Wealth management has long been considered a lower-risk segment for AML. Clients are well-documented. Assets are transparent. Transactions are deliberate.

But in 2025, regulators and institutions are waking up to a new truth: high-net-worth individuals (HNWIs) can be high-risk, not by profile, but by behavior.

As financial crime tactics grow more sophisticated, static customer profiles and legacy KYC aren’t enough. Wealth managers now need to monitor how clients behave over time, not just who they are at onboarding.

Enter behavioral screening: a powerful, emerging layer of AML intelligence designed to detect hidden patterns, evolving risk, and subtle red flags in real-time.

Traditional KYC Fails to Catch Sophisticated Risk

Wealthy clients often pass initial due diligence easily. They have clear sources of wealth, documented business ties, and legitimate financial footprints. But that doesn’t make them immune to financial crime—just harder to detect.

Static KYC processes overlook:

- Hidden affiliations or silent partners

- Shifting risk exposure after onboarding

- Changing beneficiary structures

- Indirect links to sanctioned entities or high-risk jurisdictions

And when these shifts happen gradually—over quarters or years—compliance teams relying solely on periodic reviews are unlikely to catch them in time.

That’s where behavioral screening offers a critical advantage.

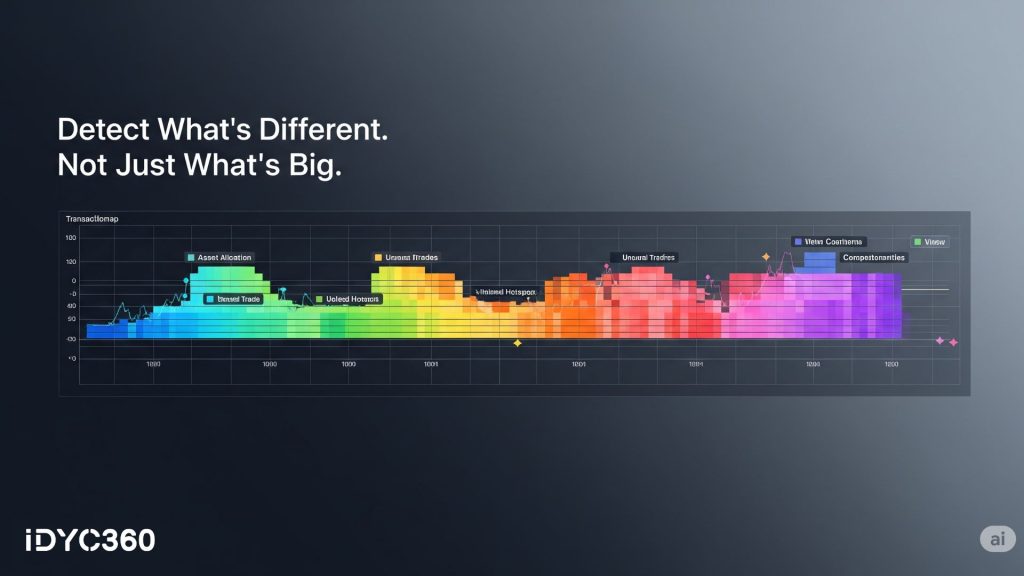

Behavioral Risk Is Contextual, Not Just Transactional

Behavioral screening focuses not on isolated transactions, but on patterns—subtle, evolving deviations from a customer’s historical behavior or peer group norms.

This includes:

- Unusual changes in asset allocation or portfolio movement

- Repeated trades that defy the client’s stated objectives

- New counterparties or offshore structures introduced late in the relationship

- Sudden or structured liquidity events before geopolitical developments

These signals often don’t raise flags in standard rules-based systems. But over time, they indicate potential misuse of legitimate wealth infrastructure.

In short, behavioral anomalies are the new red flags—and they require more than thresholds to detect.

Regulatory Expectations Are Shifting Toward Ongoing Oversight

Global regulators are no longer satisfied with a strong onboarding process followed by silence.

They now expect:

- Continuous monitoring of HNWI relationships

- Dynamic risk scoring that reflects changes over time

- Event-triggered reviews, not just calendar-based ones

- Deeper scrutiny of beneficiaries, structures, and asset flows

This reflects the broader move toward “risk-in-motion” frameworks, where decisions aren’t frozen in time, but evolve with the customer.

Wealth managers that fail to embed this model are increasingly viewed as behind the curve and vulnerable to enforcement.

Behavioral Screening Requires a Different Kind of Intelligence

Traditional AML relies on rules: if A + B + C = suspicious, trigger an alert.

