In 2025, compliance has evolved far beyond checkbox exercises and regulatory afterthoughts. It’s now a strategic cornerstone that drives business resilience, stakeholder trust, and sustainable growth.

As regulatory landscapes become more complex and enforcement actions intensify, financial institutions, fintechs, and global enterprises are recognizing a fundamental truth: strong compliance culture is not just about avoiding penalties; it’s about creating competitive advantage.

Why building a compliance culture matters now:

- Regulatory requirements are multiplying across AI governance, ESG reporting, data privacy, and AML frameworks.

- Executive accountability for compliance failures has never been higher, with personal liability becoming the norm.

- Organizations with embedded compliance cultures outperform peers in risk management, operational efficiency, and long-term profitability.

This article explores the essential strategies, emerging trends, and practical steps for building a resilient compliance culture that thrives in 2025’s demanding regulatory environment.

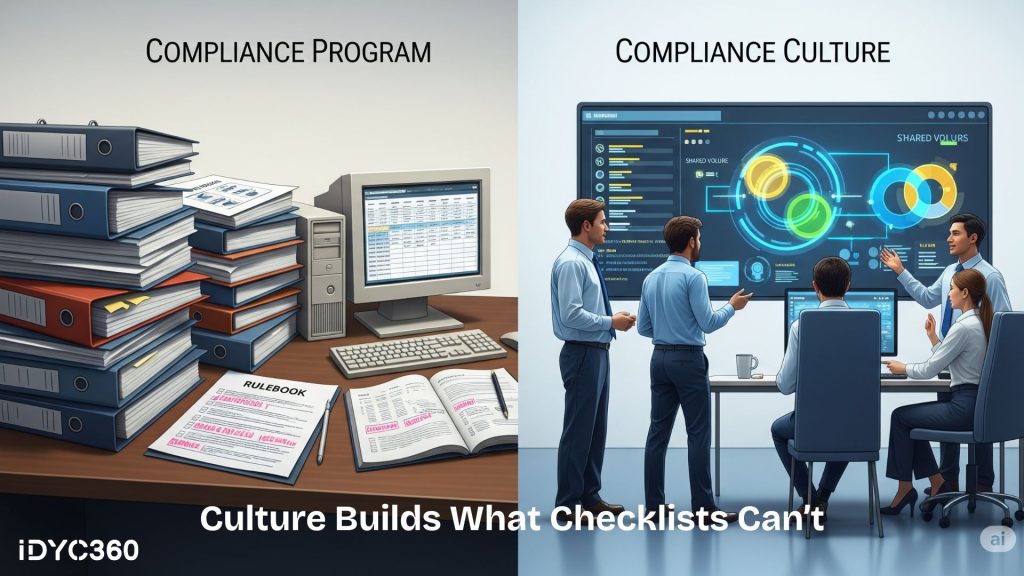

Understanding Compliance Culture vs. Compliance Programs

Traditional compliance programs focus on rules, procedures, and documentation. Compliance culture goes deeper; it’s the collective mindset where ethical behavior and regulatory adherence become second nature across every level of the organization.

Key differences between programs and culture:

- Programs are reactive; culture is proactive. While programs respond to violations, culture prevents them through ingrained behaviors.

- Programs rely on enforcement; culture thrives on ownership. Strong cultures empower employees to self-regulate and take responsibility for compliance outcomes.

- Programs are siloed; culture is integrated. Culture embeds compliance into daily operations, decision-making, and strategic planning across all departments.

What defines a mature compliance culture?

- Employees naturally consider compliance implications before making decisions.

- Open communication channels exist for reporting concerns without fear of retaliation.

- Leadership consistently models ethical behavior and prioritizes compliance investments.

- Compliance metrics are integrated into performance evaluations and business objectives.

Leadership’s Critical Role in Shaping Compliance Culture

Compliance culture begins at the top. Without genuine commitment from senior leadership, even the most sophisticated programs fail to create lasting behavioral change.

Essential leadership practices for 2025:

- Tone from the Top: CEOs and board members must consistently communicate that compliance is a core business priority, not just a cost center.

- Resource Allocation: Leaders demonstrate commitment through adequate compliance budgets, staffing, and technology investments.

