Shell companies have long been used as tools for financial crime, but in 2025, they’ve become even harder to detect. They are legally registered, often comply with surface-level regulations, and appear clean on most onboarding forms. Yet many exist solely to move money with minimal scrutiny.

Behind every shell is a hidden intent, whether it’s tax evasion, sanctions circumvention, money laundering, or corruption. These entities are particularly dangerous because they blend in. They’re not flagged because they look normal, on paper.

As global platforms onboard more cross-border businesses and high-velocity accounts, they face a hard truth: compliance teams can no longer afford to screen for just what’s visible. It’s time to uncover what’s deliberately hidden—before it becomes regulatory exposure.

What Makes Shell Companies So Hard to Detect?

Shell companies are designed to pass basic scrutiny. They often have legitimate documents, active business licenses, and even bank accounts. But what they lack is real operational substance.

No office. No staff. No product or service. Just paperwork.

They’re often registered in secrecy havens like the BVI, Seychelles, or Delaware. Their true owners are hidden behind nominee directors or complex legal structures, and many share addresses or formation agents with thousands of other companies.

This makes them difficult to catch using traditional checks. A valid registration certificate means little if the entity has no business activity. Rule-based systems miss them because they don’t violate rules—they exploit the gaps between them.

To detect shell companies, platforms must look at what’s missing: business logic, ownership clarity, and financial behavior.

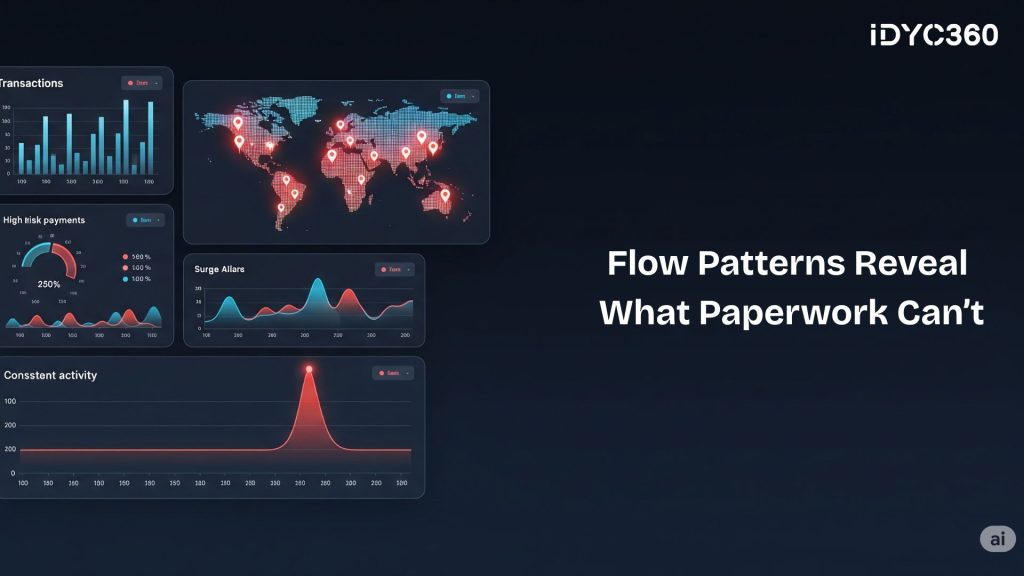

Where Shell Risk Shows Up in Financial Flows

Even when shells pass onboarding, their risk surfaces during transactions—if you’re looking at the right patterns.

Shells don’t move money like real businesses. They:

- Route payments through tax havens or financial secrecy jurisdictions

- Transact in flat, round-number amounts with no invoice or industry correlation

- Receive or send funds without a matching business counterpart

- Show burst activity after months of dormancy

These behaviors aren’t flagged by standard rule engines. But they’re critical indicators of abuse, especially when they occur repeatedly across counterparties.

Shells often act as middle-layer buffers in laundering chains, helping bad actors distance themselves from illicit funds. That makes behavioral flow monitoring just as important as identity verification. You need to see the shell not as a company, but as a conduit.

Why Beneficial Ownership Checks Are No Longer Optional

Knowing the “legal” owner of a business is no longer sufficient. Regulators worldwide, from FinCEN to FATF, now require platforms to identify who ultimately controls an entity, regardless of how many layers it takes to find them.

This is the principle of beneficial ownership.

A shell company may be registered to a trust in Panama, which is controlled by a nominee director in Hong Kong, who acts on behalf of an individual in Moscow.

Without visibility into this chain, you could unknowingly onboard sanctioned actors, PEPs, or front companies for organized crime.

But the data is fragmented. Ownership information is often:

- Hidden in offshore jurisdictions

- Structured differently across registries

- Filed with aliases, initials, or intentionally vague details

Compliance tools must resolve identities across languages, typologies, and jurisdictions, and match individuals with red flags—even when the trail is obscured.

