Most compliance teams aren’t short on tools. They have platforms for onboarding, point solutions for sanctions screening, case management systems for investigations, and spreadsheets to patch the rest.

But here’s the catch: when these tools don’t talk to each other, risk hides in the gaps.

Siloed systems lead to duplicated effort, delayed decisions, and dangerous blind spots. In 2025, when financial crime is faster and more global than ever, reactive and disconnected compliance is no longer defensible.

The answer? A unified compliance infrastructure—one that breaks down silos, centralizes context, and empowers teams to act faster with full visibility.

Siloed Tools = Fragmented Risk Intelligence

Each tool in a compliance stack might be excellent on its own. But if customer risk profiles live in one system, transaction monitoring rules in another, and PEP screening in a third, your team is working in the dark.

The result is:

- Incomplete case files

- Conflicting decisions across teams

- Manual stitching of data from different sources

- Delays in identifying high-risk customers or behaviors

Worse, regulators see through it. During audits, they expect a single view of risk, not a fragmented pile of PDFs and platform screenshots.

Alert Fatigue Is a Symptom of Siloed Thinking

Too many alerts? That’s not always because of bad detection logic—it’s often a lack of unified context.

When each tool generates alerts based on its limited inputs:

- You get false positives from sanctions hits with no behavioral context

- You escalate minor issues because historical data isn’t visible

- You ignore serious patterns because they’re spread across systems

A unified infrastructure connects these signals. It lets compliance teams see the full picture, so they can suppress noise and escalate what matters.

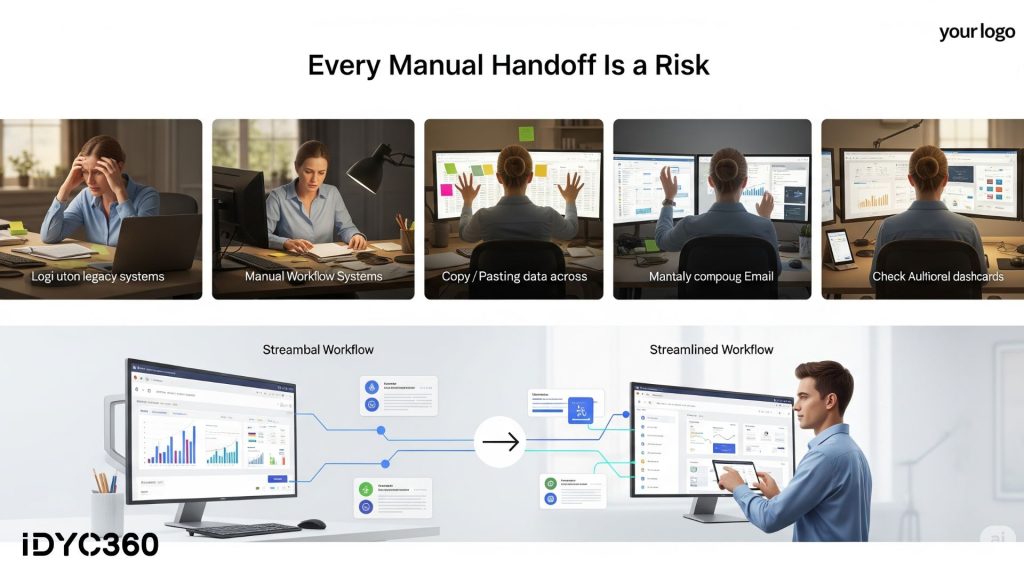

Manual Data Handoff Slows Down Decision-Making

In siloed setups, compliance analysts often spend more time gathering data than analyzing it.

They:

- Log in to multiple tools to fetch customer history

- Copy-paste alert details into spreadsheets

- Manually summarize findings for escalation or SARs

- Chase other teams for missing documentation

This isn’t just inefficient—it’s risky. Every handoff is a chance for context loss, delay, or error. In real-time environments like crypto or payments, that can mean missing your reporting window, or letting fraud through.

Unified systems reduce these handoffs by design. All case data, alerts, actions, and audit trails live in one place.

Compliance at Scale Requires Platform Thinking

As compliance moves closer to the core of digital financial services, it needs to scale like product and engineering.

That means:

- Shared infrastructure, not just feature-rich tools

- Reusable workflows across jurisdictions and teams

- Centralized decision logic that adapts in real time

- APIs that integrate compliance into onboarding, transactions, and support

This “platform thinking” lets businesses move fast without duplicating effort or introducing risk. It enables compliance to become a business enabler, not a blocker.

Siloed tools weren’t built for that. Unified infrastructure is.

