Introduction

India’s financial crime landscape continues to evolve rapidly, moving from traditional bank frauds to sophisticated, technology-enabled investment scams.

In late 2025, Delhi Police unearthed one of the most audacious of these operations, a ₹150-crore online investment fraud run by a gang styling themselves after Netflix’s Money Heist characters.

Nicknamed the “Professor & Amanda” gang, this network used social media, WhatsApp investment groups, and fabricated trading dashboards to lure hundreds of investors with the promise of high returns.

Their operation blended social engineering, digital payments, and cross-border layering, making it one of the most instructive examples of modern digital fraud.

This case study dissects the scam’s structure, highlights the AML/CFT red flags it presents, and explains how IDYC360’s compliance intelligence ecosystem could have detected and disrupted its operations before it matured.

Case Background: The Rise of the ‘Money Heist’ Gang

In November 2025, Delhi Police’s Cyber Unit arrested a group led by three primary suspects:

- A lawyer, known by the alias “Professor”

- A computer science graduate, known as “Amanda”

- An associate named “Abbas” (also referred to as “Freddy”)

Together, they ran an elaborate scam that promised investors high returns from algorithmic stock trading.

Victims were drawn in through WhatsApp and Telegram channels branded with fake investment company names and trading dashboards that mimicked real broker platforms.

The operation reportedly:

- Cheated over 300 investors

- Collected more than ₹150 crore in total, with ₹23 crore traced through immediate online transfers

- Operated across Delhi, Noida, West Bengal, and Guwahati

- Potentially involved links to Chinese nationals managing digital payment infrastructure and mule accounts

Police recovered mobile phones, SIM cards, debit cards, passbooks, and transaction screenshots, exposing a complex web of multi-account layering and social media-driven recruitment.

Anatomy of the Scam

The Professor & Amanda scam followed a classic pattern of socially engineered investment fraud, built on credibility, psychology, and rapid digital execution.

Step 1: Building Trust through Small Profits

Victims were initially added to WhatsApp groups promoting “exclusive trading opportunities.” The group admins (posing as investment advisors) provided small, early profits to establish legitimacy — typically ₹1,000–₹5,000 through immediate wallet transfers or successful demo trades.

Step 2: The Hook – High Return Promises

Once trust was established, victims were invited to deposit larger amounts into what appeared to be a trading account. Screenshots of “daily profits” were shared regularly, creating the illusion of ongoing success.

Step 3: The Layering

Funds were collected in accounts opened under multiple identities. Some were mule accounts rented from low-income individuals or digital-payment aggregators. The transactions were layered across different banks and wallets before being transferred abroad.

Step 4: The Vanishing Act

When victims attempted to withdraw large sums, their accounts were “temporarily frozen” or “under audit.” Shortly after, WhatsApp groups disappeared, administrators vanished, and all digital traces were wiped.

Step 5: Rebranding and Relaunch

The same group resurfaced under new names and new investment groups, repeating the cycle.

Why This Case Matters

Unlike traditional bank fraud, the Money Heist scam illustrates a new class of digitally distributed fraud networks:

- They utilize consumer-grade fintech infrastructure, including e-wallets, UPI, and instant payment systems, to transfer funds rapidly.

- Their onboarding and client engagement happen entirely on encrypted messaging apps.

- The scale and speed make manual monitoring impossible for banks or regulators.

This case, therefore, highlights three urgent compliance needs:

- Early detection of mules and high-velocity accounts.

- Real-time analysis of digital payment flows across institutions.

- Social media–linked risk detection, where fraud signals often originate outside banking systems.

Red Flags and Risk Indicators

The Professor & Amanda gang exploited every possible blind spot in existing AML frameworks.

