Introduction: The Switch from Compliance to Supervisory Proof

Across India’s regulated financial ecosystem, a structural shift is underway.

Regulatory compliance is no longer evaluated by the presence of policies, static risk frameworks, or technology deployments alone.

Instead, supervisory authorities, most notably the Reserve Bank of India, now assess demonstrable effectiveness, timeliness, and traceability of controls across AML/CFT, fraud risk management, and enterprise risk governance.

This evolution is reflected clearly in on-site inspections, thematic reviews, and supervisory communications.

Institutions are increasingly asked not what systems they have, but what outcomes those systems produce, and whether those outcomes can be evidenced immediately, consistently, and coherently.

In this context, inspection readiness has emerged as a distinct operational capability.

It is no longer sufficient to monitor risk; institutions must be able to prove how risk is identified, assessed, escalated, and mitigated, using inspection-grade evidence that stands up to regulatory scrutiny.

This is precisely the gap IDYC360 is designed to address.

The Modern RBI Inspection Lens: What Supervisors Actually Test

While regulatory directions define formal obligations, supervisory inspections focus on practical execution.

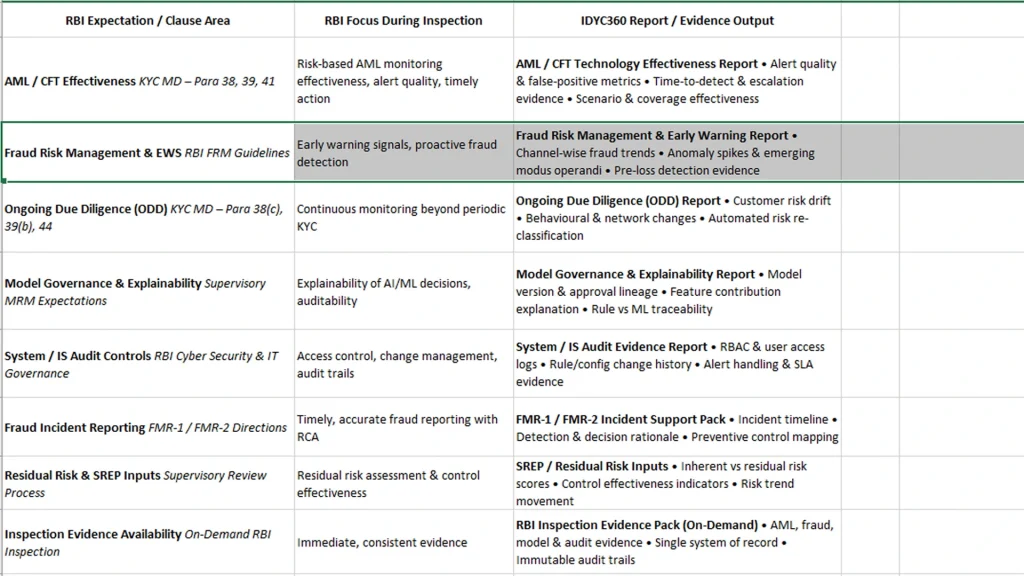

Across AML, fraud, and technology-enabled risk controls, RBI inspections consistently converge on a few non-negotiable themes:

- Risk-based decisioning, not uniform rule application

- Continuous monitoring, not point-in-time compliance

- Quality and relevance of alerts, not alert volumes

- Timeliness of detection and escalation

- Explainability and auditability of models and rules

- Evidence availability without manual reconstruction

These expectations apply across multiple regulatory domains, including KYC Master Directions, Fraud Risk Management Guidelines, cybersecurity frameworks, and supervisory review processes.

The implication is clear: inspection outcomes are driven by operational evidence, not policy intent.

AML/CFT Effectiveness: Moving Beyond Coverage to Outcome Measurement

The Regulatory Expectation

Under RBI’s KYC and AML/CFT framework, regulated entities are required to implement risk-based monitoring systems capable of detecting suspicious behaviour, reducing false positives, and enabling timely escalation and reporting.

However, inspections increasingly probe deeper than scenario coverage or rule libraries.

Supervisors assess whether AML controls are effective in practice.

Key inspection questions typically include:

- Are alerts meaningful, or operationally noisy?

- How long does it take to detect and escalate suspicious behaviour?

- Do scenarios reflect current typologies and risk exposure?

- Can the institution demonstrate coverage effectiveness?

The IDYC360 Approach

IDYC360 operationalises AML effectiveness as a measurable, reportable discipline, rather than a conceptual objective.

Its AML/CFT Technology Effectiveness framework is designed to generate inspection-ready outputs, including:

- Alert quality and false-positive metrics

- Time-to-detect and time-to-escalate analysis

- Scenario performance and coverage effectiveness

- Risk segmentation across customer types and products

Rather than relying on assumptions, institutions can present quantified evidence of how their AML monitoring performs in real operating conditions.

Fraud Risk Management & Early Warning Signals: From Reactive to Predictive

The Regulatory Context

RBI’s Fraud Risk Management guidelines emphasise early identification of emerging fraud risks, proactive monitoring, and timely preventive action.

Increasingly, inspections focus on whether institutions can identify fraud before financial loss occurs, rather than merely reporting incidents post-facto.

