In the payments industry, milliseconds matter, and so does trust. Every transaction is an opportunity, but also a potential attack vector. Fraudulent activity has grown more complex and harder to detect, making it essential for payment platforms to take fraud prevention seriously.

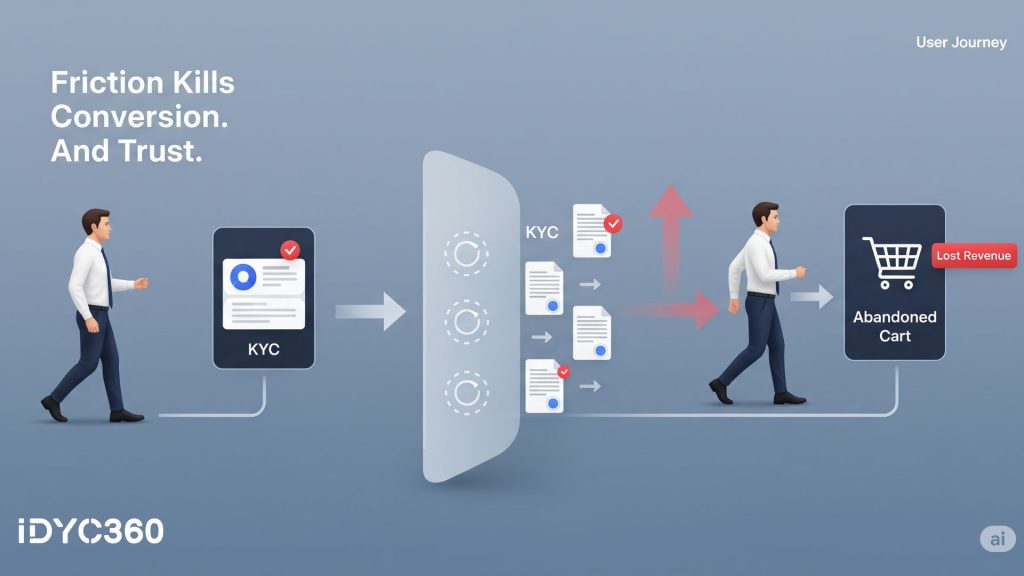

But here’s the challenge: most fraud mitigation strategies come at the cost of user experience. Overly aggressive verification steps, delay in processing, or false positives can frustrate legitimate users, leading to abandoned transactions and lost revenue. The need for speed collides with the need for security.

For modern payment platforms, the real question isn’t whether to fight fraud: it is how to do it without introducing friction that kills conversion.

Let’s explore how smart, risk-aware platforms are winning both battles.

Why Traditional Fraud Controls Don’t Work Anymore

Legacy fraud detection systems are built on rigid rule sets. They flag transactions based on static parameters, i.e., large amounts, suspicious IPs, and high-risk geographies. In theory, this seems sound. In practice, it’s broken.

Today’s fraudsters are agile. They mimic real user behavior, rotate devices, mask geolocation, and operate across borders with the help of sophisticated networks. What once looked suspicious is now commonplace, and what looks safe can be cleverly disguised.

At the same time, legitimate user behavior has evolved. A returning user may switch devices, shop from a different country, or use a VPN; all of which might trigger a false alarm under a traditional rule-based system.

The result? Too many false positives, overwhelmed detection teams, and frustrated users. To keep pace, platforms must move beyond static checks and embrace adaptive, real-time fraud detection that accounts for context.

The Cost of Drop-Offs: A Hidden Risk Multiplier

Fraud costs are visible on the balance sheet, but so are drop-offs. Every time a legit user abandons a transaction due to friction, it’s revenue left on the table. Worse, many of those users never return.

Drop-offs don’t just hurt in the short term. They erode long-term growth by:

- Lowering customer lifetime value

- Reducing checkout conversion rates

- Undermining user trust in the platform

- Driving up the cost of customer acquisition

And it doesn’t stop there. Merchants relying on your platform for payments may grow frustrated with declining approval rates or excessive verification loops. That leads to merchant churn, another silent killer of growth.

