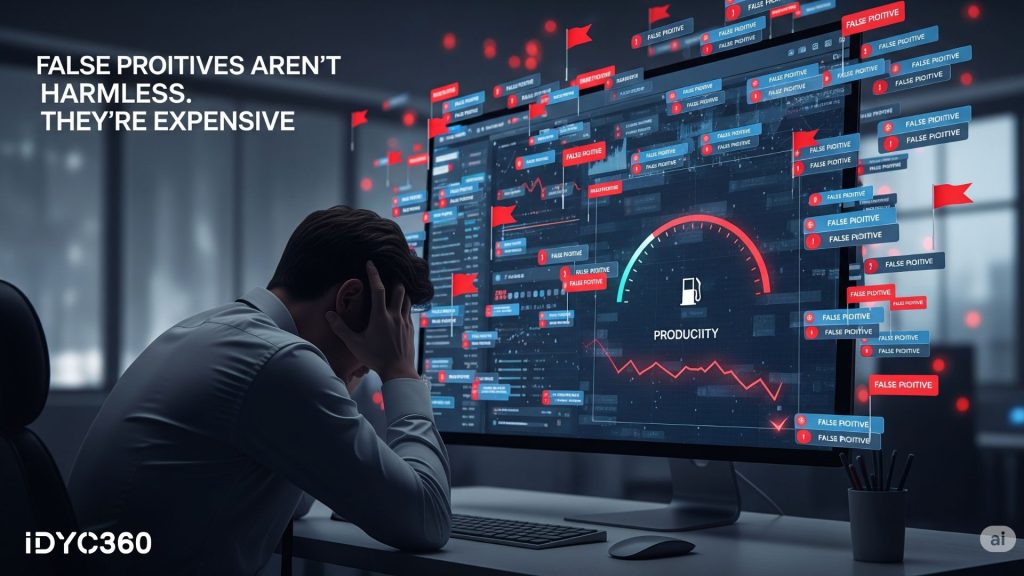

False positives are the silent killers of compliance efficiency.

Every time a flagged transaction turns out to be legitimate or a ‘high risk’ customer turns out to be safe, compliance teams burn valuable time, energy, and money chasing shadows.

This isn’t just a workflow problem. It’s a business risk.

When alerts pile up and investigation queues slow down, real threats can slip through unnoticed.

Machine learning (ML) offers a powerful solution. Instead of relying solely on static rules, ML models can learn, adapt, and improve, dramatically reducing false positives while preserving (or even enhancing) detection accuracy.

Let’s explore why false positives are such a pain point and how ML is changing the game.

Why False Positives Hurt More Than You Think

At first glance, a false positive seems like a minor nuisance. But scale changes everything.

In high-volume environments like fintech apps, digital banks, and crypto exchanges, false positives can make up over 95% of compliance alerts. That means:

- Wasted analyst hours

- Increased operational costs

- Slower resolution times

- Friction for users during onboarding or transactions

- Alert fatigue leading to missed genuine risks

And regulators are watching. They expect institutions to not only catch threats but to do so efficiently. Excessive false positives are often a sign of lazy rule design or outdated systems.

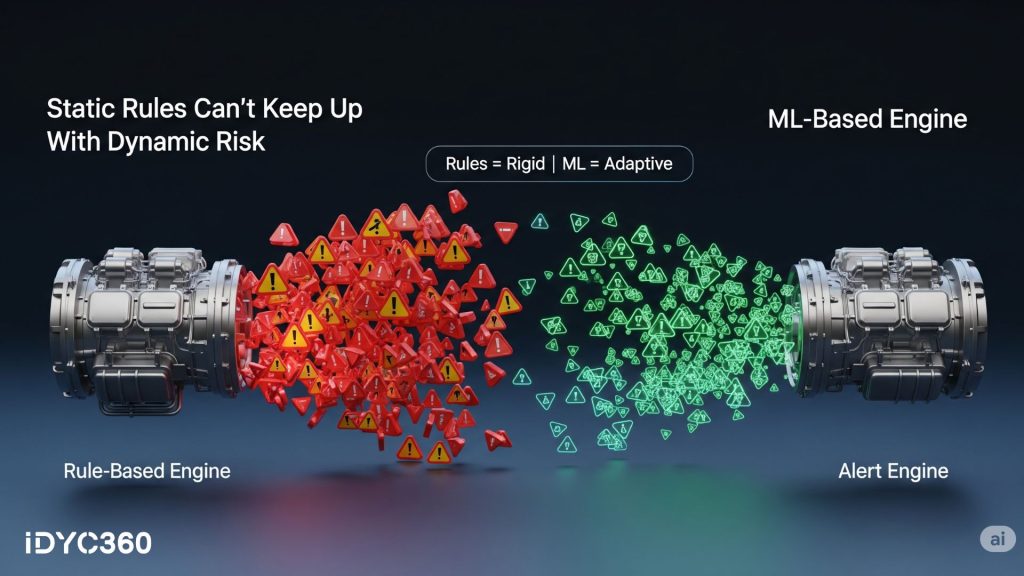

The Limits of Rule-Based Systems

Rules-based detection engines are still widely used. They are transparent, easy to implement, and useful for basic scenarios.

