Introduction

The collapse of Infrastructure Leasing & Financial Services Limited (IL&FS) in 2018 remains one of India’s most significant financial governance crises.

Once considered a pillar of the country’s infrastructure financing ecosystem, IL&FS’s downfall exposed the structural weaknesses that can exist within highly complex, multi-entity financial conglomerates.

The IL&FS episode revealed not only liquidity mismanagement but deep-rooted governance lapses, including intra-group funding opacity, poor board oversight, and a near-total absence of integrated risk monitoring.

What emerged from the crisis was a clear signal: regulatory compliance cannot be backward-looking.

The new compliance paradigm must be continuous, data-driven, and predictive.

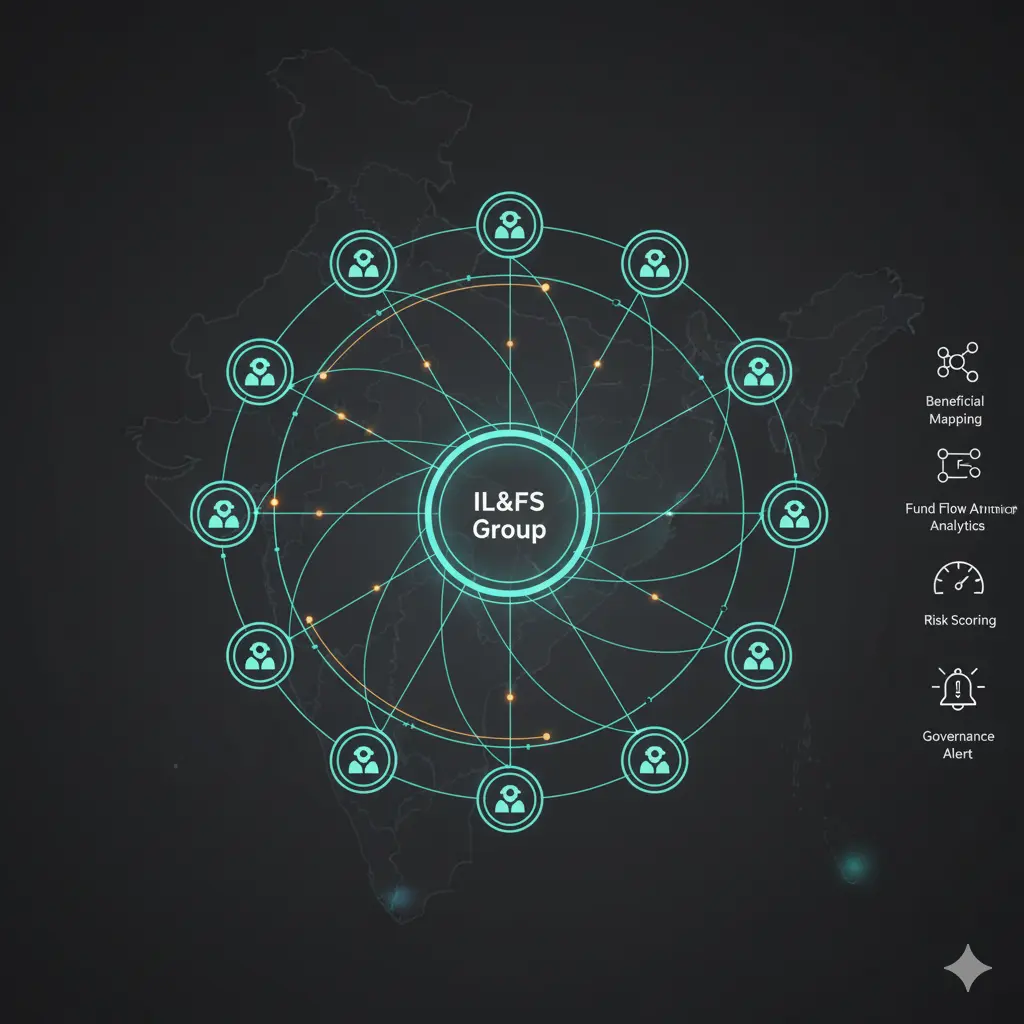

For financial institutions, NBFCs, and regulators, the IL&FS case underscores the importance of compliance intelligence systems that combine beneficial ownership transparency, real-time fund flow analytics, and automated risk escalation.