Adaptive Risk Models: The Smart Way to Fight Fraud

Not all users or transactions carry the same level of risk. Treating them as the same leads to inefficient checks, wasted resources, and frustrated customers. This is where adaptive risk models make a difference.

These systems evaluate a wide range of signals in real-time:

- Device reputation

- User history

- Behavioral cues

- Transaction context (location, amount, velocity)

Low-risk users enjoy a smooth experience, while high-risk transactions are escalated for additional verification. This enables the platforms to tailor fraud defenses dynamically, applying scrutiny where it’s needed and streamlining the rest.

Adaptive systems improve over time. Machine learning models evolve based on new platforms and data, making your fraud detection stack more accurate and resilient with each transaction.

The outcome? Fewer false positives, stronger security, and a much better user experience.

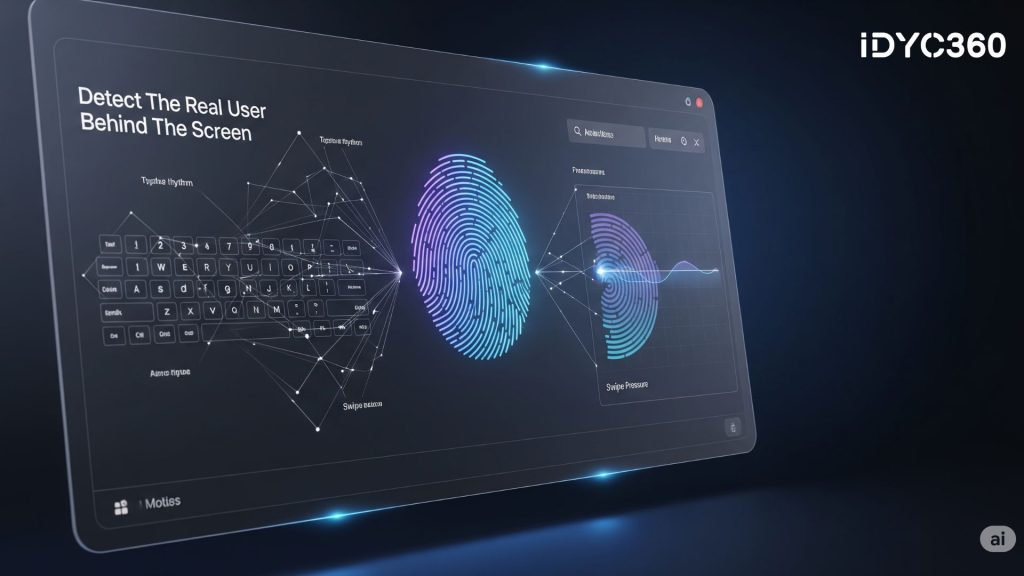

Behavioral Biometrics: The Silent Protector

In the fight against increasingly sophisticated fraud, behavioral biometrics has emerged as a powerful tool.

Unlike traditional verification methods, behavioral biometrics doesn’t rely on what a user knows (personal data) or has (device). It evaluates how they behave. Subtle cues like typing rhythm, mouse movement, swipe dynamics, and even ‘how hard a screen is tapped’ form a unique behavioral fingerprint.

These patterns are extremely difficult to replicate, especially at scale. That makes them ideal for identifying bots, synthetic identities, and account takeovers in real-time, without needing to interrupt the user journey.

By passively authenticating users in the background, behavioral biometrics provides an invisible layer of protection. It’s fraud prevention minus the friction; a win-win for both platforms and end-users.

Real-Time Monitoring is Non-Negotiable

Modern fraud doesn’t happen on a schedule, and your detection stack can’t afford to either.

Real-time monitoring is the backbone of any serious fraud prevention strategy. Payment platforms must be able to:

- Detect anomalies as they happen

- Flag high-risk behaviors mid-transaction

- Stop fraudulent activity before funds are disbursed

This is particularly crucial in high-velocity scenarios, like instant withdrawals, real-time transfers, or cryptocurrency on-ramps. A delay of even a few seconds can be enough for fraudsters to exploit vulnerabilities.

