Shadow Fleets vs Dark Fleets: Unpacking Maritime Sanctions Evasion

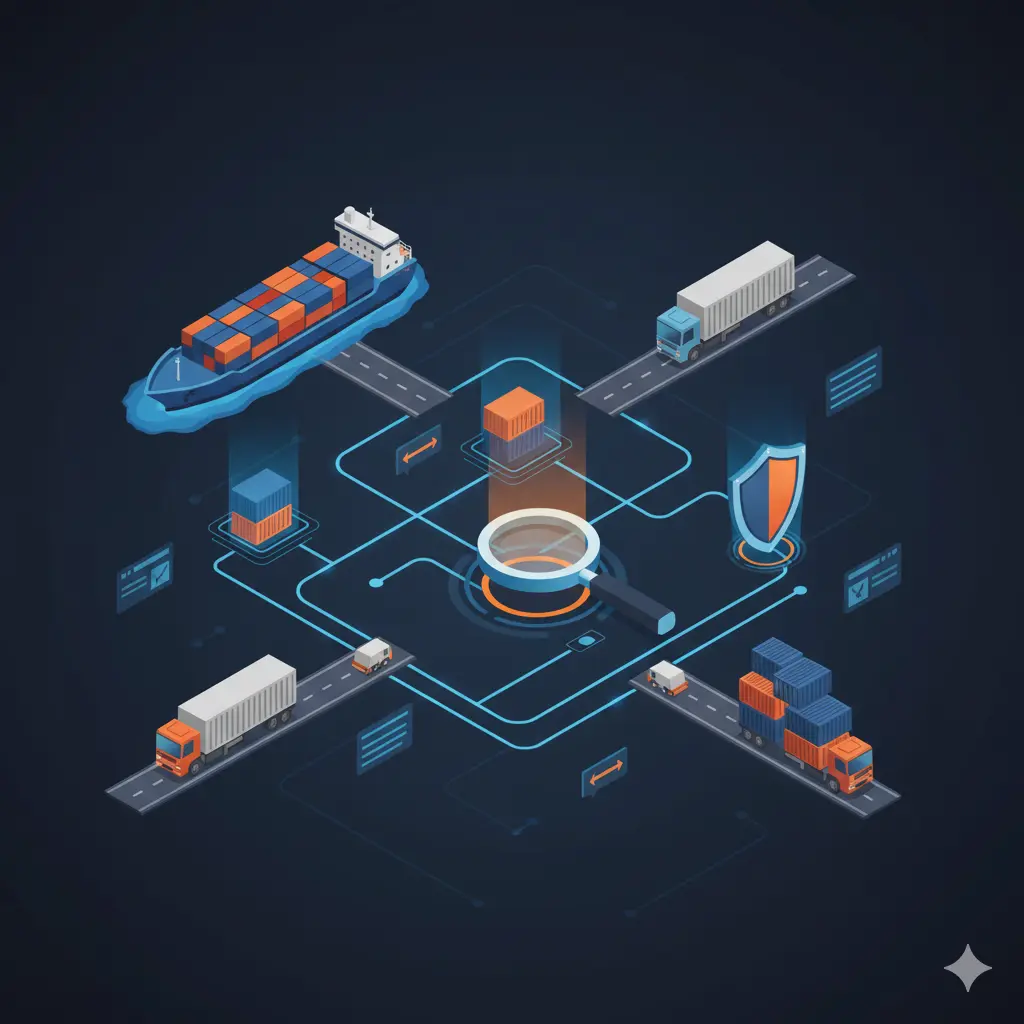

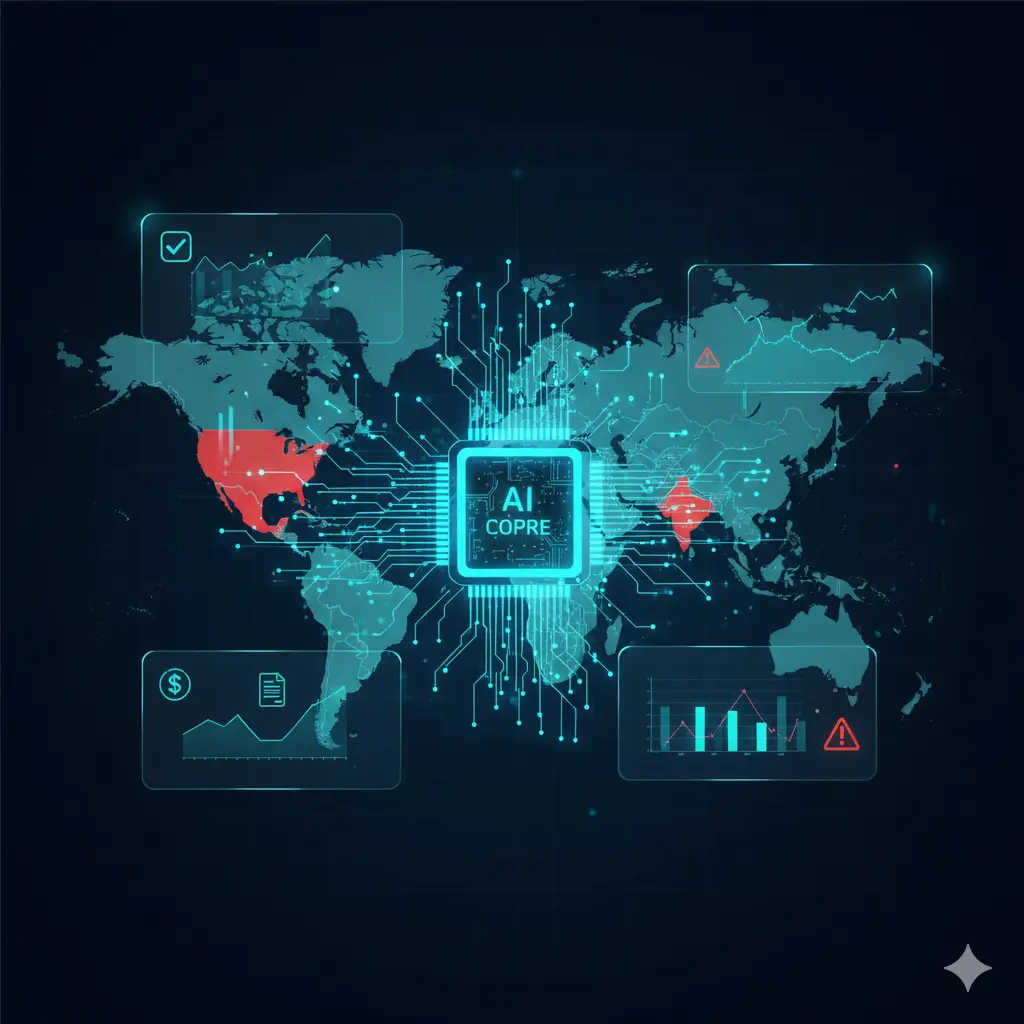

Introduction Maritime sanctions evasion has become a critical frontier for anti-money laundering and counter-terrorist financing (AML/CFT) efforts. Two overlapping yet distinct phenomena in this domain…

Read more