Platforms like IDYC360 represent this shift, from reactive governance to predictive control.

Background: The Rise of IL&FS

Founded in 1987, IL&FS was created as a public–private partnership to promote infrastructure financing in India.

Its shareholding structure included the Life Insurance Corporation of India (LIC), State Bank of India (SBI), and Japan’s Orix Corporation, a combination that lent it institutional credibility and regulatory trust.

Over three decades, IL&FS has evolved into a sprawling financial ecosystem with more than 200 subsidiaries, associates, and joint ventures.

It financed roads, ports, power projects, and urban infrastructure across India.

Through special purpose vehicles (SPVs), IL&FS borrowed heavily to finance long-gestation projects and often guaranteed debt across its group entities.

By 2017, IL&FS’s consolidated debt had crossed ₹91,000 crore.

Despite its scale, the company operated with minimal group-level risk visibility, weak internal controls, and a culture of opaque inter-company transactions.

The Unraveling of the Crisis

The crisis began quietly. In mid-2018, IL&FS defaulted on several short-term obligations, triggering a cascade of rating downgrades.

The defaults quickly escalated into a systemic liquidity crisis, freezing credit flows across India’s non-banking financial sector.

Subsequent investigations by the Serious Fraud Investigation Office (SFIO), Reserve Bank of India (RBI), and Securities and Exchange Board of India (SEBI) exposed a web of fund diversion, misrepresentation of accounts, and weak governance controls.

The company had used a complex structure of subsidiaries to mask solvency issues and recycle funds.

Key findings included:

- Circular lending among subsidiaries and group companies.

- Accounting practices that overstated asset values and underreported liabilities.

- Lapses by auditors and internal risk committees in detecting red flags.

- Board-level failures to exercise fiduciary oversight or escalate irregularities.

The systemic consequence was immediate.

Mutual funds, banks, and institutional investors holding IL&FS paper faced severe mark-to-market losses.

NBFCs dependent on short-term market borrowings saw funding channels dry up.

The crisis triggered a broader debate on corporate governance, credit risk concentration, and compliance accountability.

Anatomy of the Failure

The IL&FS collapse was not a sudden event but the outcome of long-standing structural weaknesses.

First, there was intra-group opacity.

With more than 200 subsidiaries and associates, IL&FS created layers of funding arrangements that made true exposure assessment nearly impossible.

Funds raised by one entity were often routed to another under the guise of loans or advances, concealing actual utilization.

Second, board oversight failed.

Many directors either lacked visibility into complex group structures or relied excessively on management presentations.

Governance protocols that existed on paper were rarely implemented.

Third, external audits and ratings proved ineffective.

Credit ratings remained investment grade until shortly before the default, highlighting the absence of data-driven stress indicators.

Audit reviews failed to question related-party transactions or risk provisioning gaps.

Finally, regulatory reporting remained fragmented.

No centralized system consolidated group exposures across entities, preventing early identification of financial stress.

These failures collectively point to one gap: the absence of real-time, predictive compliance and ownership intelligence.

Legal & Regulatory Aftermath

In October 2018, the National Company Law Tribunal (NCLT) intervened, superseding the IL&FS board and appointing a new management team led by Uday Kotak.

The government’s priority was to restore solvency, recover assets, and prevent contagion across the financial system.

The SFIO’s investigation revealed that IL&FS management had diverted funds, falsified accounts, and extended loans to entities with weak repayment capacity.

The Enforcement Directorate (ED) initiated proceedings under the Prevention of Money Laundering Act (PMLA) to trace and attach assets linked to proceeds of crime.

Simultaneously, SEBI and the Institute of Chartered Accountants of India (ICAI) launched actions against auditors for professional negligence.

The government estimated total recoverable assets at ₹57,000 crore out of ₹91,000 crore in liabilities.

Resolution processes under the Insolvency and Bankruptcy Code (IBC) began for multiple subsidiaries.

These investigations highlighted one key insight: compliance breaches at the governance level have systemic ripple effects far beyond one institution.

