Transaction monitoring sits at the core of every AML compliance program, but in 2025, it’s facing its most difficult challenge yet.

As digital financial activity surges, institutions are dealing with a staggering increase in transaction volumes. Cross-border payments, e-wallet transfers, crypto rail activity, BNPL schemes, and instant settlements have created a compliance storm.

And with that volume comes an overwhelming number of system-generated alerts.

However, the real problem is that most of these alerts lack context. They flag isolated data points without understanding the full picture. This leads to alert fatigue, analyst burnout, backlogs in case queues, and, worse still, missed signs of actual financial crime.

Regulators now expect more than alert generation. They expect intelligence. They want to see that institutions understand why a transaction was flagged, how it ties to risk exposure, and what action was taken.

In this new landscape, context isn’t a bonus; it’s a baseline requirement.

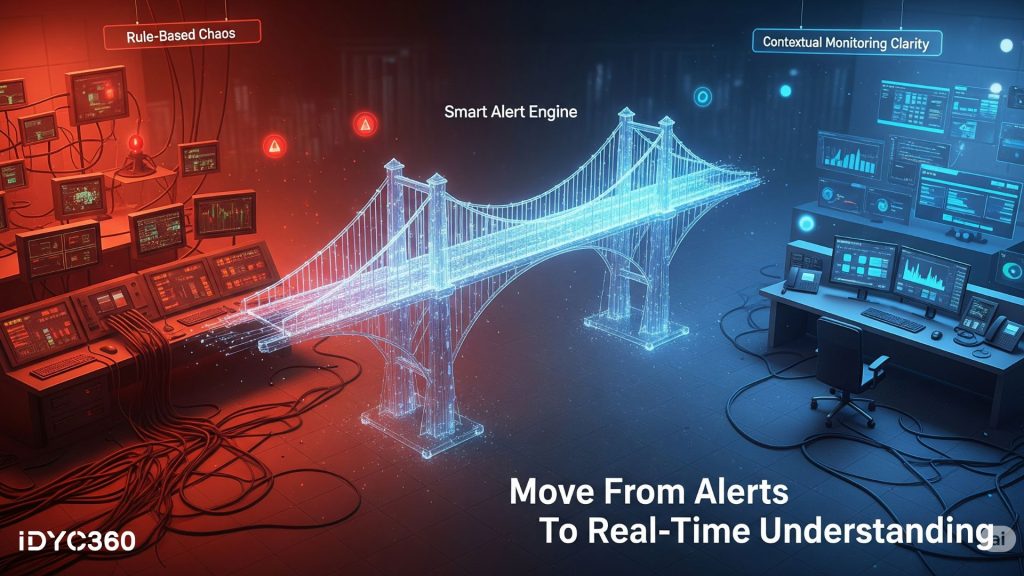

Why Rule-Based Monitoring Is Breaking Down

For decades, transaction monitoring relied on predefined, rule-based logic:

- Flag large transfers over a fixed threshold

- Alert on rapid successive withdrawals

- Highlight activity in high-risk jurisdictions

These rules served as blunt instruments—easy to implement, but blind to nuance.

Sophisticated actors quickly learned to exploit their limitations: structuring transactions just below thresholds, spacing them out over time, or using intermediaries to mask intent.

More critically, these rules don’t answer the deeper question: Is this behavior suspicious in context? A $10,000 transfer might be completely normal for a high-volume vendor, but deeply irregular for a new retail account.

Rule-based systems treat all deviations as equal. But compliance professionals know they’re not.

In 2025, relying solely on static rules creates more noise than insight, and the industry is feeling the strain.

What “Contextual Monitoring” Really Means

Contextual monitoring doesn’t just flag anomalies—it explains them.

This approach links every transaction to a broader profile that includes:

- Customer behavior history

- Known counterparties

- Jurisdictional and product risk

- Historical alert patterns

- Sanctions or media signals related to the entity

Context adds layers of meaning:

- Is the transaction unusual for this specific customer?

- Has their risk score changed recently?

- Is there a pattern across connected accounts?

Rather than reacting to isolated data points, contextual monitoring builds a narrative. It helps analysts answer not just what happened, but why it matters. And that changes everything.

It reduces wasted time, prioritizes the right cases, and elevates the credibility of investigations, especially during regulatory scrutiny.

The Role of Machine Learning in Context-Aware Monitoring

Modern compliance systems can’t keep up without machine learning. AI has become essential for adding depth, speed, and adaptability to transaction monitoring.

Machine learning models analyze thousands of data points in parallel, drawing from:

- Behavioral baselines (What’s normal for this customer?)

- Transactional flows (Is there a new counterparty or corridor?)

- Historical outcomes (What did previous similar alerts reveal?)

- Risk intelligence (Any new sanctions, media, or geographic concerns?)

These models evolve constantly, learning from analyst feedback and identifying patterns that humans or static systems might miss.

ML doesn’t eliminate alerts. It improves them. Instead of flooding your queue, it prioritizes the ones that matter, cutting false positives while improving true risk detection.

In short, ML makes context practical at scale and in real time.

