In the world of forex trading, speed isn’t a luxury; it’s the baseline.

Users expect split-second execution, real-time access to global currency pairs, and seamless cross-border fund transfers. But behind the fast-paced front end, there‘s a regulatory minefield, i.e., cross-border money flows, high-risk geographies, fraud attempts, and ever-evolving AML expectations.

Forex platforms that prioritize speed over risk are playing a dangerous game, with regulators and reputations at stake.

So, how do you scale quickly, move capital efficiently, and stay compliant across volatile jurisdictions? It starts with embedding smart, automated, and real-time compliance at the core.

The Unique Compliance Pressure Points in Forex

Fore platforms operate at the intersection of:

- Global financial markets

- Real-time currency conversions

- High liquidity and rapid user onboarding

- Regulatory arbitrage across borders

This makes them uniquely vulnerable to:

- Money laundering through rapid buy/sell cycles

- Sanctions evasions via exotic currency pairs

- Fake or stolen identities in onboarding

- Transaction layering to obscure illicit funds

What complicates the matter further is regulatory fragmentation. The rules in Singapore aren’t the same as in the EU, UAE, or the US. Yet, forex platforms must comply with them simultaneously.

Why Manual Compliance Doesn’t Work Anymore

Speed and volume kill manual compliance processes.

Reviewing documents by hand. Checking sanctions lists once a day. Approving wire transfers through multi-step email chains. These are relics of a slower era, and they simply don’t scale in modern forex environments.

The result? Either risky gaps or frustrating bottlenecks.

To stay competitive and compliant, forex platforms need to fully automate:

- ID verification and document validation

- Sanctions and PEP screening

- Ongoing adverse media monitoring

- Transaction monitoring with intelligent rule logic

Only then can platforms keep up with user experience and regulatory demands, without breaking stride.

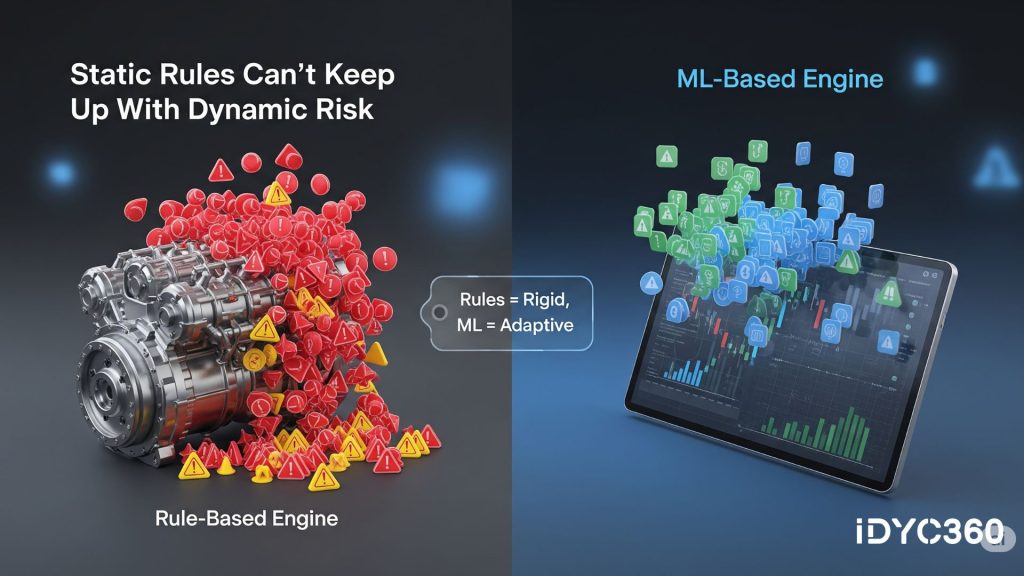

Real-Time Risk Intelligence is Non-Negotiable

In forex, timing isn’t just everything; it’s also a compliance signal.

Consider this:

- A user makes 12 rapid trends, cashes out in crypto, and withdraws it to an offshore account, all in under 30 minutes

- Another user suddenly starts trading restricted currencies after months of inactivity

- A third changes their jurisdiction to a high-risk zone without documentation

Without real-time risk intelligence, these behaviors go unnoticed. With it, they trigger immediate flags, tailored rules, and automated escalation.

That’s the difference between catching issues early and dealing with fallout later.

