Across banking, fintech, crypto, lending, and insurance, one truth is constant: compliance is mission-critical.

But so is the mounting cost.

As regulatory complexity grows, compliance teams are ballooning, manual reviews are stacking up, and alert fatigue is setting in. For many institutions, compliance spending is rising faster than revenue, creating an unsustainable curve.

That’s where automation flips the model.

Not by reducing quality. Not by removing oversight. But by helping compliance teams scale smarter, turning cost centers into control centers, and shifting the compliance curve from exponential to efficient.

The Traditional Cost Curve: Linear Teams, Exponential Risk

Legacy compliance models rely heavily on human effort. Every new customer, every new alert, and every new jurisdiction requires more:

- Reviewers

- Analysts

- Auditors

- Manual checkpoints

- Layers of oversight

At low volumes, this is manageable. But as you grow, the cost of compliance scales linearly or worse, while the risk of missed reviews grows exponentially.

The result? Teams are overworked, budgets are stretched, and quality is under pressure.

Without automation, the only way to scale compliance is to throw more people at the problem—a strategy that breaks down fast.

Alert Fatigue Isn’t Just a Risk Problem; It’s a Cost Problem

One of the biggest hidden costs in compliance? False positives.

When systems generate thousands of low-quality alerts:

- Reviewers waste time investigating noise

- Senior analysts get pulled into low-risk cases

- Escalation queues swell with low-value work

- True risks get buried under volume

The more alerts you generate, the more headcount you need. But that doesn’t translate to better compliance; it just burns time, money, and attention.

Automation flips this by scoring, triaging, and contextualizing alerts—so teams focus only on the ones that matter.

Automation Turns Compliance Into a Force Multiplier

Smart automation isn’t about replacing people—it’s about empowering them.

When done right, automation:

- Handles repetitive tasks (like document collection or initial screening)

- Flag anomalies in real time, without delay

- Assigns risk levels based on behavior and context

- Pre-fills reports and case files with structured data

- Eliminates duplication across teams or tools

This reduces the cost per case, improves throughput, and enhances defensibility. It enables compliance to scale without scaling inefficiency.

You’re not just automating workflows; you’re reengineering the economics of risk.

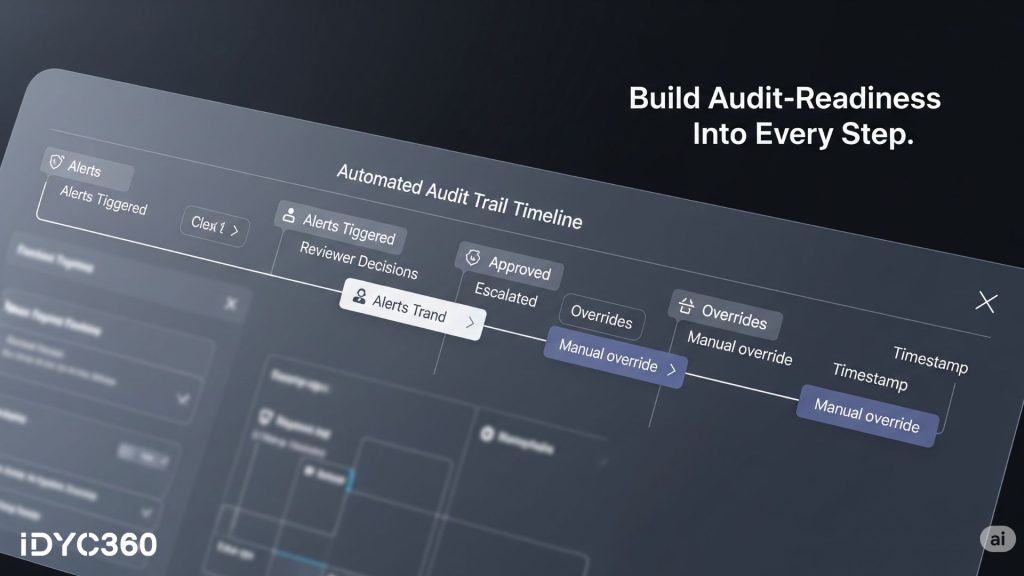

Audit-Ready by Default Means Less Cleanup Later

Another major driver of compliance cost is audit preparation.