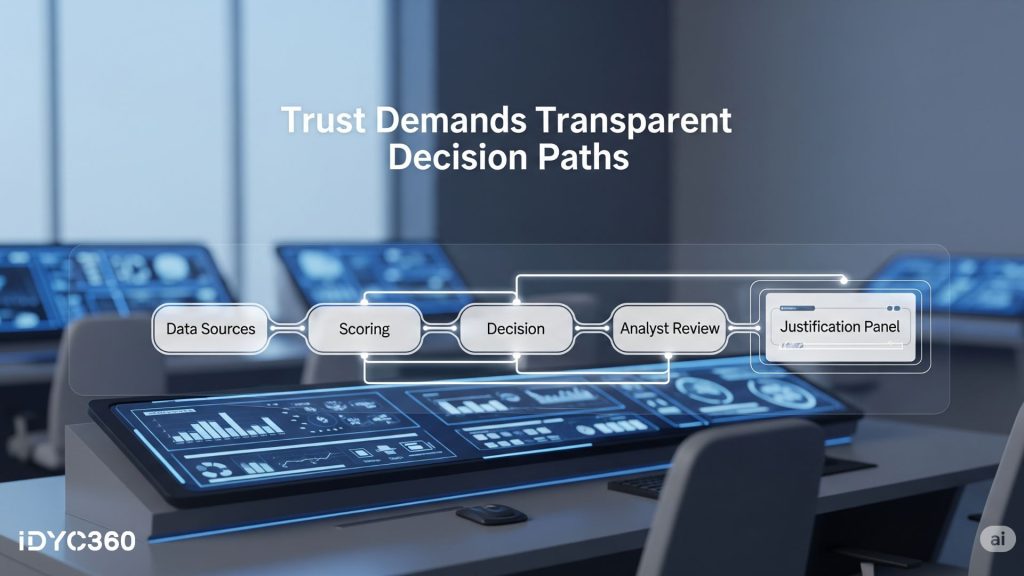

Real-Time Decisioning Requires Explainability

Speed is essential, but trust is non-negotiable.

In 2025, regulators won’t accept “AI said so” as justification. They want proof:

- Why was a transaction flagged?

- Why was it de-escalated?

- What data was used to reach that decision?

- Who reviewed and approved it?

That means every alert must come with a clear logic path, rooted in defensible, explainable models. Whether decisions are made by automation, human review, or both, the compliance team must be able to reconstruct the reasoning quickly and transparently.

Explainability isn’t just a regulatory checkbox. It’s a competitive advantage. Institutions that can prove how they operate are more agile during audits, more scalable during growth, and more trusted by partners and regulators alike.

Alert Fatigue Isn’t Just a Productivity Problem; It’s a Risk

Many compliance teams are drowning in alerts.

The vast majority, often over 90%, are false positives. These demand time, attention, and investigative energy, even when they lead nowhere. As the burden grows, teams start triaging less, missing more, and falling behind.

This creates several high-impact risks:

- Delayed response to genuine suspicious activity

- Inconsistent case handling across teams

- Burnout among skilled compliance analysts

- Regulatory exposure due to backlog and errors

Contextual monitoring mitigates this by ensuring analysts spend time where it counts. It eliminates trivial noise, automates low-risk resolutions, and escalates meaningful behavior, turning alert volume into investigative value.

In a world of compressed timelines and rising pressure, this isn’t just a technical improvement. It’s a strategic necessity.

How IDYC360 Powers Contextual Transaction Monitoring

IDYC360 transforms transaction monitoring from a reactive system into a proactive intelligence engine. Built for modern financial institutions, our platform adds context to every alert—helping teams act faster, smarter, and with greater confidence.

Here’s what sets IDYC360 apart:

Behavior-Based Risk Modeling

Our system learns what “normal” looks like for each customer, adjusting in real time to detect only relevant deviations.

Dynamic Risk Context Injection

We enrich alerts with profile data, sanctions status, prior behavior, peer group activity, and media sentiment—all in one view.

AI-Powered Prioritization Engine

Cases are scored and ranked dynamically based on urgency, risk category, and operational impact, so teams focus where it matters most.

Explainable Alerts

Each decision includes a clear logic chain, enabling faster case resolution and audit-ready transparency.

Continuous Learning Loop

Our models evolve through analyst feedback, adaptive thresholds, and real-world outcomes, improving every week.

End-to-End Case Management

From alert triage to documentation and reporting, IDYC360 handles the full workflow, seamlessly integrated into your existing systems.

With IDYC360, your transaction monitoring isn’t just faster. It’s smarter, leaner, and built for tomorrow’s regulatory expectations.

Final Thoughts

As financial activity becomes more complex and decentralized, transaction monitoring can’t afford to operate in silos.

Compliance leaders must shift from flagging transactions to understanding them. They must move from data points to decisions—and from static rules to dynamic intelligence.

Context isn’t optional anymore. It’s the difference between staying compliant and staying exposed.

Platforms that embrace contextual monitoring today will be the ones that scale securely, move confidently, and earn regulators’ trust tomorrow.

Ready to Stay

Compliant—Without Slowing Down?

Move at crypto speed without losing sight of your regulatory obligations.

With IDYC360, you can scale securely, onboard instantly, and monitor risk in real time—without the friction.