For years, AML controls in insurance focused heavily on onboarding: verify the customer, run sanctions screening, and move forward. But in 2025, that mindset is no longer enough.

Criminal networks are exploiting gaps in the insurance value chain—using policies for placement, layering, and integration of illicit funds. From life insurance and investment-linked products to high-value annuities, insurers now sit firmly in the crosshairs of global regulators.

The old playbook—screen once, store the file—is obsolete. To stay compliant, insurers must go beyond customer screening and embrace ongoing risk monitoring, behavioral insight, and contextual intelligence throughout the policy lifecycle.

Is Being Used to Launder Money, Quietly

Is Being Used to Launder Money, Quietly

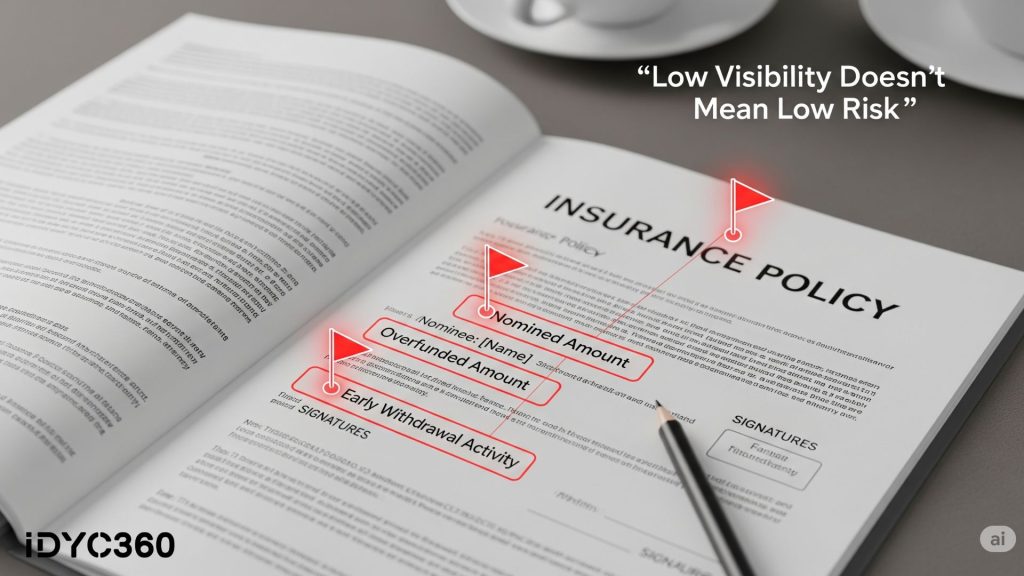

Unlike traditional banking channels, insurance transactions often appear low-risk. Premium payments are stable.

Withdrawals can be delayed by months or years. But that perceived safety is exactly why bad actors use insurance to layer illicit funds.

Common abuse tactics include:

- Overfunding life insurance with illicit cash

- Early withdrawals are structured below threshold limits

- Surrendering policies to access “clean” funds

- Using nominees or shell companies as beneficiaries

In many regions, these activities go unnoticed until well after the funds have exited the system. By then, it’s too late.

That’s why insurers must shift their focus from one-time risk assessment to lifecycle vigilance.

KYC at Onboarding Doesn’t Equal AML Compliance

Know Your Customer (KYC) is necessary, but it’s only the first layer of AML defense.

A clean ID at onboarding doesn’t mean the customer won’t become risky later. What if:

- They’re added to a sanctions list 8 months later?

- Do they become politically exposed after acquiring public office?

- Adverse media surfaces linking them to a fraud ring?

Static KYC processes can’t catch this. Insurance compliance requires dynamic, always-on screening, including real-time sanctions monitoring, adverse media tracking, and PEP status changes.

Without it, insurers are only compliant at one point in time, not continuously.

Beneficiaries & Ownership Structures Need Scrutiny Too

Criminal actors often avoid scrutiny by keeping their names off the policy. Instead, they use:

- Nominees

- Family members

- Offshore trusts

- Layered legal entities

These structures obscure true ownership and make detection harder, especially when AML controls don’t extend beyond the primary policyholder.

Regulators now expect insurers to go further:

- Screen beneficiaries, not just applicants

- Uncover ultimate beneficial owners (UBOs) in complex entity cases

- Flag suspicious changes in payout instructions or nominees

If your AML workflow stops at the policyholder, you’re likely missing critical risk.

Transaction Monitoring Applies to Insurance, Too

Many insurers don’t think of their transactions as AML-sensitive, but that’s changing fast.

