The compliance landscape in 2025 is dynamic, not static. Risk profiles shift overnight.

Sanctions lists are updated daily. And suspicious activity doesn’t wait for periodic reviews to get flagged.

Yet many compliance programs still rely on fixed checkpoints—screening at onboarding, quarterly transaction reviews, and annual KYC refreshes.

That’s no longer sustainable. Today, regulatory expectations—and criminal behavior—demand real-time vigilance.

Continuous monitoring is the answer. It’s not just a tech upgrade; it’s a strategic shift in how risk is managed. One that moves compliance teams from reactive firefighting to proactive risk management.

What Is Continuous Monitoring in AML?

At its core, continuous monitoring refers to real-time or near-real-time risk surveillance across customers, transactions, behaviors, and counterparties throughout the lifecycle, not just at onboarding.

It typically includes:

- Ongoing sanctions and PEP re-screening

- Real-time behavioral analytics

- Continuous risk scoring adjustments

- Automated alert generation for deviations or anomalies

- Trigger-based customer reviews or escalations

Unlike static controls, continuous monitoring ensures that the system is always scanning for risk, not just when compliance staff manually check in.

Why Periodic Reviews Fall Short

Periodic reviews create dangerous blind spots.

What happens if:

- A customer is added to a sanctions list a week after onboarding?

- A dormant account suddenly shows high-volume, cross-border transactions?

- A new adverse media story links a client to criminal activity after their last review?

By the time these red flags show up in an annual KYC refresh, the damage is often done—or the window for reporting has closed.

Continuous monitoring ensures nothing slips through the cracks and that risk is addressed the moment it emerges.

Regulators Are Raising the Bar

Regulators across the globe now expect financial institutions to have active surveillance frameworks, especially for high-risk customers and high-velocity platforms.

Expectations include:

- Timely alerting tied to suspicious behavior

- Proof of real-time screening system performance

- Clear, time-stamped documentation of all reviews and actions

- Adaptive thresholds that change with customer behavior

Regulatory fines and enforcement actions increasingly cite failures in ongoing monitoring, not onboarding deficiencies.

This signals a clear shift: being compliant once isn’t enough. You need to stay compliant all the time.

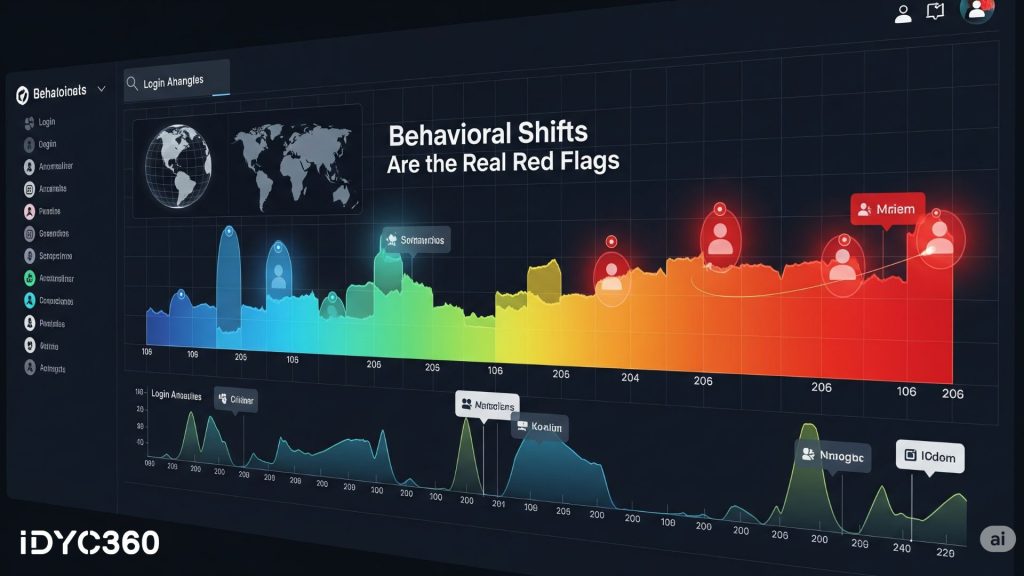

It’s Not Just About Transactions—Behavior Tells the Real Story

Continuous monitoring isn’t limited to transaction values or volumes. The most effective systems track and analyze behavioral context, like:

- Changes in transaction patterns

- New counterparties or regions involved

- Unusual login locations or device shifts

- Payment types that deviate from historical norms

These subtle shifts often precede overt red flags. When caught early, they allow compliance teams to escalate meaningfully, rather than reacting after the fact.

