The way we prove who we are online has changed dramatically.

By 2025, biometrics, think facial recognition, fingerprints, and voice scans, are no longer futuristic add-ons but foundations of modern digital identity and Know Your Customer (KYC) processes.

For banks, fintechs, e-commerce, and even governments, biometric verification isn’t just about convenience; it’s become essential in preventing fraud, ensuring compliance, and meeting rising user expectations for seamless onboarding.

Why this matters now:

- Traditional password and document checks are frequently outsmarted by fraudsters.

- Regulatory demands for robust KYC are tougher than ever, with huge penalties for mistakes.

- Customers demand fast, frictionless onboarding—biometrics deliver both security and speed.

In this piece, we’ll break down how biometrics are redefining digital identity, the tangible benefits for KYC, and what this means for compliance teams leading the way.

Biometrics 101: What They Are & Why They Work

Biometrics refers to using unique physical or behavioral traits to verify identity. Unlike passwords or even one-time passcodes, your biometric features, like your face, fingerprint, or even the way you type, are incredibly hard to fake or steal.

Core biometric methods:

- Facial Recognition: Analyzes distinct facial geometry, matching a live selfie to the photo on a government ID, for instance.

- Fingerprint Scans: Each person’s fingerprints are virtually unique and difficult to duplicate.

- Iris/Retina Scans: Extremely precise and commonly considered among the most secure methods.

- Voice Recognition & Behavioral Biometrics: Your speech patterns, typing speed, or the way you hold your device add layers of uniqueness.

Why biometrics win:

- You can’t forget or lose your biometrics like a password.

- They’re fast and often fully automated, ideal for remote digital processes.

- Spoofing is far more difficult, especially with modern “liveness” detection tech.

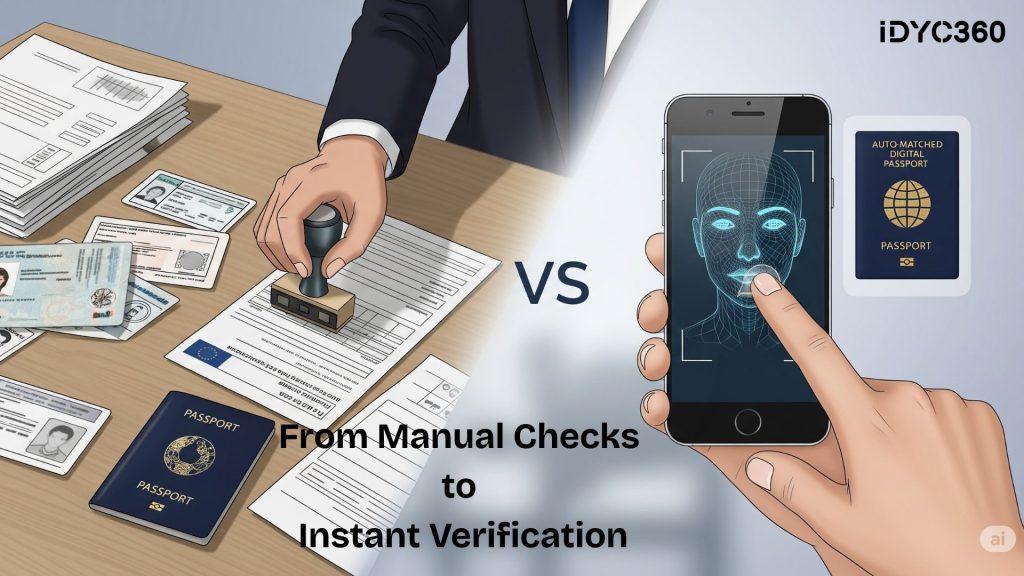

The KYC Evolution: From Documents to Digital

Know Your Customer (KYC) protocols started as paper-heavy, manual checks. Now, biometric KYC enables instant, remote, and highly secure onboarding.

How biometrics reshape KYC:

- Automated, Real-Time Verification: Customers take a quick selfie, which is verified instantly against government ID photos, significantly reducing the risk of imposters or forgeries.

- Faster Onboarding: Financial institutions report moving from multi-day manual checks to onboarding customers in minutes, sometimes even seconds.

- Always-On Security: Biometrics verify users not just at sign-up but throughout the customer lifecycle, including during high-value transactions or password resets.

Key compliance and business benefits:

- Greater accuracy in detecting fake or stolen identities.

- Reduced friction lifts customer satisfaction and conversion rates.

- Faster onboarding means less drop-off and better access to digital services.

Fraud Prevention: Why Biometrics Are Now Core in AML & Compliance

The explosion of synthetic identity fraud, document forgery, and account takeover has made biometric verification a centerpiece of Anti-Money Laundering (AML) and financial compliance strategies.

Biometric KYC is raising the bar for fraud defense:

- High Difficulty to Replicate: Facial features or fingerprints can’t be borrowed or guessed like passwords.

- AI-Powered Liveness Detection: Ensures live presence, blocks spoofing with photos/videos.

- Continuous Authentication: Behavioral biometrics double-check throughout a session, not just at login.

Regulatory wins:

- Biometric audit trails simplify regulatory reporting.

- Automated KYC with biometrics helps institutions stay ahead of complex, evolving standards and avoid costly fines.

Trends for 2025: What’s New in Biometric Identity Verification

Biometrics are forging the next generation of verification with fresh technologies:

Multimodal Biometrics

Combining two or more biometrics (e.g., face + fingerprint) for even tighter security—now common in consumer banking apps and high-stakes corporate environments.

Contactless & Privacy-First Design

Pandemic-driven hygiene concerns have embedded touchless systems, while privacy advancements mean many biometric templates can now be stored (and matched) locally on user devices, not in the cloud, mitigating mass data breach risks.

Behavioral Biometrics

Analyzing how you type, swipe, or speak constantly, adding background security invisible to the user.

AI-Driven Liveness & Anti-Spoofing

Real-time anti-fraud checks use motion, depth, or blink detection to ensure it’s a real person, not a scammer holding up a photo.

Industry-Wide Adoption

Banks, e-commerce platforms, gig services, travel, and digital government IDs—biometrics are now baseline infrastructure across nearly every sector.

How IDYC360 Helps

IDYC360 delivers advanced digital identity and KYC solutions designed for 2025’s challenges, empowering institutions to meet regulatory demands, delight customers, and fight fraud at scale:

- Seamless Multimodal Biometric Verification: Integrates facial, fingerprint, and behavioral checks for unmatched accuracy.

- AI-Powered Anti-Fraud Engine: Detects liveness, flags spoofing, and leverages behavioral analytics to monitor for fraud, even after onboarding.

- Privacy-by-Design Approach: Local template matching and encrypted storage ensure compliance with the strictest data laws.

- Real-Time, Automated Onboarding: Convert more users with lightning-fast, frictionless KYC, drastically cutting drop-off rates.

- Universal Integrations: Plug into banking, fintech, travel, and compliance systems, futureproofed for global regulatory changes.

- Automated Compliance Reporting: Generate robust audit trails and automated reports to satisfy regulators with ease.

Final Thoughts

As digital threats evolve, only the best verification methods can keep companies ahead of criminals and regulators.

Biometrics have moved from a futuristic promise to a practical, essential layer of trust in digital identity and KYC.

For financial institutions, fintech innovators, and digital platforms everywhere, adopting advanced biometric solutions isn’t a perk—it’s a necessity for growth, trust, and security.

Ready to Stay

Compliant—Without Slowing Down?

Move at crypto speed without losing sight of your regulatory obligations.

With IDYC360, you can scale securely, onboard instantly, and monitor risk in real time—without the friction.