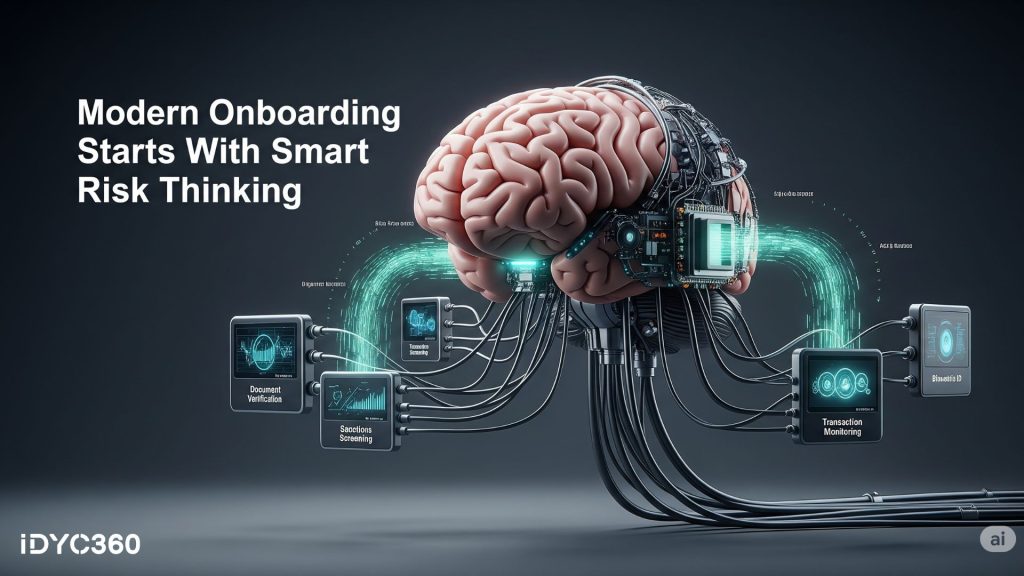

Today’s onboarding experience is a delicate balance: move fast enough to satisfy user expectations, but smart enough to detect risk before it enters your ecosystem.

The problem? Most onboarding flows still rely on binary logic—pass/fail checks, static rules, or rigid thresholds. That leads to false positives, missed red flags, and expensive manual reviews.

Risk scoring engines change that. They introduce intelligence, nuance, and adaptability into your onboarding stack, giving you the power to assess applicants holistically, in real time.

Let’s explore how risk scoring engines work, what makes them effective, and how they’re redefining onboarding for modern financial platforms.

What Is a Risk Scoring Engine, And Why Does It Matter?

A risk scoring engine evaluates multiple signals about a user or entity and assigns a score that reflects their likelihood to pose regulatory, financial, or reputational risk.

Unlike static checks, it dynamically weighs inputs like:

- ID document trustworthiness

- Geolocation and device reputation

- Sanctions/PEP screening results

- Behavioral anomalies and velocity patterns

- Adverse media hits or UBO connections

- Jurisdictional risk modifiers

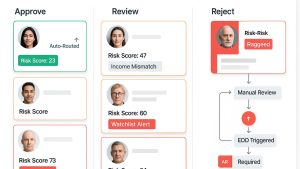

The result? A single, context-rich score that determines whether to auto-approve, route for review, or deny onboarding; all in milliseconds.

It’s not just faster. It’s smarter—and far more defensible.

Static Rules Are Easy to Game. Scores Are Harder.

Bad actors know how to beat legacy systems:

- Use clean, but stolen IDs

- Register through lower-risk jurisdictions

- Front-load accounts with benign activity

- Spread risk across multiple accounts

Binary rules (e.g., “deny if X > Y”) don’t account for these patterns. But risk scoring engines can combine dozens of weak signals into one strong indicator.

For example:

An applicant passes KYC

But they use a new device + proxy IP + high-risk country

And their name has a low confidence match with a PEP list

Individually, these might not trigger rejection. Together, they push the score over a threshold for review. That’s the power of layered intelligence.

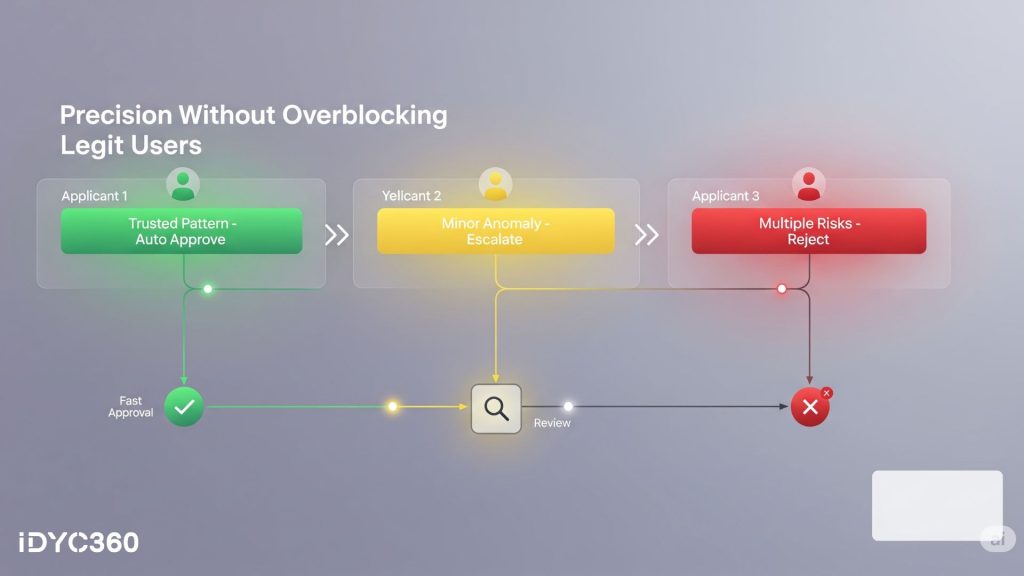

Dynamic Risk Profiles = Fewer False Positives

A smart risk engine doesn’t just flag suspicious users—it understands normal behavior and flags what deviates.