- Personal Accountability: Executives taking personal responsibility for compliance failures build credibility and set expectations.

- Integration with Strategy: Compliance considerations are woven into strategic planning, product development, and market expansion decisions.

Middle management as culture ambassadors:

- Department heads translate organizational compliance values into team-specific behaviors.

- Supervisors reinforce compliance messages through daily interactions and decision-making.

- Middle managers bridge the gap between executive vision and frontline implementation.

Measurable leadership behaviors that drive culture:

- Regular compliance discussions in executive meetings and board sessions.

- Public recognition of employees who demonstrate exceptional compliance behavior.

- Swift, consistent responses to compliance violations regardless of seniority or business impact.

Employee Engagement & Training Strategies

Effective compliance culture requires every employee to understand their role and feel empowered to contribute to organizational integrity.

Modern training approaches that work:

- Role-Specific Learning Paths: Tailored content that addresses the unique compliance risks and responsibilities of different positions.

- Scenario-Based Training: Interactive simulations that help employees practice compliance decision-making in realistic situations.

- Microlearning Modules: Bite-sized content that reinforces key concepts without overwhelming busy schedules.

- Gamification Elements: Quizzes, challenges, and leaderboards that make compliance education engaging and memorable.

Creating psychological safety for compliance:

- Anonymous reporting channels that protect whistleblowers from retaliation.

- Regular surveys that gauge employee comfort levels with raising compliance concerns.

- Clear escalation paths that ensure reports are investigated promptly and fairly.

- Communication of investigation outcomes (when appropriate) to demonstrate responsiveness.

Continuous reinforcement strategies:

- Monthly compliance spotlights highlighting relevant regulations or case studies.

- Integration of compliance reminders into existing workflows and systems.

- Peer-to-peer learning sessions where employees share compliance challenges and solutions.

Technology & Automation in Compliance Culture

Technology serves as both an enabler and amplifier of compliance culture, making ethical behavior easier and more efficient.

Key technological enablers for 2025:

- AI-Powered Risk Detection: Machine learning systems that identify compliance risks before they escalate into violations.

- Automated Policy Updates: Dynamic systems that distribute new regulations and policy changes in real-time.

- Compliance Dashboards: Visual tools that give leaders and employees clear visibility into compliance performance.

- Integration Platforms: Unified systems that embed compliance checks into business workflows.

Digital culture reinforcement tools:

- Mobile apps that provide instant access to policies, training, and reporting channels.

- Chatbots that answer common compliance questions and guide employees through complex scenarios.

- Social learning platforms that foster peer-to-peer compliance knowledge sharing.

Measuring digital engagement:

- Training completion rates and assessment scores across different employee segments.

- Usage analytics for compliance resources and reporting tools.

- Response times and resolution rates for compliance inquiries and concerns.

How IDYC360 Helps

IDYC360 transforms compliance culture from aspiration to reality through comprehensive, technology-driven solutions:

- Integrated Compliance Management Platform: Unified dashboard that centralizes policies, training, monitoring, and reporting across all compliance domains.

- AI-Driven Risk Intelligence: Advanced analytics that identify cultural risks and compliance gaps before they become violations.

- Dynamic Training and Communication Tools: Personalized learning paths, automated updates, and engaging content that keeps compliance top-of-mind.

- Real-Time Monitoring and Alerting: Continuous surveillance systems that flag potential compliance issues and guide immediate intervention.

- Cultural Assessment and Benchmarking: Data-driven insights that measure compliance culture maturity and track improvement over time.

- Expert Advisory Services: Dedicated compliance specialists who provide strategic guidance, crisis management, and culture transformation support.

Final Thoughts

Building a genuine compliance culture requires sustained commitment, strategic investment, and cultural transformation that goes far beyond traditional program implementation.

In 2025’s complex regulatory environment, organizations that successfully embed compliance into their DNA will outperform competitors, earn stakeholder trust, and build sustainable competitive advantages.

The time for reactive compliance is over; proactive culture building is the path forward.

Ready to Stay

Compliant—Without Slowing Down?

Move at crypto speed without losing sight of your regulatory obligations.

With IDYC360, you can scale securely, onboard instantly, and monitor risk in real time—without the friction.