In the digital lending space, speed is everything. Customers expect decisions in minutes, not days. But when risk signals are missed in the rush to approve, the consequences can be severe.

From fraud and identity manipulation to sanctions exposure and synthetic identities, the threat landscape for lenders has expanded. Quick decisions can’t come at the cost of compliance.

To protect themselves and scale confidently, lending institutions must move beyond simple scoring models and implement real-time risk triage at the moment of application.

Traditional Risk Scoring Doesn’t Catch Hidden Threats

Most digital lenders rely on credit scores, income verification, and repayment history to evaluate applicants. But these metrics don’t cover:

- Fraudulent identities using legitimate data

- Customers flagged on global sanctions or PEP lists

- Associations with bad actors or shell entities

- Behavior patterns linked to financial crime or bust-out fraud

Without enhanced screening at the entry point, lenders may onboard applicants who look good on paper but pose real legal and reputational risk.

Creditworthiness ≠ low compliance risk. You need visibility into both.

Real-Time Risk Triage Starts at Application Intake

Instant lending requires instant decisioning—and that includes instant screening.

With the right infrastructure in place, lenders can triage applications as they come in by checking for:

- Sanctions, PEP, and watchlist matches

- Behavioral risk indicators

- Connections to flagged entities or networks

- Synthetic ID patterns (e.g., new SSNs, address anomalies)

Instead of approving first and reviewing later, triage lets you detect and defer risk before exposure occurs.

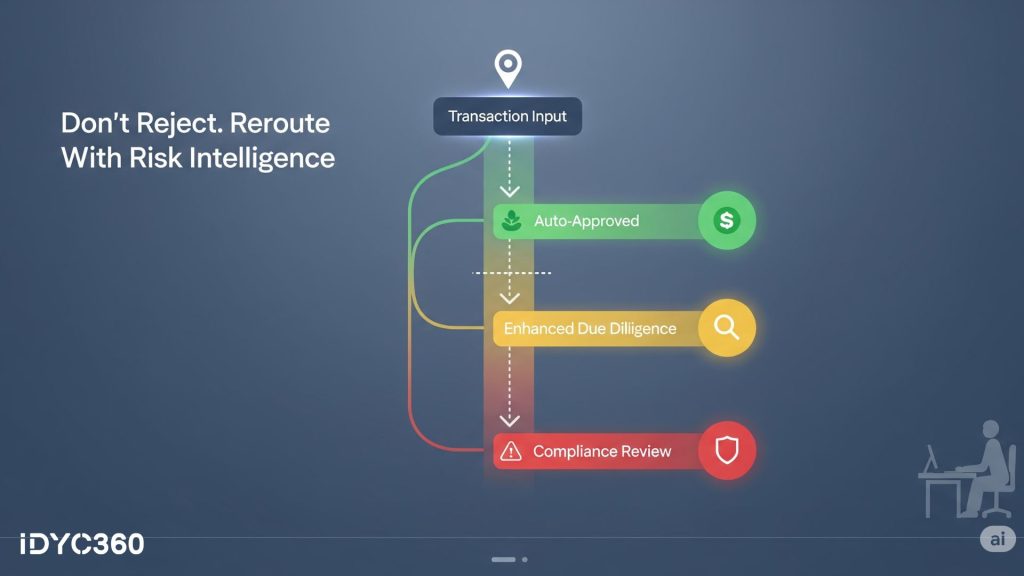

High-Risk Doesn’t Mean Decline; It Means Route Smartly

The goal isn’t to reject more applications—it’s to route them intelligently.

With a smart triage system:

- Low-risk applicants can be auto-approved

- Medium-risk applicants can go through enhanced due diligence

- High-risk applicants can be flagged for compliance review or paused entirely

This layered approach reduces backlog, improves decision consistency, and gives risk teams more time for complex cases, without slowing down low-risk approvals.

Machine Learning Enhances, Not Replaces, Human Review

AI and machine learning can identify subtle fraud patterns and behavioral anomalies, but humans remain critical for judgment.

