Executive Summary

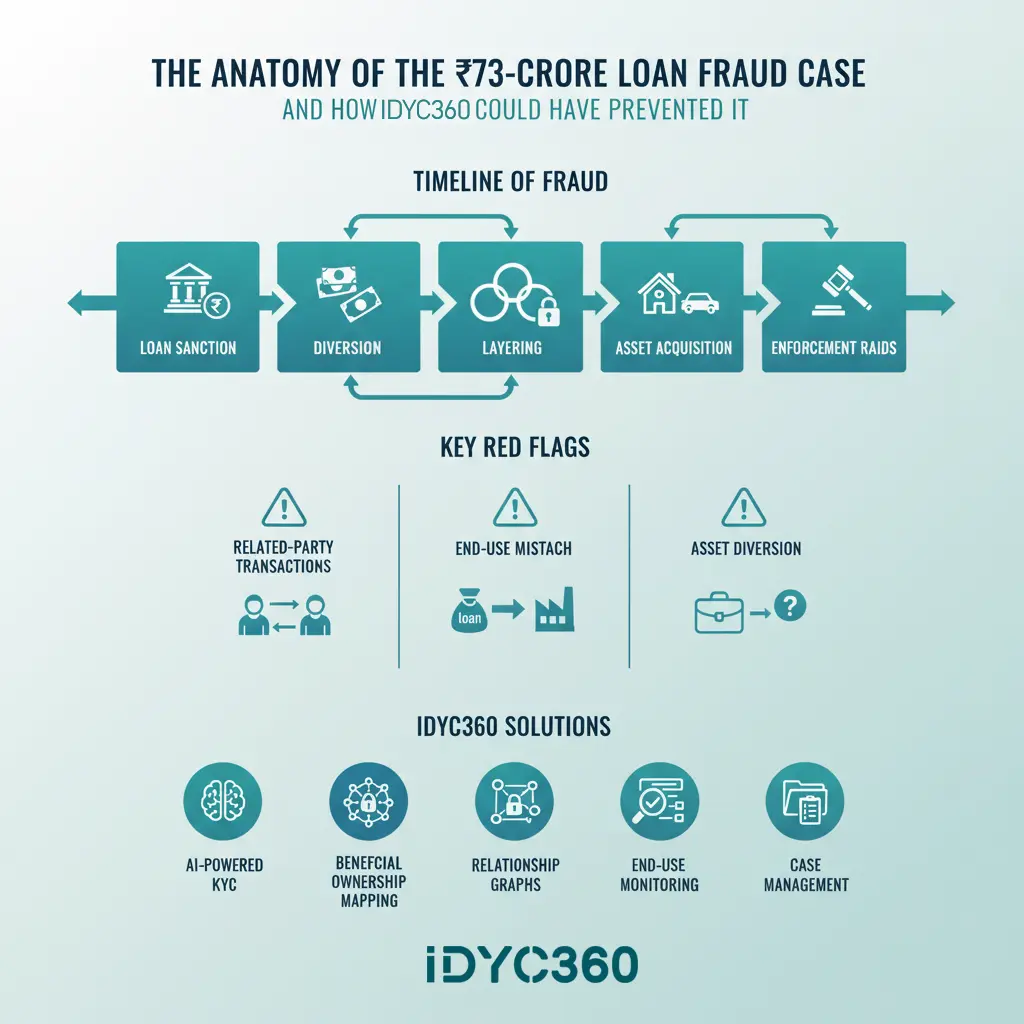

In November 2025, the Enforcement Directorate (ED) conducted coordinated raids across Odisha, Delhi, Uttarakhand, and Punjab, uncovering a ₹73-crore loan fraud linked to SR Alcobev Pvt Ltd and its associated entities.

The investigation revealed how sanctioned funds were diverted through a series of layered transactions and related companies. A pattern increasingly common in India’s credit fraud landscape.

This case highlights not only the sophistication of financial misconduct but also systemic vulnerabilities in traditional due diligence and monitoring frameworks.

IDYC360’s integrated compliance ecosystem offers a comprehensive response to such challenges, combining AI-driven KYC/CDD, beneficial ownership analytics, transaction monitoring, and end-use verification to detect anomalies before they escalate into enforcement crises.