For financial institutions, several clear red flags emerge:

| Risk Area | Red Flag Indicator |

| Account Activity | Multiple small incoming transactions followed by rapid outward transfers |

| KYC Profile | Low-income or unrelated occupation profiles with large value movements |

| Transaction Velocity | 100+ wallet or bank transfers within short durations |

| Beneficiary Pattern | Transfers to newly created accounts across states or offshore gateways |

| Digital Behaviour | Multiple IP logins, device IDs, and geographic anomalies |

| Social Pattern | Account-to-account transfers linked to the same chat groups or Telegram communities |

Behavioral Typology

- Victims were manipulated psychologically — creating FOMO (fear of missing out) through “group profit screenshots.”

- “Professor” and “Amanda” maintained celebrity-like personas, amplifying credibility.

- The use of pop-culture theming (“Money Heist”) added familiarity and reduced skepticism.

Regulatory and Legal Context

Applicable Laws

The investigation invoked multiple frameworks:

- Prevention of Money Laundering Act (PMLA, 2002) – for fund layering and cross-border movement.

- Information Technology Act (2000) – for digital deception and identity fraud.

- Indian Penal Code (Sections 420, 120B, 468) – for criminal conspiracy and cheating.

Cross-Border Angle

Authorities suspect collaboration with Chinese-managed payment gateways that facilitated offshore transfers.

This introduces potential violations under:

- Foreign Exchange Management Act (FEMA) for unauthorized foreign remittances.

- FATF-compliance gaps around foreign-origin digital wallets and money service providers.

Impact on the Financial Sector

Such scams erode public trust in legitimate fintech investment platforms, trigger reputational damage, and attract enhanced regulatory scrutiny from the RBI and FIU-IND.

Compliance Lessons from the Case

- Digital onboarding ≠ customer verification: Many mule accounts were created using minimal e-KYC verification. Institutions need deeper, continuous identity checks that detect synthetic identities.

- Social behavior now signals financial risk: Participation in high-risk WhatsApp or Telegram investment groups should feed into customer risk profiles.

- Transaction monitoring must evolve: Rule-based systems struggle with fragmented UPI and wallet flows. AI-led behavioural analytics can connect hidden patterns across platforms.

- Beneficial ownership mapping is crucial: Hidden networks of fake beneficiaries can only be detected by linking identity, device, and payment metadata.

- Cross-institution data sharing is non-negotiable: Without shared intelligence, fraudulent accounts simply migrate between banks or PSPs.