It’s not just real-time—it’s intelligent, contextual surveillance.

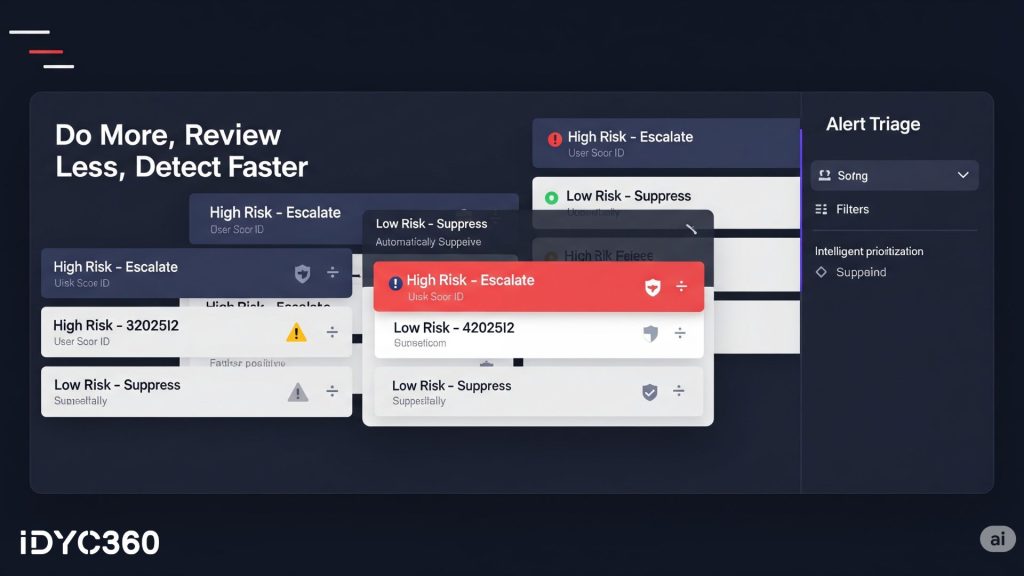

Operational Efficiency Improves With Continuous Models

Far from adding to alert fatigue, continuous monitoring can streamline operations.

Here’s how:

- Fewer false positives through contextual enrichment

- Dynamic alert thresholds reduce unnecessary reviews

- Integrated systems mean no manual re-screening

- Risk-based triaging helps teams focus on what matters

The result? Faster decisions, better prioritization, and less compliance friction.

That’s not just good for regulatory health; it’s good for the business.

How IDYC360 Makes Continuous Monitoring Seamless

IDYC360 was built with continuous monitoring at its core. Our infrastructure supports always-on, risk-aware compliance across your entire customer base.

Here’s how we help:

Real-Time Sanctions & PEP Screening

We re-screen all profiles against updated lists as changes happen—across OFAC, UN, EU, and local authorities.

Behavioral Risk Monitoring

Track evolving behavior across transactions, devices, geographies, and time—flag anomalies early, not late.

Dynamic Risk Scoring

Risk profiles automatically adjust based on new data, events, or behavior—no manual recalculation needed.

Adverse Media Monitoring

Scan thousands of global news sources and legal databases in real time—surface reputational risk the moment it hits.

Alert Workflow Automation

Create rules to auto-escalate, suppress, or tag alerts based on priority, type, or contextual factors.

Audit-Ready Logging

Every alert, override, and review is fully logged—traceable by case, user, and timestamp for regulator peace of mind.

With IDYC360, continuous monitoring isn’t another layer; it’s the default operating mode.

Final Thoughts

As risk becomes more dynamic, your compliance system has to move with it. Static checks are a relic. Periodic reviews are too late.

Continuous monitoring is how modern compliance teams stay ahead by detecting threats early, acting with precision, and proving control at every stage.

It’s not optional anymore. It’s the only way to scale securely in a high-risk world.

Ready to Stay

Compliant—Without Slowing Down?

Move at crypto speed without losing sight of your regulatory obligations.

With IDYC360, you can scale securely, onboard instantly, and monitor risk in real time—without the friction.