The Case at a Glance

- Case Name: SR Alcobev Pvt Ltd Loan Frau

- Amount Involved: ₹73 crore

- Investigating Agency: Enforcement Directorate (ED), Bhubaneswar Zonal Office

- Originating Complaint: Central Bureau of Investigation (CBI) FIR (Predicate Offence under PMLA, 2002)

- Banks Affected: Punjab National Bank (PNB) and Indian Bank

- Nature of Offence: Diversion of bank credit sanctioned for legitimate business purposes to related concerns and acquisition of assets.

- Enforcement Action: Multi-state raids, seizure of incriminating documents, and identification of properties acquired using diverted funds.

Key Insight:

The case demonstrates how a well-structured credit exposure, backed by documentation and banking relationships, can be subverted through shell layering, misrepresentation of end-use, and related-party transactions.

Anatomy of the Fraud: Modus Operandi

The SR Alcobev case follows a pattern increasingly familiar to investigators and compliance professionals:

Step 1: Credit Sanctioning

The company secured term loans and working capital facilities totaling ₹73 crore from PNB and Indian Bank, supported by ostensibly valid project documents and collateral declarations.

Step 2: Diversion of Funds

Instead of deploying the capital for the sanctioned purpose, funds were transferred to related entities such as Brewforce Technologies and other associated concerns.

Step 3: Layering and Disguise

The funds were cycled across multiple accounts, often using justifiable-looking business transactions to conceal the source.

Step 4: Asset Acquisition

ED’s raids recovered property records worth several crores, suggesting that diverted funds were used for asset creation, a hallmark of laundering proceeds of crime.

Step 5: Defaults and Exposure

Once funds were dissipated, the accounts turned non-performing, triggering lender red flags and, eventually, criminal proceedings.

Systemic Red Flags & Vulnerabilities

While the fraud was deliberate, it thrived because of systemic blind spots common in large lending operations:

Fragmented Due Diligence

- Limited visibility into ultimate beneficial owners (UBOs) and related-party connections.

- Overreliance on borrower-provided data without external verification.

Weak End-Use Monitoring

- Disbursement monitoring often focuses on repayment performance rather than real-time fund flow analysis.

- Absence of transaction-level visibility once funds leave the primary account.

Limited Data Integration

- Banks maintain siloed systems across credit, risk, and compliance departments.

- This creates latency in identifying unusual patterns or common ownership across borrowers.

Reactive Investigations

- Red flags are typically identified post-default, when recovery options are limited and evidentiary trails are weaker.

The Enforcement & Regulatory Context

The Prevention of Money Laundering Act, 2002 (PMLA) empowers the ED to trace and attach assets derived from “proceeds of crime.” Loan fraud, when linked to misappropriation, cheating, or forgery, qualifies as a scheduled offence.

In the SR Alcobev case:

- The CBI registered the initial FIR alleging misappropriation and diversion.

- The ED initiated proceedings under PMLA to trace laundered assets.

- Multi-state searches revealed properties and documents corroborating diversion.

Implications for Financial Institutions

- Regulatory scrutiny has intensified around end-use monitoring, beneficial ownership, and related-party risk.

- Lenders are expected to implement risk-based AML frameworks that extend beyond deposit accounts to include credit exposures.

- Failure to detect fund diversion may invite regulatory action for lapses in internal controls and KYC obligations.

Where the System Failed

The SR Alcobev case exposes a convergence of operational and analytical gaps:

| Failure Point | Description | Mitigation Potential (with IDYC360) |

| Beneficial Ownership Mapping | Connected entities not mapped beyond direct shareholding | Automated UBO graphing and linkage visualization |

| Transaction Pattern Recognition | Cross-entity fund flows not consolidated | AI-based anomaly detection and cross-relationship analytics |

| End-Use Verification | Post-disbursement tracking limited to documentation | Real-time fund-use tracking and invoice validation |

| Risk Scoring | Borrower profile static during loan tenure | Continuous dynamic risk scoring using multi-source data |

| Alert Escalation | Alerts reviewed manually and delayed | Automated triage and risk escalation workflow |

The failure was not merely procedural; it was technological.

Traditional compliance systems cannot correlate disparate data points, director links, shared addresses, and vendor relationships that collectively signal risk.

How IDYC360 Could Have Prevented or Detected It Earlier

IDYC360’s integrated compliance ecosystem is designed precisely to address such vulnerabilities by unifying data, analytics, and automation across the AML lifecycle.