A best-practice triage model:

- Uses AI to detect non-obvious risk signals

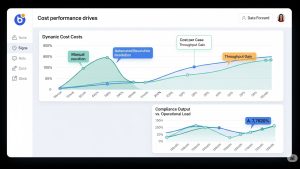

- Scores applicants based on dynamic risk factors

- Surface context and explainability for reviewers

- Helps compliance teams make faster, better decisions with fewer false flags

This hybrid model ensures scalability, speed, and defensibility, all at once.

Regulators Expect Frontline Screening, Not Just Back-End Fixes

Regulators in key markets (e.g., US, EU, APAC) increasingly expect financial institutions to:

- Catch red flags before funds are disbursed

- Prevent the onboarding of sanctioned or high-risk individuals

- Demonstrate screening logic and audit trails

- Apply consistent policies across digital and traditional channels

Delayed risk detection can lead to fines, license risk, or retroactive SAR filings. Triage helps lenders move fast and stay compliant.

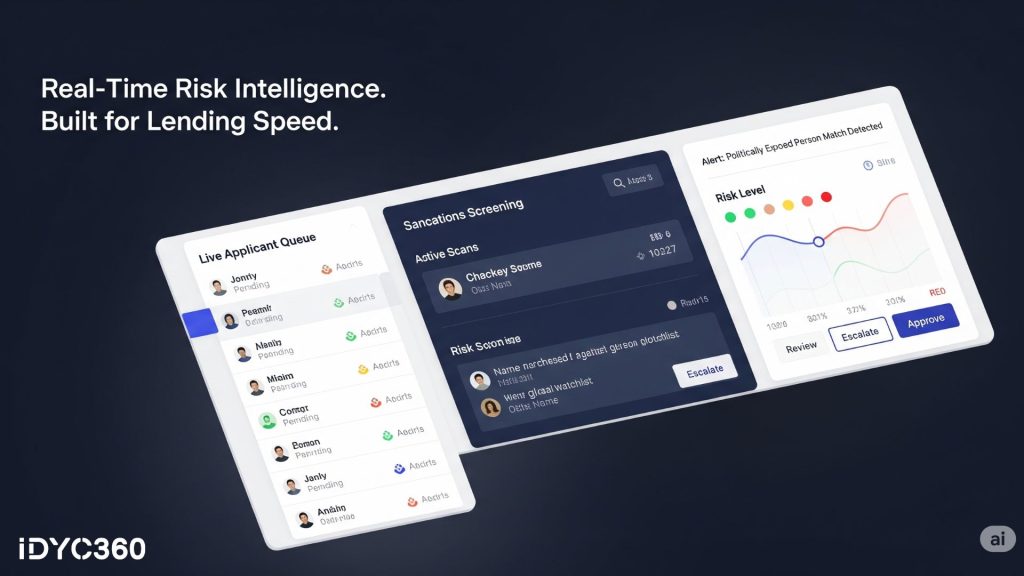

How IDYC360 Helps Lenders Triage High-Risk Applicants Instantly

At IDYC360, we equip lending platforms with smart, real-time risk intelligence—so they can approve faster, flag smarter, and stay audit-ready.

Instant Sanctions & PEP Screening

Every applicant is screened in real time across global and regional lists before approval happens.

Behavioral Risk Profiling

Spot synthetic identities, document fraud, and application anomalies using pattern-based analysis and velocity checks.

Risk-Based Routing & Escalation

Configure auto-approve, review, or reject pathways based on dynamic risk scores and thresholds.

Explainable Risk Signals

Alerts come with transparent reasoning and source data—no black-box AI, no guesswork.

Audit-Ready Case Records

Every triage action is documented, time-stamped, and traceable for both internal QA and regulatory review.

Frictionless UX for Applicants

All checks happen in the background, so your users get instant decisions without added friction.

With IDYC360, lenders don’t have to choose between speed and safety. They triage risk in real time, without slowing down business.

Final Thoughts

In the race to scale, digital lenders can’t afford manual bottlenecks—or unchecked exposure.

The smartest platforms are building real-time triage systems that protect the business without paralyzing it.

Risk doesn’t wait for periodic reviews. Your triage shouldn’t either.

Ready to Stay

Compliant—Without Slowing Down?

Move at crypto speed without losing sight of your regulatory obligations.

With IDYC360, you can scale securely, onboard instantly, and monitor risk in real time—without the friction.