The digital lending boom has unlocked new possibilities for consumers and businesses alike. Borrowers can now get approved for loans in seconds, receive funds instantly, and access credit through a variety of digital channels—from mobile apps to e-commerce platforms.

But as lending becomes more instantaneous, compliance obligations have grown more complex. Regulators are tightening controls, expecting real-time identity verification, accurate risk scoring, and fair lending practices—even when decisions happen in milliseconds.

Legacy compliance processes, built for slower environments, struggle to keep pace. And without a new approach, digital lenders risk falling out of regulatory alignment, facing operational bottlenecks, or enabling financial crime.

This is where the concept of instant compliance becomes essential. It’s not just about speed—it’s about embedding intelligence into every decision, without creating drag.

Real-Time Lending Demands Real-Time Trust Decisions

Today’s borrowers don’t wait. They expect a decision the moment they click “Apply.” In many markets, loan approvals, verifications, and disbursals now happen in under five minutes.

That means lenders must make instant trust decisions—verifying identities, screening for risk, and confirming compliance in near real time.

Relying on manual checks, third-party uploads, or delayed KYC queues simply won’t work. These outdated processes lead to drop-offs, increase fraud risk, and violate evolving regulatory mandates in jurisdictions like the U.S., EU, and India.

To keep up, lenders need infrastructure that supports always-on verification, continuous screening, and real-time eligibility logic. It’s no longer a luxury. It’s a competitive requirement.

The Compliance Stack Is Expanding

Compliance used to be synonymous with AML. Now, it’s a multi-dimensional responsibility involving:

- KYC/KYB: Verifying individuals and business borrowers

- Sanctions & PEP Screening: Ensuring no exposure to listed entities

- Consumer Protection: Transparent terms, no discriminatory underwriting

- Data Privacy & Residency: Ensuring data is stored, processed, and shared in compliance with local laws

- Cross-border Regulations: Complying with varying expectations across geographies

Each layer adds complexity, and ignoring even one can result in fines, reputational damage, or license loss.

For digital lenders operating in multiple jurisdictions, this creates a compliance minefield. The only viable solution is a modular compliance architecture that adjusts dynamically based on geography, product type, and customer profile.

Automation Isn’t Optional; It’s Infrastructure

Scaling digital lending without automation is like building a skyscraper without elevators. Manual processes can’t match the velocity of modern credit cycles.

Automation in compliance goes far beyond document verification. It includes:

- Facial biometric matching for identity authentication

- Real-time API-based screenings against global watchlists

- Machine learning models that detect anomalies in application behavior

- Pre-configured workflows that adapt based on risk scoring

- Audit trail generators that log every decision for regulators

Done right, automation improves both accuracy and defensibility. It reduces human error, improves response time, and supports confident expansion into new regions or user segments.