Systemic Lessons from the IL&FS Crisis

The IL&FS episode forced India’s regulators, financial institutions, and compliance professionals to confront deep-rooted issues in how large corporate networks are supervised.

First, beneficial ownership visibility is essential.

With hundreds of subsidiaries and SPVs, IL&FS created layers of corporate insulation that obscured accountability.

Mapping control hierarchies through AI-driven entity resolution would have exposed the same director and promoter linkages across entities.

Second, real-time risk aggregation must replace static compliance reporting.

Traditional quarterly or annual reporting cycles failed to capture intra-group liquidity stress.

Third, data integration across credit, compliance, and audit functions is crucial.

Siloed risk management prevented holistic visibility of fund movement.

Finally, board independence and competence are not procedural formality; they form the foundation of institutional integrity.

These lessons have since shaped India’s regulatory evolution, particularly in NBFC oversight and group exposure management.

How IDYC360 Could Have Detected the Risk Early

The IL&FS case presents a textbook example of how RegTech-enabled compliance systems can detect systemic weaknesses well before they escalate.

Entity and Ownership Mapping

IDYC360’s ownership analytics engine automatically identifies and visualizes direct and indirect linkages between group companies.

In IL&FS’s case, the system would have revealed repeated cross-directorships and inter-company transactions, early indicators of financial interdependence.

Fund Flow Analytics

AI-powered transaction tracing can correlate loan disbursals and repayments across subsidiaries. Circular fund movement patterns would have triggered anomaly alerts within days, flagging potential layering.

Behavioral Risk Scoring

By integrating payment velocity, debt maturity profiles, and liquidity indicators, IDYC360 could have dynamically adjusted entity risk scores, signaling imminent stress.

Governance Monitoring

Automated board-level dashboards within IDYC360 provide real-time visibility into compliance breaches and risk exposures. Early escalation workflows could have warned directors about liquidity mismatches long before default.

Regulatory Alignment

All alerts and risk summaries are logged within the platform’s case management system, ensuring audit-readiness for regulators such as RBI, SEBI, and FIU-IND.

Through such mechanisms, IDYC360 transforms compliance from a retrospective audit function into a forward-looking control system.

Predictive Compliance: The New Governance Imperative

The IL&FS crisis catalyzed a shift in regulatory thinking. Supervisors realized that governance cannot rely solely on human oversight; it must be digitally augmented.

Predictive compliance involves using artificial intelligence to forecast risks based on behavioral, financial, and network data. It allows institutions to:

- Detect anomalies in fund flow before they materialize as defaults.

- Recognize early-warning signals in group exposures.

- Generate real-time compliance dashboards for senior management and regulators.

This model aligns directly with the Financial Action Task Force (FATF)’s emphasis on technology adoption for AML/CFT governance.

For India, the crisis accelerated the push toward digital oversight.

The Reserve Bank of India introduced Scale-Based Regulation (SBR) for NBFCs, mandating enhanced risk management, internal audit, and exposure tracking.

Institutions that adopt predictive analytics for compliance are now better positioned to meet these standards, both in letter and in spirit.

Market & Regulatory Impact

The IL&FS collapse reshaped India’s financial regulatory architecture. It directly influenced multiple policy and market developments:

NBFC Regulation: RBI tightened liquidity and capital adequacy norms for non-bank lenders. Stress testing and group exposure reporting became mandatory.

Auditor Accountability: Regulators expanded audit oversight through the National Financial Reporting Authority (NFRA). Auditors are now obligated to verify group-level fund movement and related-party exposure.

Investor Confidence: Institutional investors now demand transparency across subsidiary structures before extending credit or investing in debt instruments.

AML/CFT Integration: The crisis reinforced the overlap between governance failure and financial crime risk. Fund diversion, circular lending, and misrepresentation are now treated as potential money laundering typologies under PMLA guidelines.

Ultimately, IL&FS forced India’s financial ecosystem to recognize compliance as a strategic function, not a regulatory afterthought.

The Role of IDYC360 in Preventing Future Systemic Risks

Modern financial systems operate in real time, compliance must do the same.

IDYC360 delivers that agility through integrated compliance intelligence.

