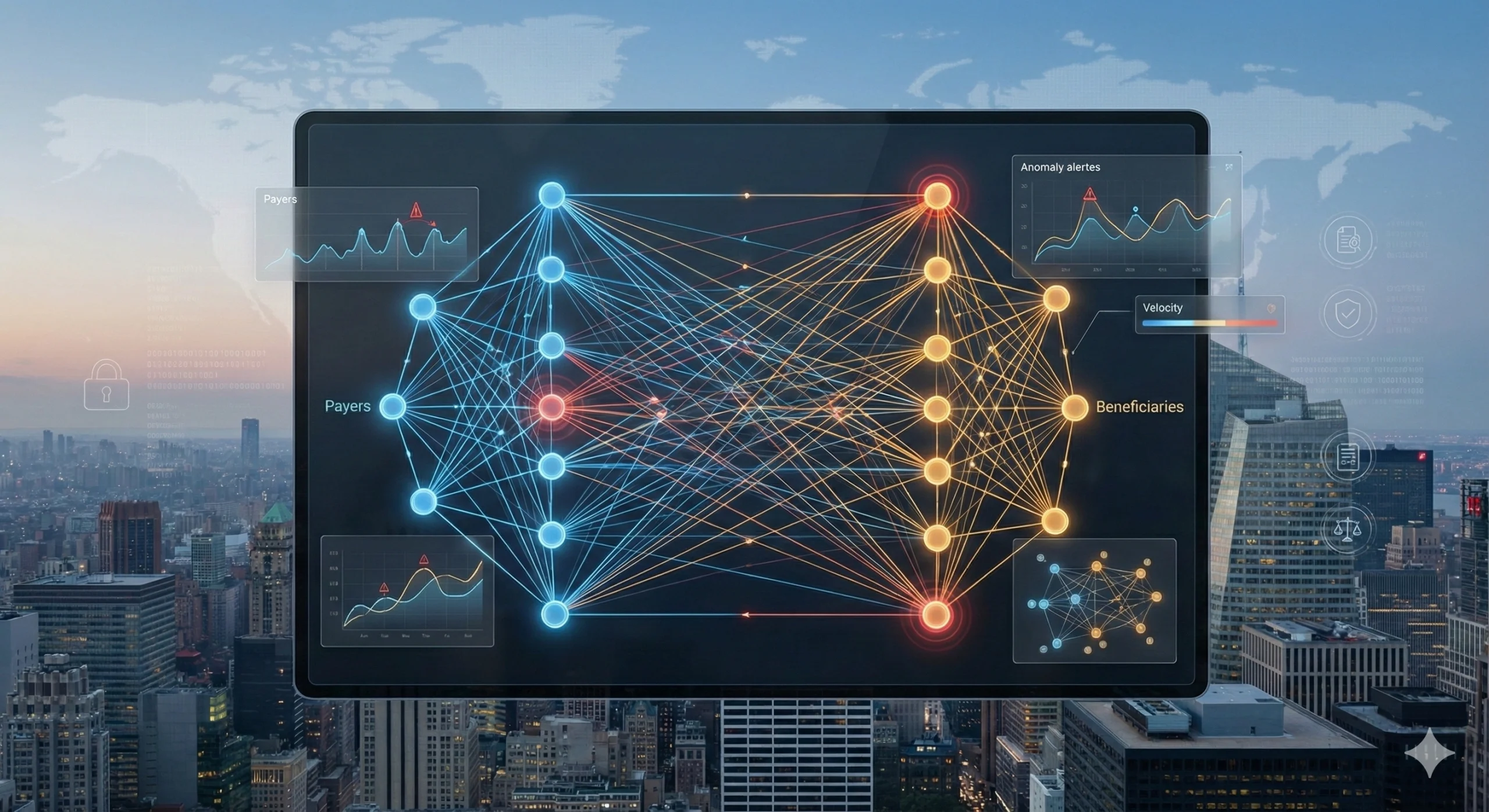

Network-Based Fraud Detection: Rethinking Payers & Beneficiaries

The Limits of Transaction-Centric Fraud Detection Financial institutions today operate in an environment defined by relentless transaction velocity, always-on digital channels, and increasingly organised fraud…

Read more