.

How this plays out:

- ML-based name matching improves over time, reducing duplicate or irrelevant hits

- Analyst feedback loops train the system to distinguish noise from threat

- Risk-scoring models adapt to actual user behavior, not just pre-set thresholds

- Alert prioritization improves as patterns of real vs. false positives emerge

The more the system is used, the better it gets. This enables your teams to stay focused on meaningful work, not noise.

Scalable = Self-improving over time

How IDYC360 Helps Compliance Scale with the Business

At IDYC360, we’ve designed every part of our platform to handle high-speed growth without adding friction or fatigue. Whether you’re a crypto exchange scaling into LATAM, a forex platform expanding in Asia, or a fintech crossing into new verticals, we help you stay compliant at every size.

Here’s how:

- Instantaneous screening and monitoring, even during high onboarding surges

- AI-powered name resolution to reduce false matches and alert fatigue

- Customizable workflows across onboarding, alerts, and EDD review

- Jurisdictional and behavioral risk scoring, not just static rules

- Built-in machine learning with feedback loops for your team

- Audit-ready reporting tools that scale with your regulatory obligations

With IDYC360, you’re not buying tools. You’re building an intelligent, flexible compliance engine that grows with your business.

Final Thoughts

You can’t afford for compliance to be the reason you slow down, stall expansion, or invite regulatory trouble. In 2025, regulators expect agility and visibility, and users expect frictionless speed.

A scalable compliance platform delivered both. It adapts to complexity, maintains control during growth, and automates with precision, without losing sight of the human oversight that keeps everything grounded.

The best growth strategy in a high-risk market? Build your compliance system to scale before your business does.

Ready to Stay

Compliant—Without Slowing Down?

Move at crypto speed without losing sight of your regulatory obligations.

With IDYC360, you can scale securely, onboard instantly, and monitor risk in real time—without the friction.