Behavioral screening requires systems that:

- Learn what “normal” looks like for a specific client or cohort

- Detect statistically significant deviations, without rigid logic

- Incorporate external events (e.g., sanctions, adverse media, regulatory developments)

- Tie customer behavior to risk drivers like asset class, geography, and counterparties

This intelligence is often powered by machine learning and contextual models, but with explainability baked in.

Because in wealth management, regulators and relationship managers alike demand clear answers.

Relationship Managers Are Part of the Risk Surface

A unique challenge in wealth is the interpersonal layer. Relationship managers are trusted advisors, but they can also inadvertently shield risk by:

- Relying on “gut feel” instead of evidence

- Underreporting activity to protect client relationships

- Missing slow-building behavioral shifts over time

Modern behavioral screening systems should empower, not replace, RMs. That means:

- Giving them insights, not just alerts

- Offering context to validate or challenge their instincts

- Documenting decisions to ensure accountability and defensibility

It’s not about policing relationships—it’s about equipping them to manage risk with intelligence.

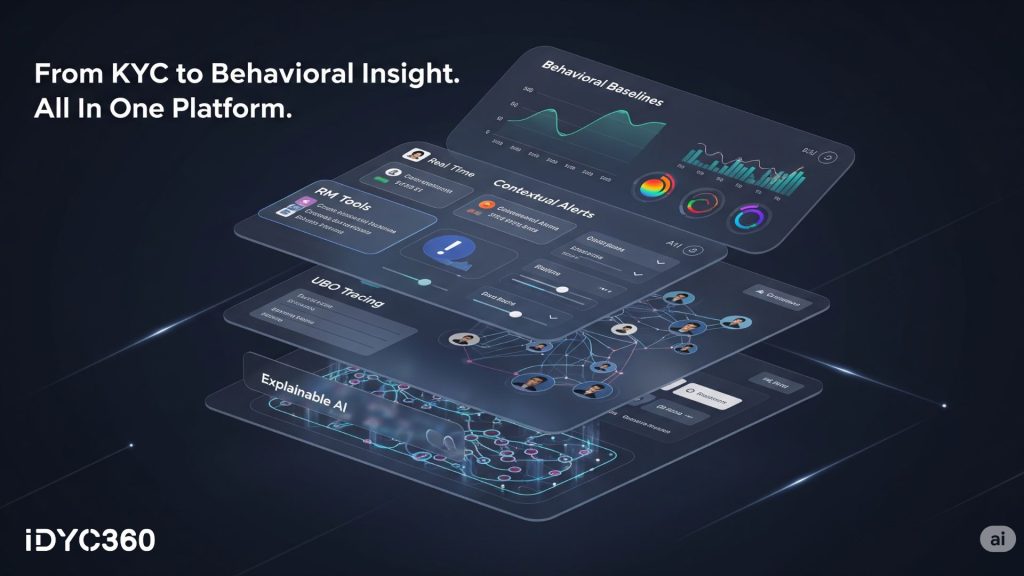

How IDYC360 Brings Behavioral Intelligence to Wealth Compliance

At IDYC360, we help wealth managers evolve from static checks to dynamic, real-time behavioral insight, without compromising client experience or regulatory alignment.

Behavioral Baseline by Client Segment

Learn normal patterns for each client or risk cohort, then flag outliers as they occur.

Contextual Alerting, Not Noise

Tie portfolio behavior to market events, PEP exposures, or evolving watchlists—with explainable logic.

Adverse Media + UBO Linkage

Surface real-time media risk or reputational red flags—even when hidden behind trusts or nominee structures.

RM-Facing Dashboards

Equip frontline teams with behavioral intelligence and alert commentary—so they can take action, not just receive noise.

Audit-Ready Documentation

Log every risk shift, override, and review—so your rationale is clear to regulators and internal teams.

ML + Explainability

Our behavioral models adapt over time but remain fully explainable, so every anomaly comes with context, not confusion.

With IDYC360, wealth compliance moves from static to strategic—from knowing your client, to understanding how they behave.

Final Thoughts

In 2025, wealth platforms can’t afford to rely solely on who their clients are. The real question is: what are they doing now, and does it make sense?

Behavioral screening helps compliance teams spot invisible risks, build defensible decisions, and meet the rising expectations of global regulators.

It’s no longer a nice-to-have. It’s the new baseline for responsible wealth management.

Ready to Stay

Compliant—Without Slowing Down?

Move at crypto speed without losing sight of your regulatory obligations.

With IDYC360, you can scale securely, onboard instantly, and monitor risk in real time—without the friction.