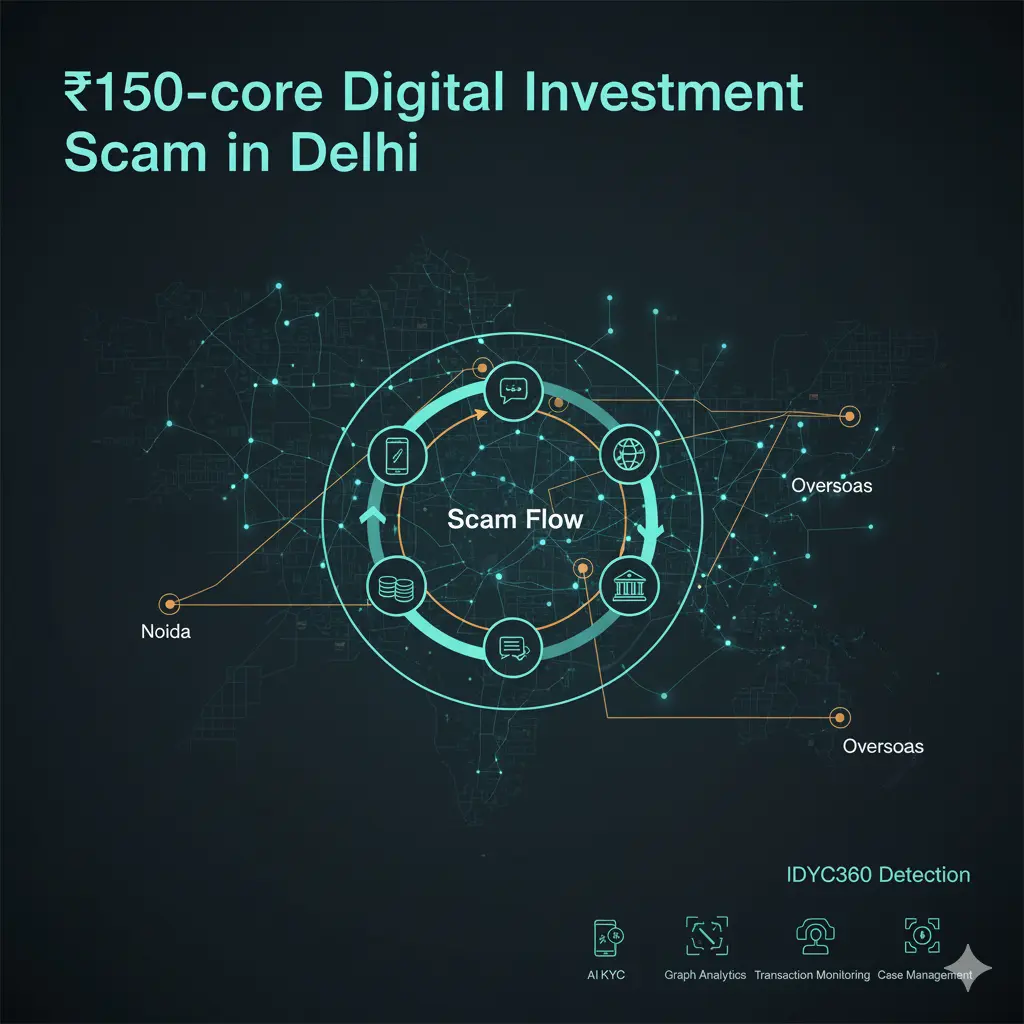

How IDYC360 Detects & Prevents Similar Schemes

IDYC360’s unified AML ecosystem is designed to tackle multi-channel fraud and digital investment scams like the Money Heist operation, where speed, fragmentation, and deception converge.

Advanced Onboarding Intelligence

- AI-driven KYC validation goes beyond document checks to identify inconsistencies in geolocation, device fingerprint, and behavioural metadata.

- Network-level screening maps social or digital linkages between applicants — useful when multiple accounts are created by a single syndicate.

Transaction Pattern Intelligence

- IDYC360’s transaction monitoring engine correlates patterns across UPI, wallets, and bank transfers.

- Detects anomalies such as:

- High transaction velocity with zero retained balances.

- Circular fund movement between the same clusters of users.

- Spikes in wallet activity matching known scam typologies.

Beneficial Ownership & Relationship Graphs

- Graph analytics reveal the true operational network behind mule accounts.

- Links seemingly unrelated individuals through shared devices, phone numbers, IPs, and counterparties.

- Detects fraud rings early, before funds disperse.

Cross-Border Payment Analytics

- Integrates with SWIFT, fintech payment gateways, and alternative remittance channels.

- Flags outgoing transfers to high-risk jurisdictions or unregistered merchant accounts.

- Provides jurisdiction-linked risk scoring, automatically reflecting FATF and domestic advisories.

Social Media Risk Intelligence

- Through open-source and dark web data integration, IDYC360 can identify emerging investment scams by tracking group affiliations, keywords, and repetitive financial patterns.

- Institutions can blacklist or pre-emptively flag users linked to such groups.

Case Management & Regulatory Reporting

- Unified case console consolidates suspicious activity, evidence, and workflow logs.

- STR/SAR templates aligned with FIU-IND formats enable seamless submission.

- Reduces response time and ensures full audit traceability.

How the Scam Would Have Appeared on IDYC360

If a bank or payment institution involved in this case had been using IDYC360, the system would have generated multiple early alerts:

Onboarding Risk

IDYC360’s entity-resolution engine would have detected the creation of multiple accounts using similar email domains, device IDs, and geolocation fingerprints.

Transaction Flow Red Flag

The AI monitoring engine would have flagged abnormal inflow-outflow symmetry, numerous incoming UPI payments followed by same-day external transfers.