But they are also:

- Rigid

- High-maintenance

- Poor at adapting to complex or evolving patterns

For example, a static rule might flag every transaction of over $10,000 from a high-risk jurisdiction. But what if the sender is a long-standing, fully verified customer? Or if the pattern of activity is completely normal for that account?

Rules don’t do nuance. And in today’s dynamic threat landscape, that’s a problem.

How Machine Learning Learns How to Spot the Signal

Unlike static rules, machine learning systems learn from data.

By analyzing historical alerts, resolved cases, user behavior, and transactional context, ML models can begin to recognize what a “true risk” looks like. And just as importantly, what a “false positive” looks like.

Over time, these systems improve their precision, reducing unnecessary escalations while surfacing genuinely suspicious patterns.

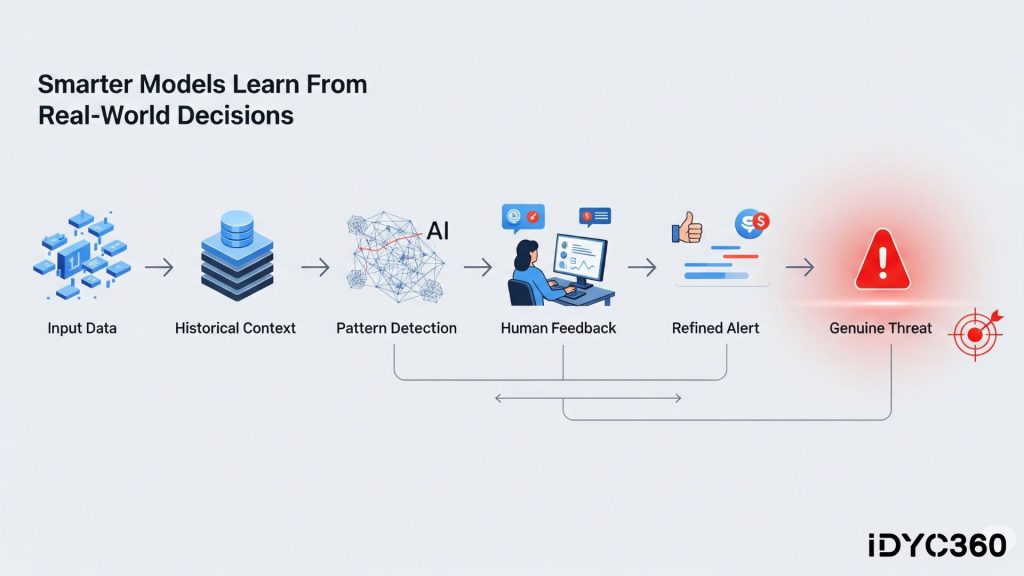

Key ML techniques used in false positive reduction include:

- Supervised learning from labeled data

- Behavioral profiling to establish user baselines

- Anomaly detection to catch deviations from normal

- Feedback loops that incorporate analyst decisions

The result? Fewer noise alerts. More meaningful flags. Less human burnout.

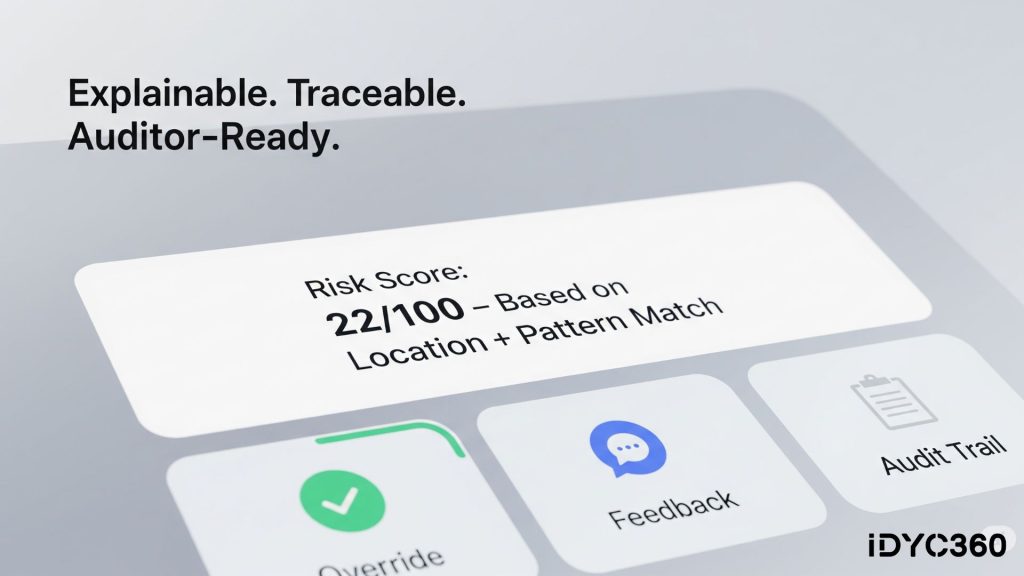

Building Trust in ML: Explainability & Control

A common concern: “If the machine makes a decision, how do I explain it to a regulator?”

