In 2025, asset platforms, from trading apps to token exchanges to wealthtech solutions, are dealing with a new kind of fraud: multi-layered, fast-moving, and increasingly difficult to spot.

Traditional red flags like unusual volume or login mismatches are no longer enough. Today’s fraudsters mimic legitimate behavior, exploit new payment rails, and manipulate timing to evade detection.

Worse? They don’t act alone. Many operate as part of coordinated networks using synthetic identities, mules, and social engineering tactics.

If your platform is built to detect “yesterday’s fraud,” you’re exposed.

Let’s unpack what’s changing—and what modern platforms must do to stay one step ahead.

Fraud in 2025 Is Dynamic, Distributed, & Data-Rich

Fraud is no longer a single suspicious transaction; it’s a pattern stitched across:

- Multiple accounts

- Cross-platform flows

- Deceptively normal-looking transactions

- Time-based triggers tied to market or news cycles

It might look like:

- Dozens of micro-deposits to test payment limits

- Sudden asset off-ramps after large, structured inflows

- Coordinated trading to simulate market interest

- Use of proxy wallets or secondary accounts to mask the origin

Static rules (e.g., “flag transactions > $10K”) can’t catch this. Dynamic, behavioral analysis is essential.

Traditional Controls Create Too Much Noise, Not Enough Signal

Legacy fraud detection systems often generate high volumes of alerts, most of them false positives. This creates:

- Alert fatigue among analysts

- Delayed investigations

- Missed genuine fraud because it’s buried in noise

- Escalation bottlenecks and operational drag

In 2025, efficiency matters as much as accuracy. Platforms need systems that prioritize context, reduce clutter, and elevate meaningful alerts.

That requires automation, machine learning, and a deeper understanding of what “normal” looks like.

Fraud Detection Must Move From Reactive to Real-Time

Delays are dangerous. Once a fraudulent transaction clears, recovery becomes exponentially harder.

That’s why modern fraud defense must be:

- Proactive (flagging patterns before they fully form)

- Instant (scoring transactions in milliseconds)

- Contextual (factoring in user history, velocity, and behavior)

- Adaptive (learning from new tactics and evolving accordingly)

The fraud landscape changes weekly. Your platform needs defenses that learn just as fast.

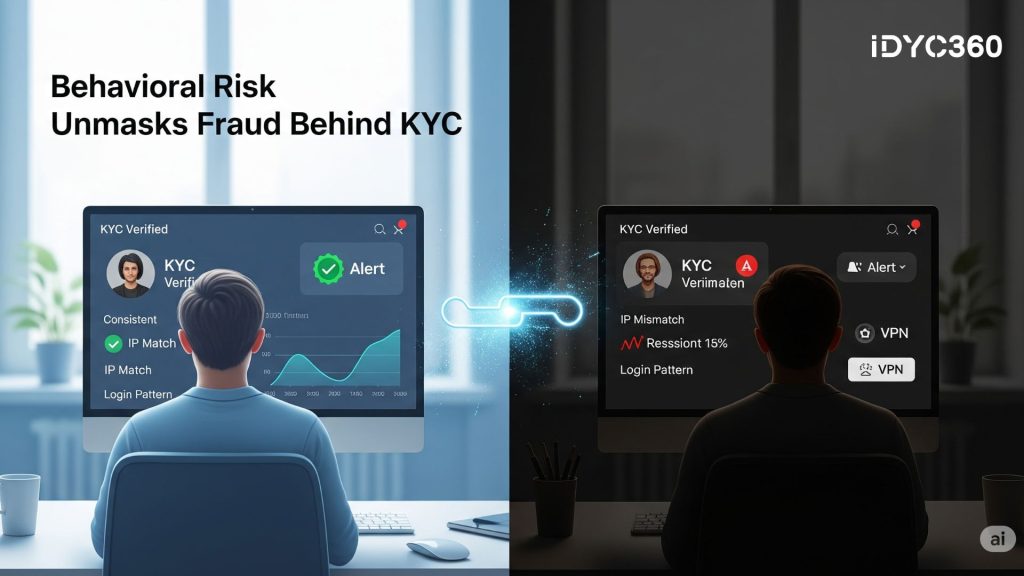

Identity Alone Isn’t Enough. Behavior Is the Real Identifier

Even verified users can become fraud vectors:

- Accounts taken over through phishing or social engineering

- Dormant accounts repurposed for laundering

- Customers coerced into mule activity

This makes static identity checks insufficient. Modern platforms must also analyze:

- Device and IP fingerprinting

- Geolocation mismatches

- Unusual session patterns

- Changes in transaction rhythm or counterparties

It’s not who they are; it’s what they’re doing that reveals the risk.