Real-time insights also help fraud-detection and compliance teams act faster. Instead of waiting for a daily batch review, analysts can intervene immediately, reducing financial exposure and minimizing downstream impact.

In 2025, delayed detection equals missed protection. Real-time is the new standard.

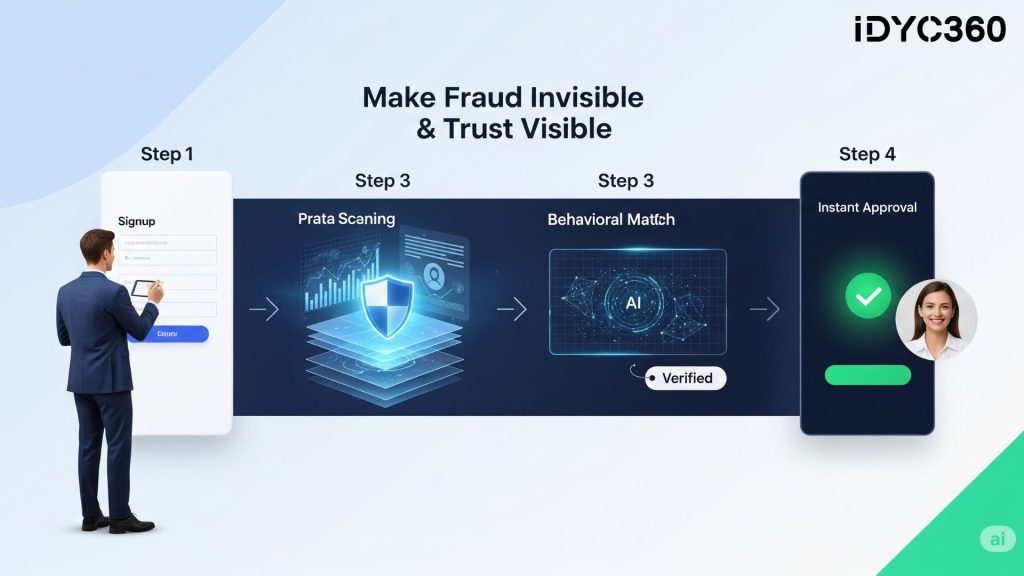

How IDYC360 Helps Minimize Fraud Without Killing UX

At IDYC360, we help payment platforms stay fast, secure, and fully compliant, without introducing the kind of friction that alienates users or merchants.

Here’s how we empower fraud-detection teams without sacrificing growth:

Adaptive Risk Scoring That Evolves

Our intelligent engine processes real-time data to deliver dynamic risk scores, helping you escalate only where necessary and streamline low-risk flows.

Frictionless Behavioral Intelligence

We embed behavioral biometrics that identify bots, fake accounts, and anomalous patterns; silently and without disrupting the user journey.

Real-Time Threat Detection & Alerts

Our always-on monitoring flags suspicious activity he moment it happens, allowing instant intervention before funds move or damage is done.

Progressive Verification Triggers

No need for blanket checks, IDYC360 helps you configure tiered verification based on user profile, geography, transaction type, and more.

Developer-Friendly API Stack

Integrate effortlessly with your existing infrastructure, whether you are a payment gateway, wallet, or embedded financial product.

With IDYC360, you can reduce fraud, cut drop-offs, and keep growing securely and at speed.

Final Thoughts

Fraud is inevitable, but drop-offs don’t have to be.

With smarter technology, contextual decision-making, and real-time intelligence, payment platforms can reduce risk without increasing friction. The best platforms turn compliance and fraud defense into growth enablers, building trust, improving approvals, and driving user satisfaction.

When fraud prevention becomes seamless, users don’t notice it. And that’s exactly how it should be.

Ready to Stay

Compliant—Without Slowing Down?

Move at crypto speed without losing sight of your regulatory obligations.

With IDYC360, you can scale securely, onboard instantly, and monitor risk in real time—without the friction.