Supervisors now expect:

- Channel-wise and product-wise fraud trend analysis

- Detection of anomalous behaviour and emerging patterns

- Evidence of proactive controls and early intervention

IDYC36 – Translating Expectation into Evidence

IDYC360’s Fraud Risk Management and Early Warning framework addresses this supervisory focus by embedding:

- Behavioural anomaly detection across channels

- Module-wise fraud trend analysis

- Emerging modus operandi identification

- Pre-loss detection evidence

These capabilities allow institutions to demonstrate that fraud controls are not only reactive reporting mechanisms, but predictive, risk-adaptive systems aligned with supervisory expectations.

Ongoing Due Diligence: Continuous Risk Visibility, Not Periodic Formality

Why ODD Is a Supervisory Hotspot

Ongoing Due Diligence (ODD) has emerged as one of the most scrutinised areas during RBI inspections.

While initial KYC compliance is foundational, supervisors increasingly test whether customer risk profiles are actively monitored and dynamically updated.

Inspection focus areas include:

- Customer risk drift over time

- Behavioural deviations from expected profiles

- Network and relationship changes

- Automated risk re-classification

IDYC360’s ODD Capability

IDYC360 treats ODD as a living risk process, not a scheduled compliance task. Its ODD reporting outputs include:

- Customer risk drift analysis

- Behavioural and transactional pattern changes

- Network and linkage evolution

- Automated re-scoring and re-classification logic

This enables institutions to demonstrate continuous vigilance, a critical supervisory expectation that is often weakly evidenced in traditional setups.

Model Governance & Explainability: Making AI Supervisory-Safe

The Supervisory Challenge of Advanced Analytics

As financial institutions increasingly adopt AI/ML models for AML and fraud detection, RBI inspections now extend into model risk management and explainability.

Supervisors seek assurance that advanced models are:

- Governed through formal approval processes

- Transparent in their decision logic

- Auditable and reproducible

- Traceable across versions and changes

The absence of explainability is no longer acceptable, regardless of model sophistication.

IDYC360’s Model Governance Framework

IDYC360 embeds model governance into its core architecture, generating evidence such as:

- Model versioning and approval lineage

- Feature contribution and decision explanation

- Rule-based versus ML-based traceability

- End-to-end audit trails for model changes

This ensures that innovation does not come at the cost of supervisory defensibility.

System, IS Audit & Technology Controls: The Backbone of Evidence Integrity

What RBI Inspects

Beyond functional risk controls, RBI inspections extend into technology governance, including:

- Role-based access control (RBAC)

- User activity and access logs

- Change management and configuration history

- Alert handling workflows and SLA adherence

These controls are critical to ensuring that risk systems themselves are secure, governed, and tamper-resistant.

IDYC360’s Evidence-First Architecture

IDYC360 is designed as a system of record, producing immutable audit trails and technology evidence, including:

- RBAC and user access logs

- Rule and configuration change history

- Alert handling workflows

- SLA and operational performance evidence

This eliminates the need for manual evidence reconstruction during inspections.

Fraud Incident Reporting: Supporting FMR-1 & FMR-2 Obligations

Regulatory Reporting Expectations

Under the RBI’s fraud reporting framework, institutions must submit accurate, timely, and well-reasoned incident reports, supported by:

- Detection timelines

- Root cause analysis (RCA)

- Preventive control mapping

Supervisors increasingly evaluate the quality and consistency of these submissions.

IDYC360’s Incident Support Pack

IDYC360 generates structured incident support outputs, including:

- Incident chronology and detection evidence

- Decision rationale and escalation paths

- Preventive and corrective control mapping

This enables institutions to respond confidently to supervisory queries and post-incident reviews.

Residual Risk & SREP Alignment: Enabling Supervisory Dialogue

Why Residual Risk Matters

The Supervisory Review and Evaluation Process (SREP) relies heavily on an institution’s ability to articulate residual risk, control effectiveness, and risk trajectory.

Inspections often test whether institutions can explain:

- Inherent versus residual risk positioning

- Control effectiveness indicators

- Risk trend movement over time

IDYC360’s SREP-Aligned Outputs

IDYC360 supports SREP readiness through:

- Inherent and residual risk scoring

- Control effectiveness indicators

- Risk trend and movement analysis

This transforms supervisory engagement from reactive defence to structured risk dialogue.

Inspection Evidence Availability: The Ultimate Differentiator

One of the most frequent supervisory pain points is evidence latency. Institutions often struggle to produce consistent, reconciled evidence under inspection timelines.

IDYC360 addresses this directly by enabling:

- On-demand inspection evidence packs

- Single system of record across AML, fraud, model, and audit domains

- Immutable audit trails

This capability fundamentally alters inspection dynamics, reducing disruption, risk, and uncertainty.

Conclusion:

Regulatory supervision has entered an era where proof matters more than posture. Policies, frameworks, and technology deployments are now baseline expectations.

What differentiates institutions during inspections is their ability to demonstrate:

- Effectiveness

- Timeliness

- Explainability

- Evidence integrity

IDYC360 is purpose-built for this supervisory reality.

Aligning operational risk controls with inspection-grade evidence outputs, it enables regulated entities to move from reactive compliance to confident supervisory readiness.

In a landscape where inspections are increasingly outcome-driven,

IDYC360 functions not as a replacement for existing systems but as an API-driven, plug-and-play force multiplier, transforming risk management into a defensible, auditable, and regulator-aligned capability

Ready to Stay

Compliant—Without Slowing Down?

Move at crypto speed without losing sight of your regulatory obligations.

With IDYC360, you can scale securely, onboard instantly, and monitor risk in real time—without the friction.