Cross-border remittances are faster and more accessible than ever. Whether it’s a migrant worker sending wages home or a fintech platform powering peer-to-peer payments across regions, the global money movement market is booming.

But behind the speed of transfers lies a complex web of compliance obligations.

Each corridor comes with its regulations, customer verification standards, data privacy laws, and reporting thresholds.

For remittance platforms, staying compliant isn’t just about onboarding users—it’s about navigating a regulatory maze that changes by jurisdiction, transaction type, and even currency.

In 2025, compliance is no longer a back-end concern—it’s a critical part of how remittance businesses scale safely and sustainably.

The Compliance Complexity of Cross-Border Transfers

Unlike domestic payments, cross-border remittances involve multiple layers of scrutiny. A single transaction may touch:

- Multiple regulators

- Varying KYC thresholds

- Diverse data sharing rules

- Currency conversion reporting

- Intermediary banks and payout partners

This creates fragmentation. For example, a remittance from the UK to Nigeria may require full biometric KYC on one end, but only partial ID on the other.

Add to that anti-money laundering (AML) directives, tax authority reporting, and capital controls, and the compliance landscape gets very complex, very fast.

Remittance platforms that grow across borders must build systems that adapt to these differences without breaking the user experience or introducing compliance blind spots.

One User, Many Rules: Why Universal KYC Doesn’t Work

Many platforms attempt to simplify global compliance with a “universal KYC” policy, asking for the same documentation and applying the same logic everywhere.

But that approach often backfires.

Regulators in high-risk jurisdictions may require enhanced due diligence. Others, particularly in emerging markets, may reject verification flows that rely on foreign documents or methods (like selfie-based ID checks or third-party APIs).

The better approach is jurisdiction-aware onboarding, a flexible model that:

- Adjusts requirements by geography and user profile

- Applies real-time risk scoring based on local standards

- Flag mismatches or unsupported ID types instantly

This ensures that the platform remains compliant with both source and destination country laws while still offering a smooth user experience.

Sanctions, PEPs & Real-Time Screening: A Moving Target

Cross-border transactions are heavily monitored for sanctions exposure, terrorist financing, and political risk.

In many regions, even a single transaction involving a sanctioned entity or politically exposed person (PEP) can lead to investigation or enforcement action.

The problem? These lists change constantly and vary by jurisdiction.

To remain compliant, remittance platforms must implement:

- Real-time screening of senders, recipients, and counterparties

- Automated watchlist updates (OFAC, EU, UN, FATF, national registries)

- Smart fuzzy matching to handle transliteration and alias variations

- Alert workflows that prioritize based on risk context

This is no longer optional. In 2025, regulators expect proactive, intelligent screening that works globally and updates daily.

The Rise of Local Regulations & Why They Matter

Beyond global standards like FATF recommendations or EU AMLDs, local regulators are asserting more control.

Countries like India, Brazil, Kenya, and Indonesia have issued their compliance frameworks for remittance operators. These may include:

- Mandatory reporting to central banks

- Digital ID verification through local systems (e.g., Aadhaar, NIN)

- Transaction caps or volume thresholds

- Required disclosures in the local language

- Specific timelines for SAR filing or dispute resolution

Platforms that fail to align with local expectations often face operational freezes, license revocations, or public enforcement actions.

The solution? Local regulatory intelligence—a system that stays current with regional shifts and adapts instantly.

Monitoring Beyond Onboarding: Continuous Oversight is Key

Onboarding a user is just the start. Remittance platforms must monitor behavior over time to detect and respond to risk signals such as:

- Sudden spikes in transaction volume

- Repeated high-value transfers to flagged jurisdictions

- Rapid onboarding of multiple users from the same IP

- Behavioral anomalies in payout patterns or timing

These indicators may not trigger concern in isolation, but in combination, they often point to fraud or money laundering risk.

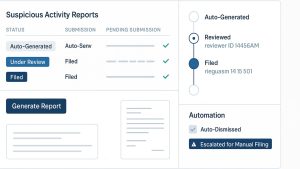

A strong compliance system supports:

- Behavioral baselining

- Trigger-based re-screening

- Real-time alerting tied to user activity

- Investigation workflows for follow-up and escalation

With this infrastructure, remittance platforms move from reactive to proactive compliance.

How IDYC360 Helps Remittance Platforms Stay Compliant

IDYC360 is built for high-velocity, cross-border environments like remittance. Our platform helps compliance teams manage jurisdictional risk, meet global standards, and adapt to local regulations, without slowing down.

Here’s how we help:

Jurisdiction-Aware KYC/KYB

Automatically adjust onboarding flows based on local requirements—supporting national IDs, biometrics, and alternative verification methods.

Global Sanctions & PEP Screening

Continuously screen senders, recipients, and intermediaries across OFAC, EU, UN, domestic lists, and more—with built-in fuzzy logic and native character matching.

Local Regulation Mapping

Stay aligned with local mandates through real-time updates on policy changes, reporting rules, and verification expectations.

Behavioral Risk Monitoring

Detect anomalies like transaction spikes, corridor misuse, or repeated high-risk patterns with configurable rules and machine learning overlays.

Real-Time Alerting & Escalation

Trigger workflows the moment a profile changes, a risk threshold is crossed, or a local compliance rule is breached.

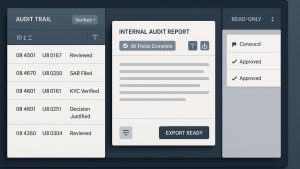

Audit-Ready Documentation

Every action, alert, and override is logged and traceable, ready for regulator review or internal audit.

With IDYC360, remittance platforms don’t just keep up with global compliance—they stay ahead of it.

Final Thoughts

In cross-border remittances, compliance isn’t a barrier to scale—it’s what allows you to scale confidently.

With regulators tightening expectations across every corridor, platforms that treat compliance as a one-size-fits-all process will hit roadblocks.

The ones that build flexible, intelligent systems—adaptable by market, by user, and by risk—will unlock growth, speed, and global trust.

Ready to Stay

Compliant—Without Slowing Down?

Move at crypto speed without losing sight of your regulatory obligations.

With IDYC360, you can scale securely, onboard instantly, and monitor risk in real time—without the friction.