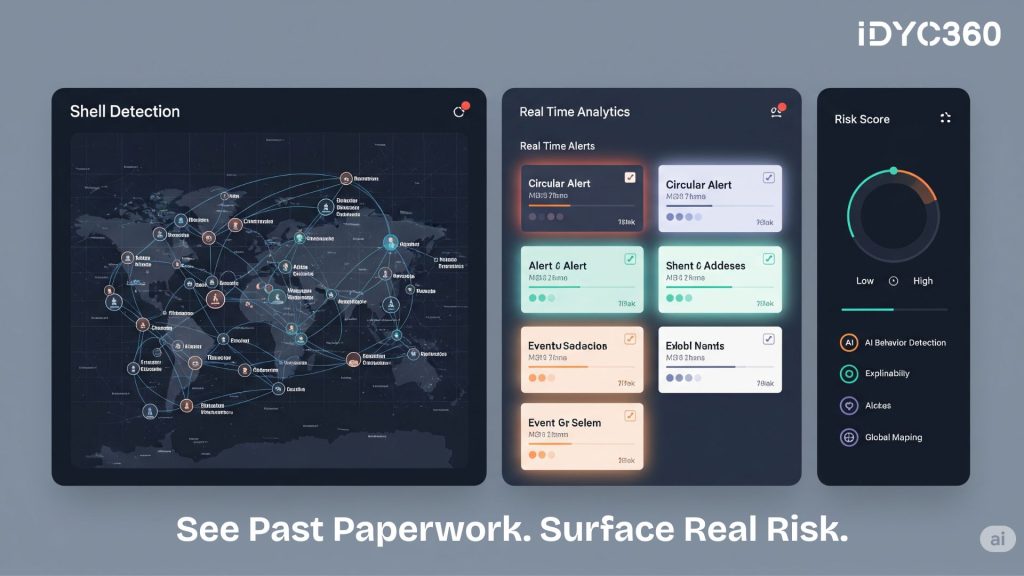

Public Data isn’t Enough: Shell Detection Needs Pattern Intelligence

Most platforms rely heavily on open-source company registries, sanctions lists, and ownership databases. These are critical, but not enough to detect shells to deceive.

That’s because:

- Shells are created to look legitimate and evade list-based detection

- New shells pop up constantly, using formation agents that never raise red flags

- Many act as network nodes, connected to risk via patterns, not names

That’s where pattern intelligence becomes vital.

Platforms need systems that analyze how an entity behaves relative to its peers, jurisdiction, industry, and stated purpose. For example:

- Is the transaction volume consistent with the declared sector?

- Is the address used by hundreds of other shell companies?

- Are the counterparties part of a circular chain?

This level of contextual modeling moves beyond “is this name risky?” to “is this behavior consistent with shell activity?”

Shell Company Risk Isn’t Static. It Evolves Over Time

The riskiest shell companies often appear quiet at first.

They may lie dormant for months, conducting minimal activity, then suddenly start channeling high-value international wires or suspicious trade invoices. The entity itself hasn’t changed, but its intent has.

This dynamic risk is missed by compliance models that rely on one-time onboarding reviews or annual KYC refreshes. What’s needed is real-time, event-triggered monitoring that flags changes like:

- Velocity spikes

- New jurisdictional connections

- Suspiciously repetitive payments

- Interaction with newly sanctioned or high-risk entities

Platforms that continuously monitor business behavior—not just identity—are the ones that can detect shell companies before the money moves.

How IDYC360 Helps

IDYC360 equips compliance and risk teams with powerful tools to uncover shell companies, even when they look legitimate on paper.

Entity Graph Resolution

IDYC360 builds multi-layered entity maps, connecting directors, shareholders, aliases, and nominee links—even across jurisdictions and languages.

Flow Behavior Intelligence

Detects suspicious flow structures: circular payments, jurisdictional layering, and anomalous velocity patterns—all common with shell entities.

Continuous Risk Scoring

Scores every entity dynamically, based on behavior shifts, metadata changes, and external data, ensuring you catch dormant shells before they activate.

Beneficial Ownership Insights

Flags gaps in disclosure, circular ownership, or repeated use of nominee structures, surfacing risks that don’t appear in standard company filings.

Shell Formation Risk Profiling

Uses AI models to detect shell-like behaviors and traits based on real-world laundering typologies, not just metadata.

Explainable Risk Logs

Every shell flag is documented with context, source, and decision trail—ideal for internal reviews and regulatory audits.

With IDYC360, platforms stop onboarding unknowns—and start understanding who’s really behind the transaction.

Final Thoughts

In 2025, shell companies remain one of the most effective and dangerous tools for financial crime. They don’t appear on lists. They don’t always break rules. But they do facilitate laundering, evasion, and fraud on a global scale.

Compliance teams must evolve from “checklist KYC” to contextual risk intelligence. That means screening for what’s missing. Looking for substance. Monitoring for change.

The cost of ignoring shell risk isn’t just fines—it’s exposure to networks you never intended to serve.

Ready to Stay

Compliant—Without Slowing Down?

Move at crypto speed without losing sight of your regulatory obligations.

With IDYC360, you can scale securely, onboard instantly, and monitor risk in real time—without the friction.