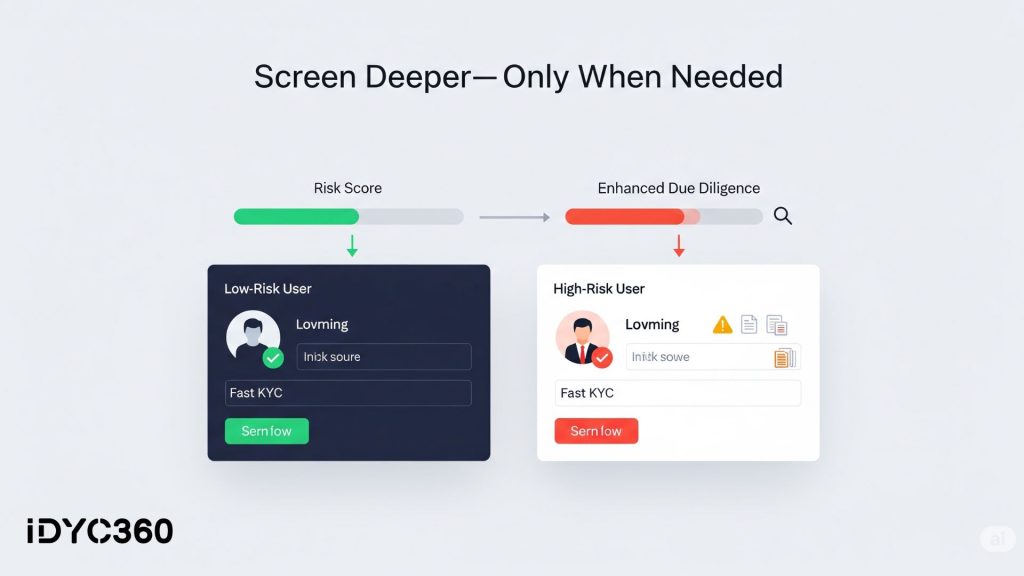

Risk-Based Compliance = Smarter, Not Slower

Not all borrowers present the same level of risk. Yet many platforms apply the same compliance checks to everyone, slowing down the process unnecessarily.

Risk-based compliance solves this problem by tailoring the depth and complexity of checks to each borrower’s risk profile. For example:

- A salaried individual applying for a micro-loan in a low-risk jurisdiction may only need basic KYC.

- A business requesting a cross-border line of credit might require enhanced due diligence, UBO screening, and additional document verification.

This dynamic approach reduces friction for good users while providing stronger scrutiny for higher-risk cases. It’s a smarter way to allocate resources and protect both the platform and the borrower.

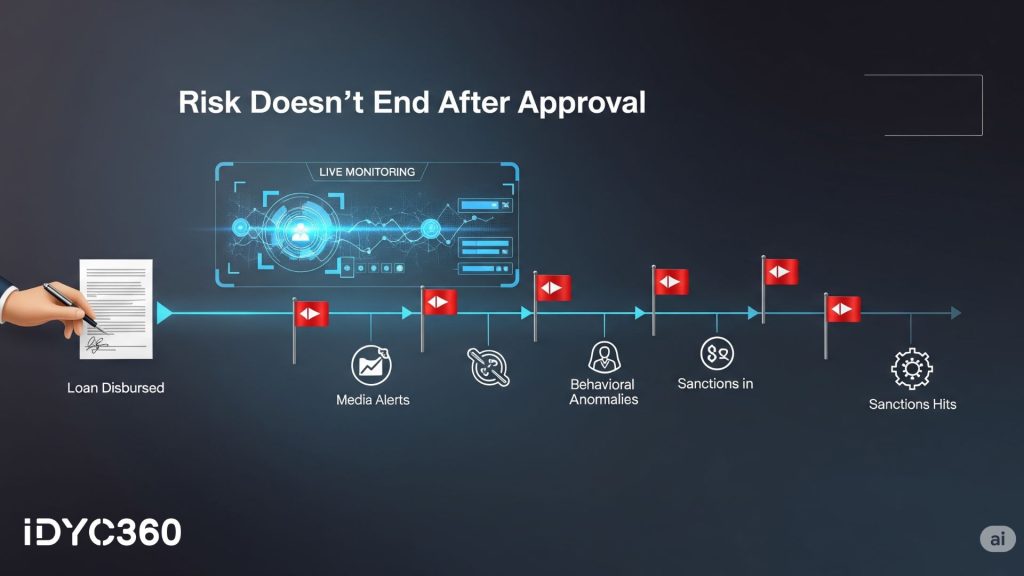

Post-Disbursement Monitoring Matters More Than Ever

Compliance doesn’t stop once a loan is disbursed.

Risk often emerges after the funds leave the lender. Borrowers might use loans for illicit purposes, suddenly appear on sanctions lists, or begin exhibiting suspicious behavior, like rapid repayments from foreign sources or involvement in negative news.

To detect and prevent such risks, lenders need to implement continuous, real-time monitoring. That includes:

- Ongoing name screening against updated watchlists

- Automated media monitoring for reputational risk

- Behavioral analytics that flag abnormal repayment or usage patterns

- Rule-based triggers that escalate unusual activity to compliance teams

This is what separates instant compliance from one-time checks. It’s about building a living, breathing system that never stops assessing risk.