Continuous Ownership Transparency

The platform maintains dynamic maps of beneficial ownership and group control structures.

As entities evolve, these visual graphs update automatically, providing accurate risk lineage.

AI-Driven Fund Flow Correlation

Using machine learning, IDYC360 detects repeated or circular transaction behavior.

This capability would have identified IL&FS’s intra-group lending chains months before the liquidity collapse.

Dynamic Risk Scoring

Entity risk profiles adjust in real time as new data arrives, whether transactional, geographical, or behavioral.

High-risk clusters trigger alerts across compliance and risk teams.

Regulatory-Ready Reporting

The system auto-generates audit trails, risk summaries, and regulatory reports, formatted to RBI and FIU-IND standards.

This reduces compliance friction and ensures full transparency during inspections or investigations.

Board-Level Intelligence

Interactive dashboards empower boards and audit committees to visualize exposure concentration and governance breaches, fostering accountability at the top.

By embedding predictive analytics within compliance frameworks, IDYC360 ensures that institutions can identify, isolate, and address governance risk long before it becomes a systemic crisis.

Strategic Lessons for Governance & Compliance Leaders

The IL&FS crisis offers enduring lessons for both regulators and market participants.

- Complexity breeds opacity: Large corporate groups must invest in systems that consolidate visibility across all subsidiaries and SPVs.

- Risk is interconnected: Financial, operational, and compliance risks cannot be managed in silos. Integrated risk management systems are no longer optional.

- Technology is governance infrastructure: Artificial intelligence, data analytics, and automated risk scoring form the foundation of 21st-century compliance.

- Transparency equals resilience: Institutions that can trace every rupee’s origin and destination are inherently more stable — and more trusted by regulators.

- Compliance must be continuous: Quarterly reports and periodic reviews are insufficient. Real-time surveillance and continuous monitoring define modern regulatory expectations.

For boards, the takeaway is simple: predictive compliance is not a tool; it’s a mindset.

The Future of Compliance Intelligence

Post-IL&FS, India’s regulatory focus has expanded from punishing governance failures to preventing them.

The next phase of compliance evolution will involve tighter integration between financial technology, corporate governance, and enforcement oversight.

Key trends include:

- Unified risk registries integrating data from multiple regulators.

- Mandatory beneficial ownership disclosures linked to corporate filings.

- AI-led anomaly detection in financial statements.

- Collaborative compliance frameworks between RegTech providers and regulators.

Platforms like IDYC360 sit at the intersection of these shifts, enabling regulated entities to meet evolving expectations while enhancing operational integrity.

Conclusion

The IL&FS crisis was not just an episode of corporate failure; it was a systemic wake-up call.

It showed that governance breakdowns in one institution can trigger ripples across an entire economy.

It also demonstrated that compliance cannot remain a reactive discipline rooted in paperwork and periodic checks.

In a world of complex financial ecosystems, compliance must be intelligent, predictive, and data-integrated.

That is the philosophy behind IDYC360, an AI-powered compliance infrastructure built to anticipate risk, reveal hidden ownership networks, and strengthen institutional accountability.

IL&FS taught the financial world that opacity breeds fragility.

IDYC360 proves that transparency, when powered by intelligence, builds resilience.

As regulators, boards, and compliance leaders move into a new era of accountability, predictive compliance will no longer be a competitive advantage; it will be the cost of survival.

References

- Serious Fraud Investigation Office (SFIO) – IL&FS Group Investigation Reports, 2019–2021.

- Reserve Bank of India – Scale-Based Regulation Framework for NBFCs (2021).

- Securities and Exchange Board of India – Corporate Governance Norms for Listed Entities, 2020.

- Enforcement Directorate – PMLA Proceedings and Asset Attachment Orders in IL&FS Case.

- Financial Intelligence Unit – Beneficial Ownership and Complex Corporate Structures, 2023.

- Economic Times – “How IL&FS Collapse Changed India’s Financial Oversight Framework,” 2024.

Ready to Stay

Compliant—Without Slowing Down?

Move at crypto speed without losing sight of your regulatory obligations.

With IDYC360, you can scale securely, onboard instantly, and monitor risk in real time—without the friction.