This means:

- Fewer good customers are blocked

- Escalations are based on real anomalies

- High-risk applicants are triaged early, not discovered later

- Manual reviews become smarter and more consistent

This reduces operational drag without relaxing your controls. Risk scoring allows for tighter controls because it’s contextual, not generic.

Customization Is Key: One Size Doesn’t Fit All

Every institution has a different risk appetite based on:

- Jurisdictions covered

- Product type (credit, wallet, insurance, crypto, etc.)

- Regulatory exposure

- User base

- Fraud history

An effective scoring engine must be:

- Configurable (custom thresholds, rule logic)

- Adaptable (change as regulations or patterns shift)

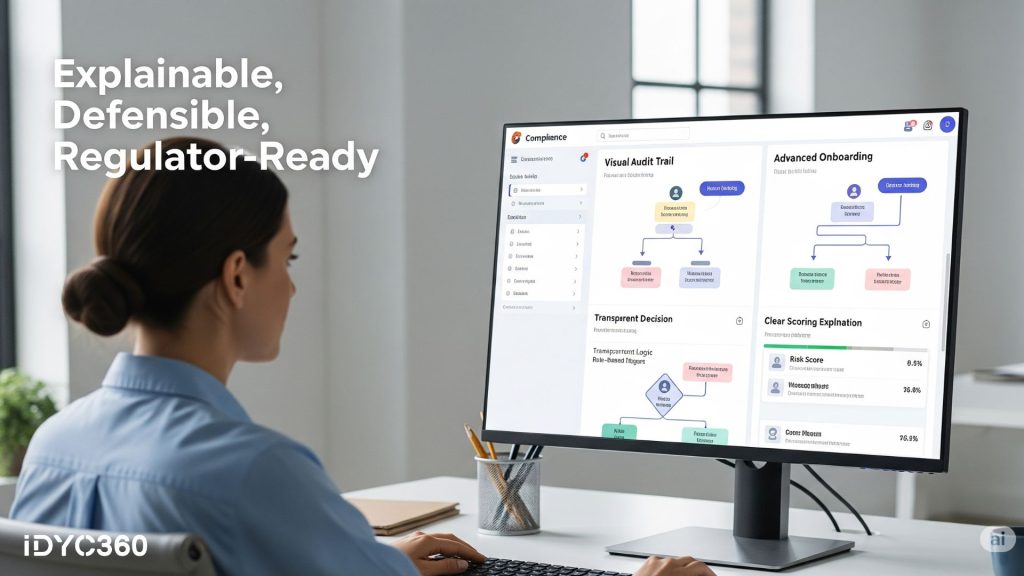

- Transparent (explain how each score is calculated)

- Auditable (store scoring history and rule versions)

The engine is only as good as the control it gives you, not just the results it gives you.

Regulators Want Intelligence, Not Just Checklists

Global regulators are increasingly pushing for risk-based approaches to onboarding.

What does that mean?

- A high-risk customer in a high-risk region needs enhanced controls

- A low-risk user with a clean digital footprint can be auto-approved

- You must show your rationale—why a decision was made, and what data it was based on

Risk scoring engines provide that transparency. They create a repeatable, explainable, and defensible process—so you can scale your customer base without inviting scrutiny.

IDYC360’s risk scoring engine is built to empower real-time onboarding decisions with deep, contextual intelligence.

Here’s how we help:

Multi-Layered Risk Signals

Ingests signals from document checks, device telemetry, geolocation, adverse media, sanctions, and behavioral markers.

Configurable Risk Logic

Weight and tune rules to match your risk appetite, industry, and regulatory requirements.

Instant Risk Scores

Delivers risk decisions in real time—triggering auto-approvals, reviews, or rejections instantly.

Explainable Scoring Framework

Every score is backed by a detailed, human-readable rationale, built for both compliance teams and regulators.

Dynamic Learning Loops

Optional feedback loops improve future scoring accuracy based on investigation outcomes and human inputs.

Audit-Ready Records

All scores, actions, thresholds, and overrides are logged with full traceability and version control.

With IDYC360, risk scoring isn’t a backend afterthought—it’s the frontline of smart, secure, and scalable onboarding.

Final Thoughts

Static onboarding flows were built for simpler times. Today, threats are dynamic, fraudsters are adaptive, and regulators are watching closely.

Risk scoring engines bring intelligence, agility, and precision to onboarding, so you can grow with confidence and stay compliant under pressure.

If you’re scaling without a scoring engine, you’re not onboarding intelligently.

Ready to Stay

Compliant—Without Slowing Down?

Move at crypto speed without losing sight of your regulatory obligations.

With IDYC360, you can scale securely, onboard instantly, and monitor risk in real time—without the friction.