Know Your Customer (KYC) is foundational in crypto compliance, but it’s no longer sufficient on its own.

As regulatory pressure mounts and bad actors become more sophisticated, traditional KYC methods fall short, especially when dealing with high-risk wallets, cross-platform identities, or multi-layered business structures.

This is where entity resolution becomes essential. It goes beyond basic verification. It is the process of accurately connecting fragmented, incomplete, or seemingly unrelated data points to form a unified, trustworthy profile of a person or organization.

In crypto, where using an ‘alias’ is the norm and obfuscation tactics are common, entity resolution turns KYC from a check-the-box process into a real compliance safeguard.

The Challenge: Fragmented Identities in Web3

Crypto users don’t behave like traditional banking customers.

They might:

- Use multiple wallets across chains

- Interact via different exchanges or platforms

- Appear as an individual but act on behalf of a decentralized autonomous organization (DAO), fund, or corporate structure

- Transact under a pseudonym while hiding links to known bad actors

This fragmented footprint makes it incredibly difficult to answer basic compliance questions like:

- Who is this?

- Is this the same entity I flagged last month?

- Are they connected to a sanctioned party ot a fraud network?

With strong entity resolution, compliance teams are left piecing together a puzzle with missing or mislabelled pieces.

Why Traditional KYC Doesn’t Cut It?

Legacy KYC processes were designed for centralized systems with formal documentation trails. Crypto breaks that model.

In a decentralized ecosystem:

- Identities are fluid

- Users may self-custody assets under multiple addresses

- A single legal entity may interact through multiple wallet personas

- Some actors intentionally create noise to evade detection

Even when KYC is collected, it often lives in isolated silos, limiting its usefulness for holistic risk assessments.

Entity resolution acts as the connective tissue, linking:

- On-chain wallet data

- Off-chain KYC data

- IPs, emails, device fingerprints

- Behavioral and transactional signals

That’s how you turn raw data into actionable intelligence.

How Entity Resolution Elevates Risk Detection

When you resolve identities accurately, your risk lens sharpens dramatically.

You can:

- Spot multi-wallet abuse and identity cycling

- Link previously unconnected suspicious activity

- Detect when the same actor tries to onboard under a different alias

- Map exposure to high-risk entities, even if they operate through proxies

Entity resolution helps answer, “who’s really behind this transaction?”; and that’s the question regulators care about more.

It is the foundation for smarter sanctions screening, fraud detection, and behavioral risk scoring.

Crypto’s Unique Need for Real-Time Resolution

Speed is non-negotiable in crypto.

By the time a static KYC review flags a concern, funds may have moved through five wallets, between anonymized through a mixer, and exited the ecosystem.

That’s why entity resolution must be real-time and always-on.

Modern systems are:

- Graph-based identity clustering

- AI-driven anomaly detection

- Behavioral heuristics

- Cross-platform fingerprinting

To continuously update and refine identity graphs as new data comes in.

This enables platforms to detect risk as it happens, not weeks later during a periodic review.

The Business Case: Compliance Without the Drag

Entity resolution isn’t just about stopping crime; it’s also about moving fast with confidence.

For crypto platforms:

- You reduce false positives that frustrate legit users

- You can onboard with lower friction by using dynamic resolution instead of excessive document requests

- You build audit trails that satisfy regulators

- You enable your compliance team to focus on true risk, not duplicated records or fragmented profiles

The result: Faster growth, cleaner books, and a compliance stack ready for whatever 2025 brings.

How IDYC360 Helps Resolve Entities, Fast

IDYC360 was built for fast-moving, high-risk environments like crypto.

Here’s how we make entity resolution, real-time, accurate, and scalable:

Advanced Identity Graphs

We connect fragmented KYC, wallet, and behavioral data into unified, live identity profiles, so you see the full picture across your platform.

Multi-Source Resolution

Our platform links on-chain and off-chain signals, including e-mails, IPs, named, and UBO data, back to a central risk identity.

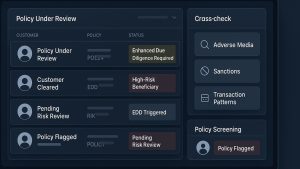

Dynamic Watchlist Intelligence

We track identity exposure to sanctions, PEPs, adverse media, and known fraud rings, flagging new connections as they emerge.

Automated Escalation & Monitoring

Get alerts when a user’s risk profile changes, a duplicated identity is detected, or a previously “clean” wallet links to suspicious behavior.

Frictionless Integration

Plug entity resolution directly into your onboarding and transaction monitoring workflows. Reduce review time. Increase certainty. Scale securely.

IDYC360 turns fragmented crypto data into actionable insight, so your compliance isn’t guessing, it’s resolving.

Final Thoughts

KYC is still critical, but it’s no longer enough in isolation.

Crypto platforms that want to stay compliant, competitive, and regulator-ready in 2025 need stronger identity infrastructure. And that starts with smart, scalable entity resolution.

Because in Web3, the question isn’t just “do we know the customer?”

It’s: “Do we know who they are and who they are connected to?”

Ready to Stay

Compliant—Without Slowing Down?

Move at crypto speed without losing sight of your regulatory obligations.

With IDYC360, you can scale securely, onboard instantly, and monitor risk in real time—without the friction.