From premium payments to withdrawals and fund switches, every financial event is a potential risk signal. Especially when:

- Payment sources shift suddenly (e.g., from local bank to foreign entity)

- Surrender requests follow shortly after policy initiation

- Transaction patterns don’t align with the declared risk profile

Modern compliance systems must treat these as alerts, not just admin events.

This requires:

- Behavioral baselining

- Risk scoring on payout activity

- Smart alerts for policy behavior that deviates from the norm

It’s transaction monitoring, adapted to insurance.

Global Regulators Are Tightening the Screws

Insurers are no longer under the radar.

The FATF, EU AMLA, FinCEN, and regional regulators have all raised expectations for the sector, including:

- Enhanced due diligence for high-risk policies

- Clear audit trails for AML review processes

- Timely SARs tied to suspicious claim or withdrawal behavior

- Proof of continuous screening and adverse media checks

Penalties are rising, and reputational damage can be just as costly.

Insurers that want to scale must treat AML not as a regulatory burden, but as a non-negotiable part of the business model.

How IDYC360 Helps Insurance Platforms Close the Gaps

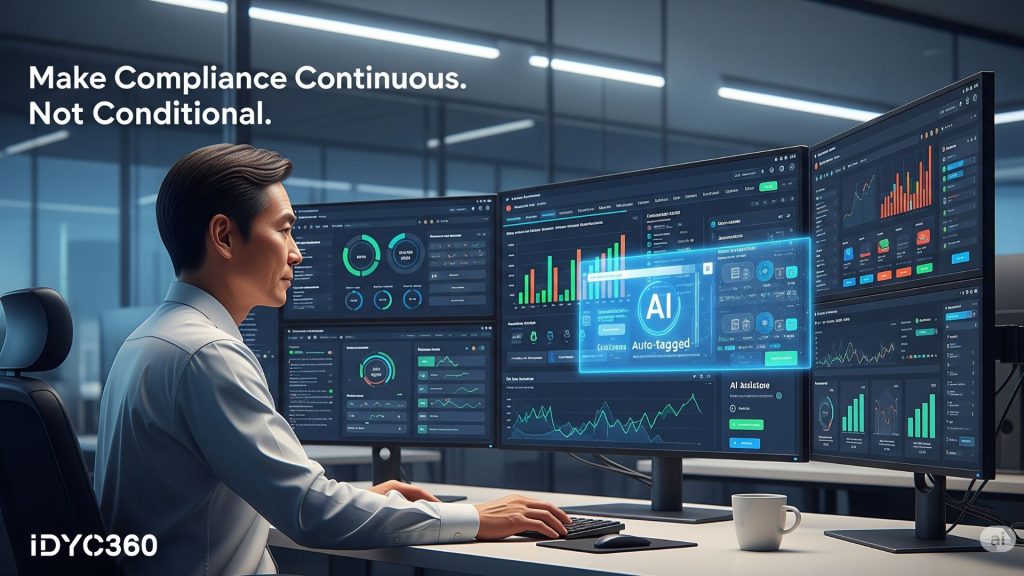

IDYC360 is built to bring real-time AML intelligence into complex, layered financial products like insurance, without disrupting policyholder experience or operational workflows.

Here’s how we help insurers level up their compliance:

End-to-End Sanctions & PEP Monitoring

From policyholder to beneficiary, we screen every party involved—continuously, across global and domestic lists.

Beneficial Ownership Discovery

Uncover hidden ownership structures and nominee arrangements through layered UBO resolution and entity graphing.

Behavioral Risk Tracking

Baseline customer transaction activity and trigger alerts when payouts, contributions, or claims deviate from expected patterns.

Adverse Media Intelligence

Monitor policyholders and associated entities in real time across thousands of global news sources and legal records.

Policy Lifecycle Risk Scoring

Track evolving risk across the full insurance journey—from onboarding to claim or surrender—with AI-driven alerts.

Audit-Ready Case Management

Every action, alert, and override is documented, timestamped, and fully traceable for regulator inspection or internal review.

With IDYC360, insurers don’t just screen at entry—they monitor risk continuously, intelligently, and defensibly.

Final Thoughts

In 2025, insurers can’t afford to treat compliance as a static process.

The risks are evolving. So are the expectations. Screening alone won’t protect your platform from abuse or your license from scrutiny.

AML in insurance must be dynamic, contextual, and embedded across the policy lifecycle.

The platforms that succeed will be those that build compliance into their infrastructure, not just their onboarding flow.

Ready to Stay

Compliant—Without Slowing Down?

Move at crypto speed without losing sight of your regulatory obligations.

With IDYC360, you can scale securely, onboard instantly, and monitor risk in real time—without the friction.