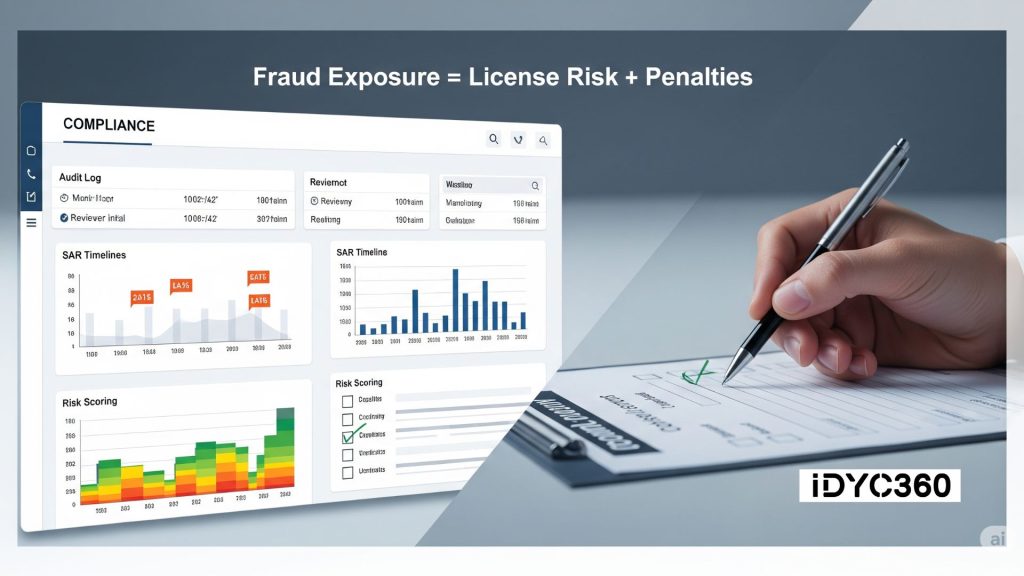

Fraud Has Regulatory Consequences Now

Beyond financial loss, fraud has serious compliance and reputational implications.

Regulators now expect:

- Real-time monitoring for suspicious transaction behavior

- Prompt SAR filings for suspected fraud

- Documented decision-making and audit logs

- Evidence of fraud risk mitigation across all user segments

Asset platforms that fail to detect fraud early can face:

- License risk

- Regulatory penalties

- Loss of banking relationships

- Reputational damage that’s hard to undo

Fraud detection is no longer just a security issue; it’s a compliance imperative.

How IDYC360 Helps Asset Platforms Combat Fraud in Real Time

IDYC360 empowers asset platforms with intelligent, real-time fraud defense built for scale, speed, and regulatory alignment.

Behavioral Transaction Monitoring

Track not just what users send, but how, when, and with whom. Spot deviations from normal patterns instantly.

Real-Time Risk Scoring

Each transaction is scored contextually, factoring in behavioral history, device data, and fraud signals.

ML-Driven Pattern Detection

Our models learn from fraud across industries and geographies, so you stay ahead of emerging typologies.

Smart Alert Routing

Reduce false positives with precision triage—only escalate when there’s true risk.

Audit-Ready Case Logs

Every decision is tracked, justified, and time-stamped—for regulatory comfort and internal control.

Global Watchlist & Adverse Media Screening

Screen transaction participants for sanctions, PEPs, or negative press, even when identities are obfuscated.

With IDYC360, asset platforms can detect transaction fraud in real time, without compromising speed or user experience.

Final Thoughts

In a world of real-time money movement, transaction fraud evolves too quickly for outdated systems to keep up.

Modern asset platforms must blend intelligence, automation, and contextual insight to detect risk as it happens, not after damage is done.

Because when it comes to fraud in 2025, delay equals exposure.

Ready to Stay

Compliant—Without Slowing Down?

Move at crypto speed without losing sight of your regulatory obligations.

With IDYC360, you can scale securely, onboard instantly, and monitor risk in real time—without the friction.