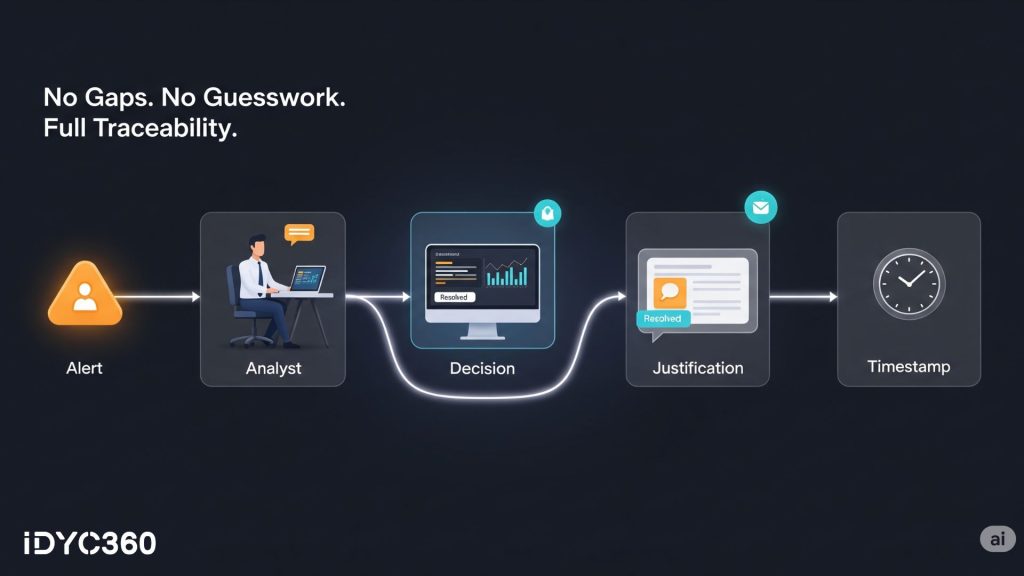

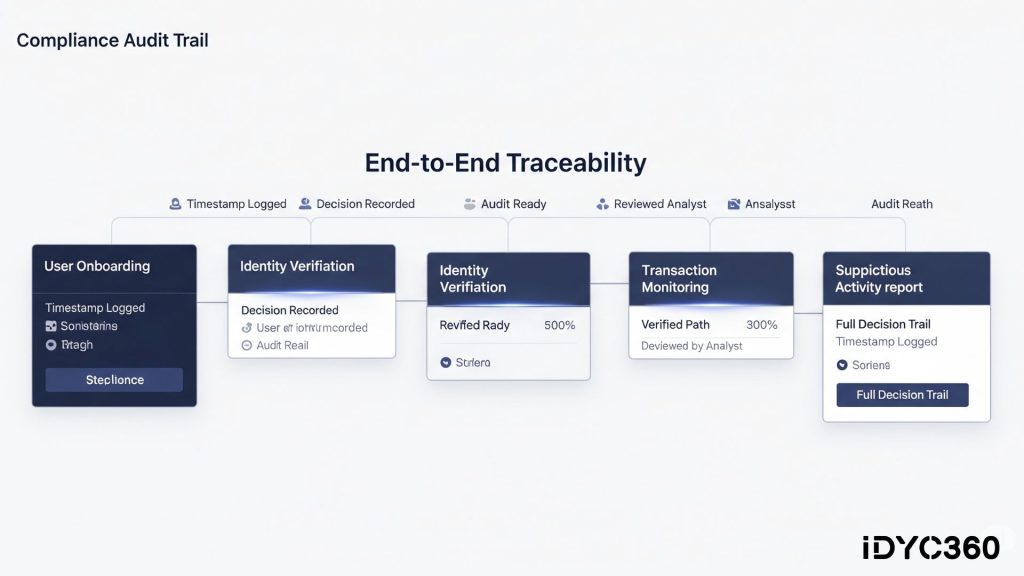

Regulators Expect End-to-End Traceability

Siloed systems make it hard to tell a clean story:

What triggered the alert? Who reviewed it? What context was available? What decision was made and why?

Without central records, regulators see:

- Conflicting case outcomes

- Missing audit trails

- Inconsistent policy enforcement

- Decisions made without full context

Unified platforms ensure every action is documented, every decision is defensible, and every alert can be reconstructed from start to finish, regardless of who was on shift.

In 2025, that’s not a luxury. It’s table stakes.

How IDYC360 Replaces Siloed Tools With Real-Time Unity

IDYC360 is purpose-built to unify your compliance operations across screening, onboarding, monitoring, and reporting.

Here’s how we eliminate silos and centralize intelligence:

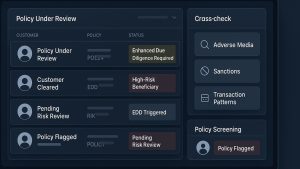

Single View of Risk

Combine customer data, alert history, transaction behavior, and screening outcomes in one intelligent profile.

Real-Time, Cross-Module Workflows

Triaging, escalation, investigation, and reporting are all linked—no more jumping between systems or re-keying data.

Explainable AI With Full Visibility

Risk scores and alerts come with transparent logic, source data, and reviewer commentary—so everyone’s on the same page.

Seamless API Integrations

Plug IDYC360 into your KYC vendors, core platforms, or data providers—without breaking your ecosystem.

Jurisdiction-Specific Logic, Centrally Managed

Deploy tailored compliance rules by market, while keeping policy governance centralized and audit-ready.

Audit Trails by Default

Every alert, override, note, and decision is auto-logged and time-stamped for complete regulatory traceability.

With IDYC360, your compliance program evolves from a patchwork of tools into a cohesive, future-ready platform.

Final Thoughts

In fast-moving, regulated industries, compliance can’t afford to be disjointed. Every disconnected workflow, manual handoff, and alert misfire increases risk, not just operationally, but reputationally.

Unified infrastructure is the new standard. It’s how modern compliance teams cut noise, reduce risk, and scale with confidence.

Tools don’t win audits. Platforms do.

Ready to Stay

Compliant—Without Slowing Down?

Move at crypto speed without losing sight of your regulatory obligations.

With IDYC360, you can scale securely, onboard instantly, and monitor risk in real time—without the friction.