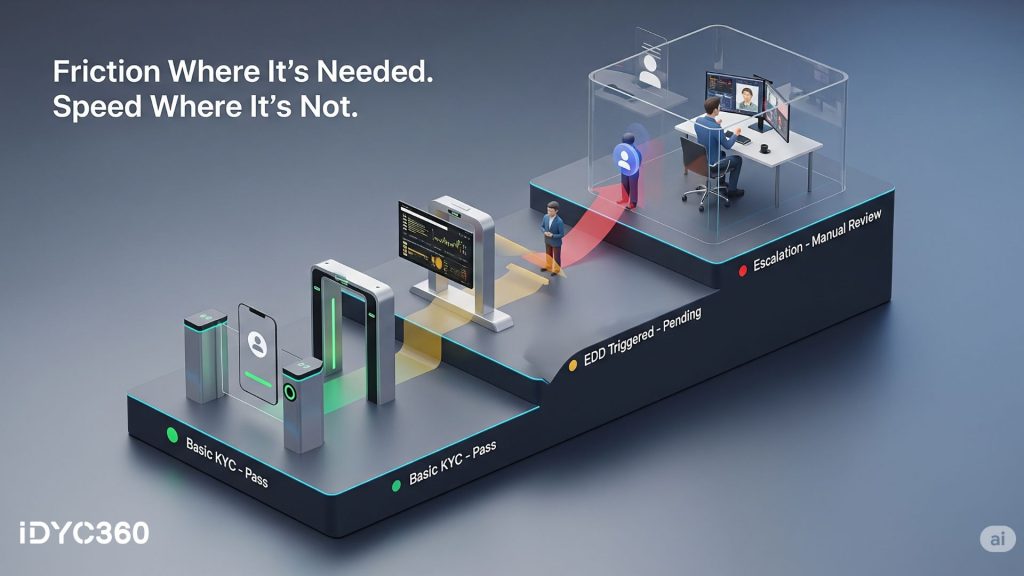

Balancing Onboarding Speed with Risk Controls

Forex users are notoriously impatient. If onboarding takes too long, they jump to another platform, especially in emerging markets.

But speed can’t come at the cost of due diligence.

Smart forex platforms solve this with tiered onboarding and adaptive workflows:

- Low-risk users clear basic verification instantly

- Higher-risk profiles face enhanced checks automatically

- All flows are integrated via API, so there’s no “compliance handoff” slowdown

This balance enables platforms to onboard faster without leaving open doors to bad actors.

Monitoring Doesn’t Stop at Signup

Some of the biggest threats don’t emerge at onboarding; they emerge later.

For example:

- A user starts transferring unusually large amounts

- A partner institution suddenly gets flagged in sanctions news

- A user begins using forex trades to layer illicit funds

Continuous monitoring enables forex platforms to react in real-time. It creates a feedback loop where behaviours update the risk model, which then shapes how the system responds.

It’s not surveillance; it’s smart, scalable protection for your brand, your users, and your regulatory posture.

How IDYC360 Helps Forex Platforms Stay Fast & Compliant

At IDYC360, we help high-velocity platforms like yours move fast without compromising trust, compliance, or global scale.

Here’s how we power secure growth in the forex space:

Instant Global KYC/KYB Checks

Verify individual traders and institutional clients in seconds, with access to over 200 global identity databases, corporate registries, and risk intelligence feeds.

Real-Time Sanctions & PEP Screening

Our engine checks names, aliases, and associated entities against OFAC, EU, UN, and global lists—instantly and continuously.

Adverse Media Monitoring That Never Sleeps

We track thousands of sources across jurisdictions, alerting you to emerging risks tied to your users, partners, or counterparties.

Dynamic Risk Scoring & Behavior Alerts

Detect risky trading patterns, unusual fund flows, and jurisdiction shifts in real time—so you’re always ahead of potential threats.

Built for API Integration and Speed

IDYC360 plugs directly into your onboarding, transaction, and support workflows. Compliance runs quietly in the background, while your platform keeps moving.

For forex platforms, we offer compliance without drag and scale without exposure.

Final Thoughts

Forex is fast by nature. But in today’s regulatory environment, speed without control is reckless.

The platforms that thrive will be the ones that embed risk management deeply—but invisibly—into their systems.

Not as a blocker, but as a foundational capability.

That’s how you stay compliant, earn user trust, and grow confidently in every market.

Ready to Stay

Compliant—Without Slowing Down?

Move at crypto speed without losing sight of your regulatory obligations.

With IDYC360, you can scale securely, onboard instantly, and monitor risk in real time—without the friction.