Without centralized documentation and clean audit trails, teams scramble to:

- Compile decisions and case notes

- Trace overrides and approvals

- Find evidence to support historical actions

- Reconcile conflicting records across platforms

Automation solves this upstream. With the right regtech platform, every alert, action, and decision is automatically:

- Logged

- Time-stamped

- Linked to the right case

- Stored with its rationale

That means audit prep takes hours, not weeks, and regulatory scrutiny becomes an operational routine, not a fire drill.

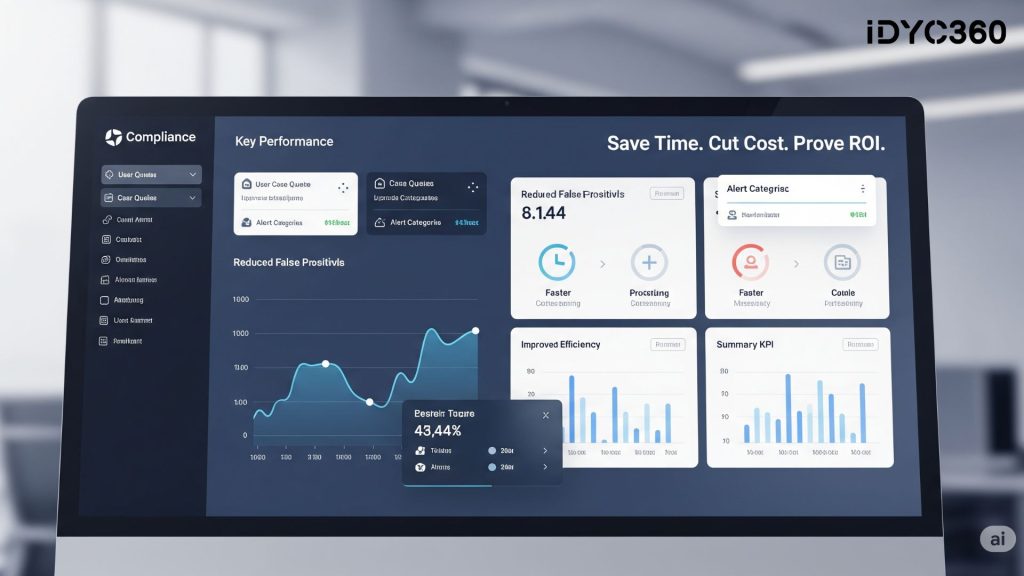

The ROI of Compliance Automation Is Measurable

For institutions that automate intelligently, the impact on the bottom line is real:

- Up to 50–70% fewer false positives

- 3 to 5x faster alert resolution

- 30 to 40% reduction in SAR processing time

- Significant drop in manual escalations

- Lower staffing costs without compromising coverage

- Improved regulatory confidence (which protects licenses and reputation)

It’s not about cutting corners. It’s about cutting costs without cutting compliance.

How IDYC360 Flips the Cost Curve for Compliance Teams

At IDYC360, we help fast-scaling financial institutions modernize their compliance operations—without bloating their team or budget.

Here’s how we help flip the curve:

Smart Alert Triage

Our engine scores and routes alerts based on risk, urgency, and behavior, so your team focuses on what truly matters.

Automation-First Case Workflows

From pre-filling SARs to handling escalations, repetitive tasks are streamlined and documented automatically.

Explainable AI Built-In

Every alert comes with rationale, inputs, and logic—no black boxes, no guesswork, no wasted time.

Modular Platform Design

Adopt what you need, when you need it. We grow with you, without costly rip-and-replace migrations.

Real-Time Audit Trails

Every case action is tracked and logged, saving you time, resources, and stress during exams or inquiries.

Cross-Team Efficiency

Our unified view reduces internal duplication, unnecessary escalations, and platform-switching delays.

With IDYC360, your compliance team gets more done—with fewer resources—and stronger outcomes.

Final Thoughts

In a high-risk world, compliance is non-negotiable. But inefficiency isn’t.

Manual reviews, static risk models, and disconnected systems are costing institutions more than they realize.

Automation flips the cost curve by scaling what matters, reducing what doesn’t, and making compliance a source of strategic advantage.

The future isn’t cheaper compliance—it’s smarter compliance.

Ready to Stay

Compliant—Without Slowing Down?

Move at crypto speed without losing sight of your regulatory obligations.

With IDYC360, you can scale securely, onboard instantly, and monitor risk in real time—without the friction.