By November 2025, global banking will face a watershed moment: ISO 20022 will become the universal financial messaging standard, ending decades of reliance on outdated SWIFT MT formats.

This shift brings structured, data-rich payment messages, offering new levels of transparency and efficiency. But for transaction monitoring teams, it also rewrites the playbook.

Banks that fail to adapt risk not only payment disruption but also heightened compliance and operational risks. So, what must financial institutions know and do to make the most of ISO 20022 in transaction monitoring?

The ISO 20022 Difference: Why It Matters to Banks

ISO 20022 isn’t just a new file format, but a fundamental upgrade to how payment data is captured, shared, and analyzed:

Richer, Structured Data

Payments now carry highly detailed information—beneficiary details, remitter references, purposes, and originators, structured in clear XML-based fields.

Greater Transparency & Traceability

The new format enables banks to trace funds and identify parties more precisely, making suspicious behaviors and transaction anomalies easier to spot.

Universal Interoperability

Cross-border and domestic payments use a unified standard, bridging legacy silos and boosting automation across institutions.

Improved Customer Experience

Richer data means faster reconciliations, reduced errors, and better tracking for clients, strengthening trust and efficiency.

For transaction monitoring and AML teams, this means:

- More granular data for identifying red flags.

- Expanded scope for automated rules, AI analytics, and sanctions screening.

- Reduced false positives, as ambiguity and free-text fields decline.

Key Challenges Banks Face in the Transition

Despite clear benefits, banks face significant hurdles as the ISO 20022 deadline looms:

Legacy System Dependencies

Many institutions still rely on core banking and monitoring systems designed for flat, limited SWIFT MT fields, requiring costly upgrades or replacements.

Data Quality & Integrity Risks

Poorly mapped or incomplete data fields during migration can lead to message truncation, rejected transactions, and compliance failures.

Operational Disruptions

Failing to adequately test and validate systems may cause settlement delays, failed transfers, and unhappy customers after November 2025.

Cross-Functional Coordination Gaps

Collaboration between compliance, technology, and operations is essential, yet many banks struggle to align teams on requirements and ownership.

Top red flags banks must watch for:

- Message rejections due to incorrect formatting or missing fields.

- Increased exception handling as legacy and new systems interact.

- Higher risk of regulatory non-compliance if monitoring can’t interpret enriched ISO data correctly.

ISO 20022’s Impact on Transaction Monitoring

With ISO 20022, transaction monitoring gains new capabilities and responsibilities:

Enhanced Screening & Detection

Richer, structured fields allow monitoring systems to flag suspicious activity more accurately across sanctions, PEP, and AML rules.

Advanced Typology Identification

Full remittance and purpose-of-payment details support sophisticated rulesets and machine learning to detect layering, shell activity, or trade-based laundering.

Reduced False Positives

Better data structure means screening tools can ignore irrelevant fields and focus on the most meaningful risk signals, boosting efficiency.

Regulatory Reporting & Auditability

Automated extraction and reporting of granular data satisfy evolving regulatory demands for transparency and responsiveness.

Practical enhancements:

- Screening in real time against richer payloads, minimizing operational friction for legitimate transactions.

- Expanded ability to automate ongoing customer due diligence, not just onboarding.

Global Readiness & Banking Industry Updates

- The coexistence period for legacy MT and ISO 20022 formats will end on November 22, 2025, after which messages in legacy formats will be rejected.

- Many major banks are well advanced in their migration; however, institutions lagging in transition face operational and compliance risks, particularly in high-growth markets like India.

- Active engagement with SWIFT’s Transaction Manager and proactive testing has become industry best practice, ensuring data remains consistent across increasingly digitalized payment chains.

- Banks are urged to complete technical migration efforts by August 2025, allowing a buffer for system monitoring and issue resolution before the global deadline.

Best Practices for a Smooth Transition

Banks should act now to maximize benefits and mitigate risk:

Assess & Upgrade Infrastructure:

Ensure payment and monitoring systems can natively process the full ISO 20022 data set. Avoid reliance on translation “adapters” alone.

Strengthen Data Governance:

Clean, standardize, and validate data before, during, and after migration; closely monitor truncation or mapping errors.

Collaborate & Align Teams:

Cross-functional steering between compliance, IT, operations, and vendor partners is critical—consistency and shared accountability prevent last-minute surprises.

Educate Stakeholders:

Train internal teams and prepare clients for the new standards, emphasizing the enhanced transparency and risk management capabilities.

Test, Test & Test Again:

Rigorous end-to-end testing—especially of high-value and cross-border flows—ensures readiness for November 2025 and beyond.

How IDYC360 Helps

IDYC360 empowers banks to navigate and capitalize on the ISO 20022 revolution with:

Native ISO 20022 Monitoring & Analytics:

AI-driven detection and reporting leverage rich payloads, not just legacy fields, enabling stronger AML/sanctions oversight.

Seamless System Integration:

Rapid deployment that connects to core banking and payment engines, minimizing disruption and maximizing data utility.

Dynamic Data Quality Tools:

Ongoing validation, mapping, and enrichment functions automatically flag inconsistencies and exceptions.

Automated Compliance Reporting:

Real-time extraction of key regulatory data simplifies SARs, transaction audits, and regulatory responses.

Industry-Best Advisory:

Specialist consultants to guide your bank’s migration, test scenarios, and troubleshoot issues in real-time.

Final Thoughts

The ISO 20022 transition marks more than a compliance deadline; it’s a catalyst for modernizing banking operations and elevating risk management.

Banks that fully embrace richer data, update their monitoring, and coordinate across teams will achieve not just compliance but new levels of security, client trust, and operational agility.

Ready to Stay

Compliant—Without Slowing Down?

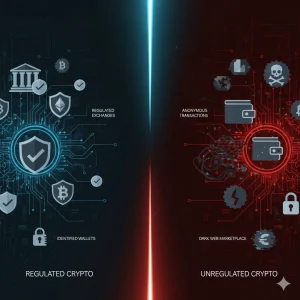

Move at crypto speed without losing sight of your regulatory obligations.

With IDYC360, you can scale securely, onboard instantly, and monitor risk in real time—without the friction.