Major anti-money laundering (AML) enforcement actions in recent years have not only made headlines due to billion-dollar penalties but have actively reshaped global compliance standards.

As regulatory expectations broaden, both legacy financial institutions and modern fintechs have found themselves at the center of costly scandals.

For compliance professionals and leadership teams, understanding these pivotal failures and the waves of reform they triggered is essential for futureproofing their programs.

Case Study: The Landmark AML Failures

Several high-profile AML failures have set new benchmarks for regulatory action and reform:

Goldman Sachs & the 1MDB Scandal

- In 2020, Goldman Sachs was fined $2.9 billion for its role in the 1MDB affair, where Malaysia’s sovereign wealth fund was looted to fund luxury purchases and political bribes. The case revealed how inadequate due diligence and culture failures can enable systemic crime.

- Lesson: Even financial giants are not immune to crippling fines and reputational damage from failing to spot red flags.

Danske Bank’s Baltic Blunder

- In 2022, Danske Bank agreed to pay a $2 billion penalty for processing $160 billion in suspicious transactions through its Estonian branch, often for high-risk non-residents. Lax controls and an apparent willingness to ignore risk facilitated one of Europe’s biggest scandals.

- Lesson: Weaknesses at even a single subsidiary can pose existential risks—robust group-wide compliance is essential.

BitMEX & the Crypto Reckoning

- Crypto exchange BitMEX was fined $100 million in 2021 for failing to conduct essential KYC checks, enabling anonymous trading, and suspicious activity. The case sent shockwaves through the crypto industry, underscoring regulators’ intolerance of “legacy compliance gaps.”

- Lesson: New financial platforms are under the same obligations as banks—growth does not excuse compliance failure.

Westpac’s Child Exploitation Payments

- Westpac, one of Australia’s largest banks, was hit with a record $700 million fine in 2020 after its systems allowed thousands of transactions related to child exploitation material to go undetected.

- Lesson: Automated monitoring systems must be continually updated and scrutinized for effectiveness—failure exposes not just institutions, but vulnerable communities.

OKX: Fintech’s Wakeup Call

- In 2025, OKX, a top crypto exchange, was fined over $500 million after enabling $5 billion in suspicious transactions over seven years, knowingly guiding users to bypass AML/KYC protocols.

- Lesson: Regulators are increasingly scrutinizing fintech and digital assets, raising the bar for AML controls in new sectors.

Why AML Programs Failed

Behind every record fine and headline, common themes emerge:

Inadequate Due Diligence

- Institutions missed or ignored beneficial ownership, failed to recognize shell companies, or neglected ongoing monitoring.

Lack of Integrated Systems

- Siloed or outdated monitoring technology led to blind spots across branches, geographies, or product lines.

Under-resourced Compliance

- Insufficient staffing and training left teams unable to spot, investigate, or escalate red flags.

Culture of Complacency or Willful Blindness

- In some cases, compliance failures were repeated or even tolerated so as not to disrupt “business as usual.”

Regulatory Responses that Shaped the Landscape

Regulators worldwide have responded decisively:

Record-Breaking Fines

- The past five years have seen penalties routinely in the hundreds of millions—or even billions—demanding greater investment in compliance.

Focus on Beneficial Ownership

- Disclosure requirements and scrutiny of complex entity structures have increased sharply, especially in the EU and the US.

Greater Accountability for Individuals

- Enforcement has increasingly targeted directors and compliance officers personally for failings.

Expansion to Emerging Sectors

- Fintechs, neobanks, and crypto firms must now meet the same AML standards as traditional banks, ending the era of regulatory arbitrage.

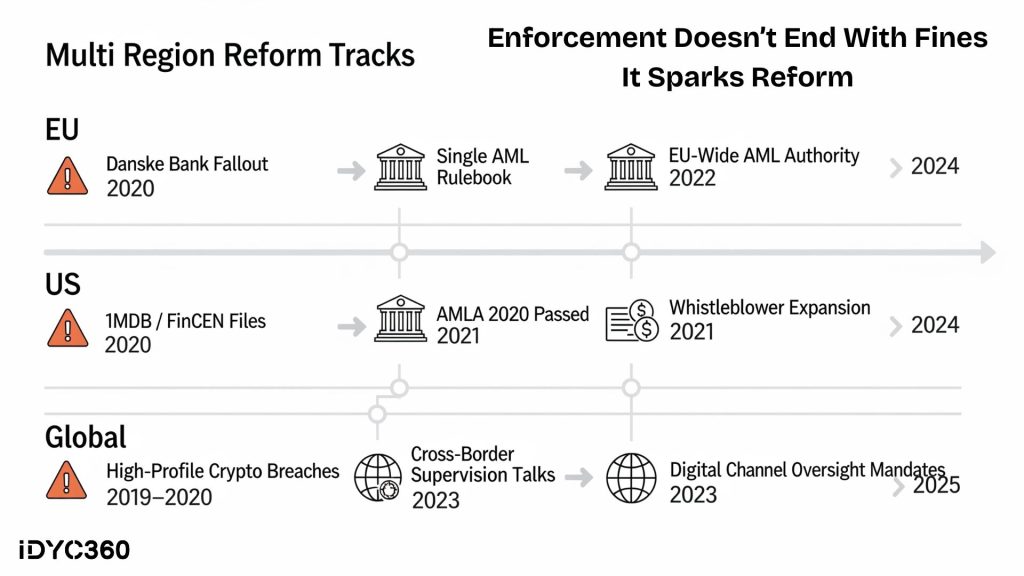

Global Reform Driven by Enforcement

These enforcement actions led directly to new and amended regulations:

The EU’s Single AML Rulebook & AMLA

- The EU has moved to harmonize rules across member states and develop a central AML authority, addressing inconsistencies in beneficial ownership reporting and enforcement.

The US AMLA and Whistleblower Incentives

- The US Anti-Money Laundering Act of 2020 expanded oversight and significantly enhanced whistleblower rewards, encouraging insider reporting of failures.

Broader Scope of Supervision

- Financial regulators now routinely require end-to-end transaction monitoring, ongoing customer due diligence, and scrutiny of all business lines, including cross-border and digital channels.

How IDYC360 Helps

IDYC360 empowers institutions to evolve in lock-step with rising compliance expectations:

End-to-End KYC, Transaction, and UBO Monitoring

- Advanced technology uncovers hidden connections, layered ownership, and shell company misuse.

Dynamic, AI-Powered Detection

- Machine learning models adapt to emerging threats, flagging anomalies across assets, payment channels, and geographies.

Integrated Crypto and Fintech Controls

- Tools designed for hybrid and digital financial platforms provide unified oversight, ensuring even innovative products meet global regulatory thresholds.

Real-Time Regulatory Updates

- Automated alerts update compliance teams on new enforcement trends, typologies, and blacklists, so nothing slips through the cracks.

Expert Advisory and Remediation

- IDYC360 offers direct access to regulatory specialists, helping organizations understand new rules, remediate gaps, and prepare defensible compliance documentation.

Final Thoughts

The past decade’s AML failures reshaped the global regulatory scaffolding and drove an enormous leap in compliance requirements.

The institutions that suffered the gravest losses and catalyzed the greatest reforms typically shared a lack of holistic monitoring, culture, or investment in compliance.

As enforcement inexorably leads to reform, organizations must remain constantly vigilant, continuously innovating and reviewing their programs to match—or exceed—the regulatory bar.

Ready to Stay

Compliant—Without Slowing Down?

Move at crypto speed without losing sight of your regulatory obligations.

With IDYC360, you can scale securely, onboard instantly, and monitor risk in real time—without the friction.