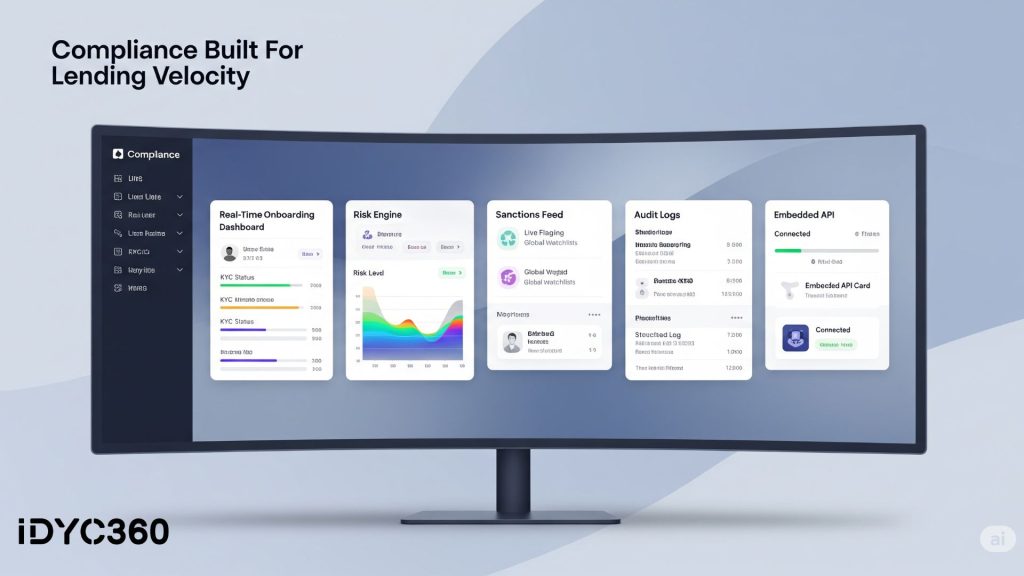

How IDYC360 Helps Digital Lenders Stay Instantly Compliant

IDYC360 was built for the digital age of lending. Our platform empowers credit providers to onboard, assess, monitor, and scale—without compromising compliance or speed.

Here’s how we do it:

Instant KYC/KYB Intelligence

Verify individuals and businesses globally through document verification, registry matching, biometric checks, and tax ID validation—within seconds.

Real-Time Sanctions & Watchlist Screening

Continuously screen all borrowers and related entities across OFAC, EU, UN, and PEP databases with auto-updated alerts and minimal false positives.

Adverse Media Monitoring

Automatically monitor for reputational risks using AI-powered adverse media feeds that surface what matters—before regulators do.

Risk-Based Rule Engine

Define onboarding flows and screening depth dynamically based on borrower profile, geography, loan type, and behavioral signals.

Fully Auditable Decision Trails

Every alert, decision, and override is logged with timestamps and logic chains, making audits fast and defensible.

Seamless API Integration

Embed compliance directly into your lending stack—without disrupting your UX or adding unnecessary friction.

With IDYC360, digital lenders get the confidence to grow fast, stay compliant, and scale globally—on their terms.

Final Thoughts

Digital lending will only keep accelerating—from microloans to embedded credit to cross-border merchant financing.

But with speed comes risk. And without real-time, intelligent compliance, lenders risk everything from fraud exposure to regulatory breakdowns.

The new rules of lending demand a new compliance model:

- Instant

- Intelligent

- Invisible to the user, but ironclad underneath.

Platforms that get this right won’t just survive—they’ll lead the market.

Ready to Stay

Compliant—Without Slowing Down?

Move at crypto speed without losing sight of your regulatory obligations.

With IDYC360, you can scale securely, onboard instantly, and monitor risk in real time—without the friction.