This is where explainable AI (XAI) comes in. Modern ML systems can now provide decision trails, outlining which feature led to an alert or suppression. That means compliance teams stay in control and can justify decisions with confidence.

What to look for in an ML-powered compliance tool:

- Transparent scoring and rationale

- Easy override or escalation mechanisms

- Continuous retraining based on new data

- Audit-ready outputs for regulators.

With the right setup, ML doesn’t replace humans. It makes their judgment sharper and their work more strategic.

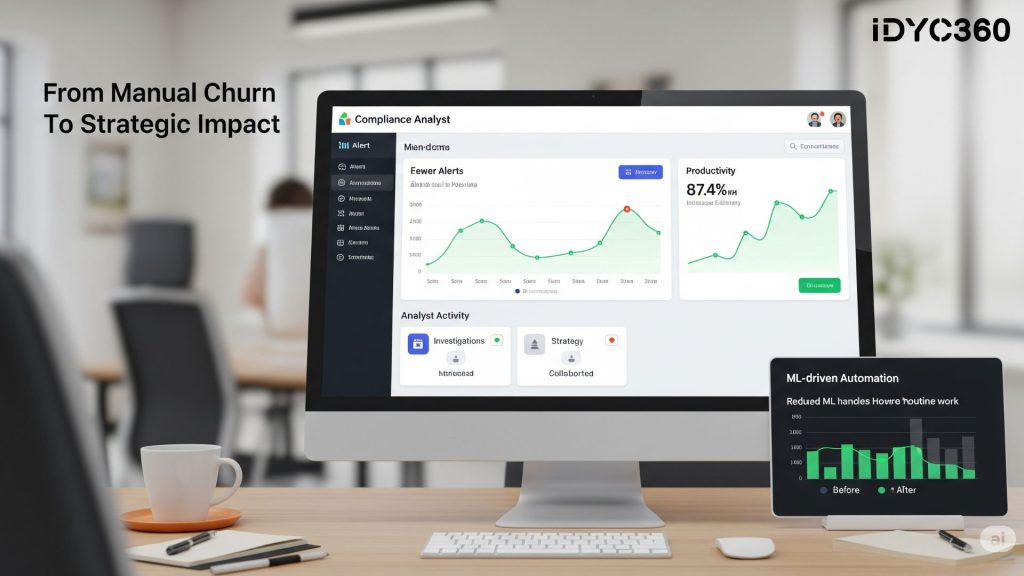

ML as a Strategic Enabler, Not Just a Tech Upgrade

Reducing false positives isn’t just about saving time; it’s about shifting compliance from reactive to proactive.

When your analysts aren’t drowning in noise, they can focus on:

- Investigating complex cases

- Strengthening risk models

- Collaborating with regulators and internal teams

- Scaling compliance alongside product growth

ML allows compliance functions to move from being a cost center to becoming a strategic enabler, protecting the business and unlocking efficiency.

How IDYC360 Helps Reduce False Positives with ML

AT IDYC360, we’ve designed our platform to address one of the most painful challenges in compliance: alert fatigue caused by false positives.

Here’s how we help our partners reduce noise and stay sharp:

ML-Driven Alert Scoring

Our system continuously learns from historical alerts, investigations outcomes, and contextual data to better distinguish true risks from false flags

Behavioral Risk Models

We build adaptive behavioral profiles that allow the system to detect meaningful anomalies while filtering out normal, expected behavior, even in high-volume environments

Analyst Feedback Loop

Every analyst’s decision feeds back into the system, helping improve precision and reduce repeated manual reviews over time

Explainable Outputs

Our platform provides transparent risk scores and traceable decision pathways, making it easy to justify suppression decisions to auditors and regulators

Flexible Rule + ML Approach

Combine static rules with adaptive ML, giving the best of both worlds. Tune thresholds, override outcomes, or create custom alert pathways based on your needs

With IDYC360, you reduce false positives without losing visibility, freeing up your team to focus on what matters.

Final Thoughts

Machine learning isn’t a silver bullet. But when applied with care, it becomes a powerful ally in reducing friction, improving focus, and scaling compliance intelligently.

In a world where every transaction is a potential risk or a false alarm, the ability to tell the difference efficiently is a competitive edge.

Ready to Stay

Compliant—Without Slowing Down?

Move at crypto speed without losing sight of your regulatory obligations.

With IDYC360, you can scale securely, onboard instantly, and monitor risk in real time—without the friction.