AI-Powered KYC & Beneficial Ownership Mapping

- Automated entity resolution and graph-based relationship mapping uncover hidden linkages between applicants, directors, and affiliates.

- Cross-referencing with corporate registries and watchlists ensures real-time exposure visibility.

- Example: SR Alcobev’s connections to Brewforce Technologies and other entities could have been flagged via shared directors, addresses, or transaction overlaps.

Credit Monitoring & End-Use Verification

- IDYC360’s End-Use Intelligence module traces fund flow post-disbursement, correlating it with the intended use declared during the loan application.

- AI models flag inconsistencies between declared business activity and actual transaction behaviour.

- Integration with core banking systems enables early-stage alerts before repayment defaults surface.

Relationship Intelligence Graphs

- The platform visualizes transactional and ownership interconnections across entities, enabling banks to identify clusters of exposure risk.

- By aggregating risk signals (ownership, common vendors, transaction mirrors), IDYC360 generates a relationship-based risk index that improves decision-making accuracy.

Real-Time Risk Scoring & Alerts

- Continuous scoring across entity networks, geography, and behavioural patterns.

- Alerts prioritized by risk severity and compliance category — fraud, money laundering, related-party risk, or fund diversion.

- Adaptive learning refines the risk model as new data emerges.

Integrated Case Management for Investigations

- Centralized case workflow consolidates alerts, supporting documents, and analyst notes.

- Enables collaborative investigations, audit trails, and regulatory reporting aligned with PMLA and RBI AML standards.

- Reduces manual reconciliation effort and enhances accountability.

Result: A unified surveillance environment that detects, validates, and escalates anomalies long before they escalate into enforcement actions.

Building a Resilient Credit Surveillance Framework

The SR Alcobev case illustrates why loan monitoring must evolve from static credit assessment to dynamic compliance intelligence.

Key Pillars of a Modern Framework

Entity-Centric Compliance

Move beyond borrower-level scrutiny to ecosystem-level analysis — tracing connected entities, beneficial owners, and related exposures.

Data Fusion

Integrate data from core banking, CERSAI, MCA, FIU-IND reports, and third-party KYC sources for unified monitoring.

Behavioural Analytics

Employ machine learning to model expected fund flows and flag deviations suggestive of diversion.

Cross-Jurisdictional Visibility

Link state-level and national data to capture geographically dispersed asset trails.

Continuous Risk Refresh

Replace periodic risk reviews with real-time scoring based on new transactions, filings, or counterparties.

RegTech Collaboration

Partnering with specialized AML platforms like IDYC360 enables faster integration of intelligence layers, reducing the cost and complexity of compliance.

Key Takeaways for Financial Institutions

Strategic

- Credit risk and AML risk are increasingly intertwined; they must be monitored within a single framework.

- Technology-driven compliance is not optional — it’s central to financial resilience.

Operational

- Early warning systems must combine transactional monitoring with ownership analysis.

- Inter-departmental data integration is essential for timely detection.

Regulatory

- Strengthened focus from RBI, ED, and FIU-IND on fund flow tracking and beneficial ownership transparency.

- Institutions unable to demonstrate proactive monitoring may face reputational and supervisory consequences.

For IDYC360 Clients

IDYC360’s platform empowers institutions to transition from reactive compliance to predictive financial integrity management, ensuring that every rupee disbursed is traceable, defensible, and compliant.

Conclusion

The ₹73-crore SR Alcobev loan fraud is not an isolated incident; it’s a mirror to the systemic risks embedded in traditional credit operations.As financial ecosystems grow more interconnected, the ability to connect patterns across entities, transactions, and geographies defines the strength of a compliance framework.

IDYC360 bridges this gap, transforming fragmented data into actionable intelligence, aligning institutions with AML/CFT imperatives, and fortifying the integrity of India’s financial system.

References

- The New Indian Express. “Rs 73 crore loan fraud case: ED conducts raids across states.” Published November 5, 2025.

- Enforcement Directorate (India) – Prevention of Money Laundering Act, 2002 (PMLA) Overview.

- Reserve Bank of India – Master Direction on KYC, 2023 (Updated).

- Financial Intelligence Unit – AML/CFT Compliance and Reporting Obligations for Banks & NBFCs.

Ready to Stay

Compliant—Without Slowing Down?

Move at crypto speed without losing sight of your regulatory obligations.

With IDYC360, you can scale securely, onboard instantly, and monitor risk in real time—without the friction.