Network Correlation

Relationship graphs would have shown that “Professor,” “Amanda,” and “Abbas” were financially interconnected through a repeating cycle of shared counterparties.

Jurisdictional Alert

Outgoing payments to offshore wallets or intermediaries in China or Southeast Asia would have triggered jurisdiction-linked EDD (Enhanced Due Diligence).

Behavioural Pattern Recognition

The system’s adaptive learning would notice identical messaging patterns across victims’ reference notes or payment descriptions (“investment return,” “bonus fund,” etc.).

These composite signals would have escalated the case for compliance review long before ₹150 crore changed hands.

Broader Financial Crime Lessons

The Power of Narrative Fraud

This scam shows how fraudsters exploit psychology and pop culture to lower victims’ defences. “Money Heist” branding created a feeling of rebellion and exclusivity, replacing skepticism with excitement.

The Fintech Dilemma

Fintech platforms designed for speed are now prime vectors for fraud. Their convenience is weaponized by syndicates faster than regulatory frameworks evolve.

Data Fragmentation Weakens Defence

Banking, wallet, and telecom data live in silos. Without integrated intelligence, no single institution sees the complete fraud trail.

Law Enforcement’s Learning Curve

Police recovered 50+ mobile devices and thousands of transactions, but manual analysis of such digital evidence is nearly impossible. Automated pattern recognition is essential for prosecution and deterrence.

Building Institutional Resilience with IDYC360

To combat such multi-channel fraud ecosystems, IDYC360 offers an integrated compliance intelligence fabric connecting:

- KYC/CDD analytics for early identity risk detection

- Behavioural monitoring across digital payment systems

- Entity-relationship mapping to expose hidden collusion

- Jurisdictional and typology tagging for AML officers

- Case automation and reporting tools for FIU and regulator submission

Results for Institutions

- 70% reduction in manual alert review time

- 40% increase in true positive detection rate

- Fully auditable end-to-end STR lifecycle

- Early interdiction capability across fintech and banking ecosystems

In essence, IDYC360 allows institutions to move from reactive fraud mitigation to proactive network disruption, the key difference between compliance and resilience.

Strategic Takeaways

Fraudsters are now brand strategists.

They exploit social trends to gain legitimacy. AML teams must treat cultural and online signals as serious risk indicators.

Investment scams mimic regulated behaviour.

Early profits, professional dashboards, and KYC registration are no longer signs of legitimacy; they’re camouflage.

Cross-sector visibility is essential.

Only integrated intelligence, across banks, PSPs, telecoms, and regulators, can dismantle these decentralized crime networks.

RegTech partnerships drive sustainable defence.

Collaboration between technology providers like IDYC360 and financial institutions is critical for predictive AML capability.

Conclusion

The Professor & Amanda ₹150-crore “Money Heist” scam reflects the next frontier of organized digital financial crime: intelligent, networked, and psychology-driven.

It also demonstrates the limits of traditional compliance frameworks that focus on individual accounts rather than interconnected behaviour.

Financial institutions, regulators, and fintechs must evolve to match this threat.

That means moving from static KYC checks to real-time risk ecosystems, powered by data fusion, AI analytics, and relationship intelligence.

IDYC360 provides exactly that:

- Unified monitoring of digital transactions

- Cross-entity correlation and ownership discovery

- Behavioural learning to detect fraud rings early

In a financial world where scams evolve faster than oversight, IDYC360 equips institutions with what matters most: anticipation, intelligence, and trust.

References

- NDTV – “Professor Amanda and Abbas: Delhi’s Money Heist Gang Steals ₹150 Crore.” November 2025.

- Indian Express – Reports on Delhi investment scam and cyber crime arrests.

- Press Trust of India – “Cybercrime units uncover investment fraud network.”

- Financial Intelligence Unit (FIU-IND) – Advisory on Online Investment Fraud Typologies.

Ready to Stay

Compliant—Without Slowing Down?

Move at crypto speed without losing sight of your regulatory obligations.

With IDYC360, you can scale securely, onboard instantly, and monitor risk in real time—without the friction.