When regulators show up, it’s already too late to prepare. By then, every decision, every oversight, and every gap in your compliance system is under the microscope.

Whether you’re a fintech, crypto exchange, digital lender, or cross-border payments platform, regulatory scrutiny in 2025 is sharper than ever.

With evolving AML directives, rising enforcement actions, and tighter cross-border coordination, being “mostly compliant” doesn’t cut it anymore.

You need audit-ready compliance—a state where systems are documented, decisions are traceable, and risk is addressed before the regulator finds it.

Let’s unpack what that means and how modern compliance teams are building it into their infrastructure from day one.

Audit Readiness Starts With Proactive Controls

Regulators want to see that your compliance isn’t reactive—it’s embedded. That begins with robust, proactive controls across the core areas:

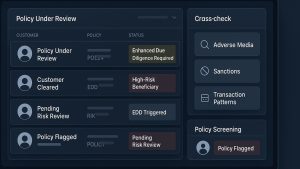

- Onboarding: Are KYC/KYB procedures aligned with current regulations and tailored by risk level?

- Transaction Monitoring: Do your alerts reflect actual risk patterns, or just thresholds?

- Sanctions Screening: Are lists updated in real time? Is fuzzy matching in place?

- Ongoing Risk Reviews: Do you reassess high-risk customers regularly?

These systems should not only exist—they should be documented, explainable, and defensible.

That means clear policies, rule logic, and oversight processes that prove your compliance isn’t improvised—it’s intentional.

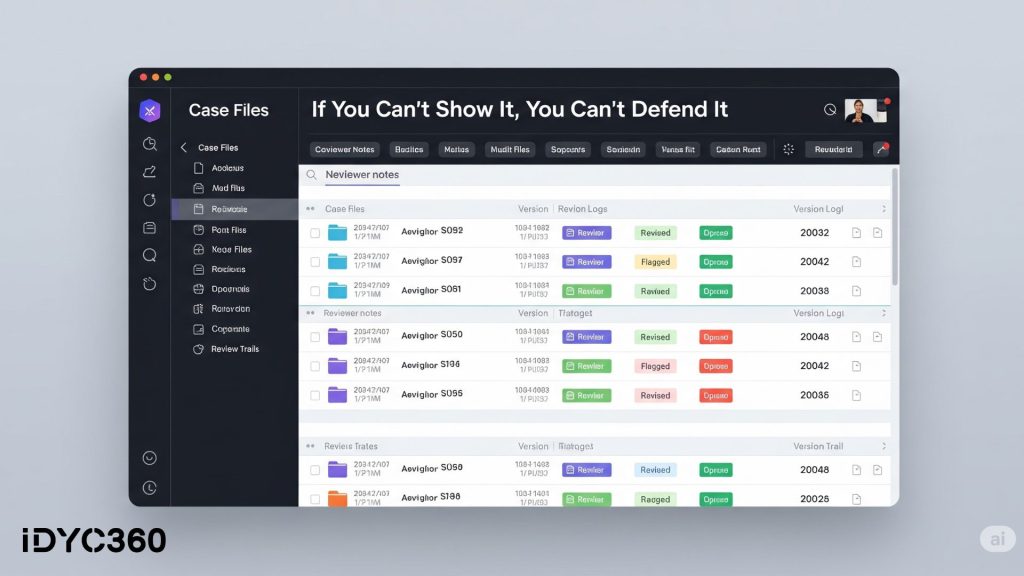

Documentation Is the Regulator’s First Test

Even the strongest controls fall apart in an audit if you can’t show your work.

Regulators don’t just want to hear what you do—they want to see how you do it, who signed off, and when it happened. That includes:

- Case files with timestamps and reviewer notes

- Versions of risk models, screening logic, and policy updates

- Audit trails for overrides, escalations, and decision reversals

- Internal investigation summaries and SAR documentation

If your documentation is fragmented across spreadsheets, shared folders, or memory, you’re not audit-ready. You’re audit-vulnerable.

Consistency Across Teams, Regions, and Time

One of the most common regulatory red flags? Inconsistency.

For example:

- Two analysts flag similar cases—but one files a SAR, and the other doesn’t

- Sanctions lists are updated in Europe weekly, but in Asia, quarterly

- A high-risk customer in one region is under review, but in another, they pass onboarding with minimal checks

These discrepancies suggest weak governance, and regulators don’t need many of them to lose confidence.

Audit-ready platforms implement uniform policies, rule logic, and escalation paths, all of which are centrally governed, version-controlled, and applied consistently across the business.

Real-Time Audit Trails Are Non-Negotiable

Audit-readiness means nothing without visibility.

Regulators need to see not just outcomes, but how you got there. That’s why real-time audit trails are critical.

These should include:

- Who triggered or modified an alert

- What data supported the risk decision

- Who reviewed or approved a SAR

- How long did each step in the case take

- Why was one case escalated and another wasn’t

This level of transparency not only supports compliance but also builds trust. It shows regulators that your decisions are based on structured, repeatable logic, not gut instinct or fire drills.

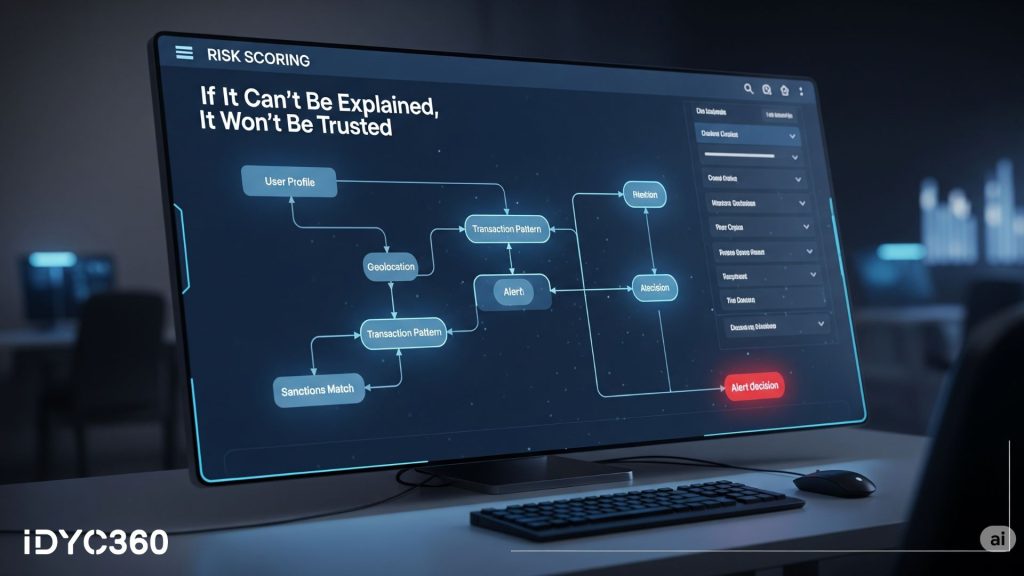

Explainability Is Key to Defensibility

AI is increasingly part of compliance. But if regulators can’t understand the decision path, they’ll question the result.

Audit-ready compliance means using explainable AI wherever machine learning supports detection, triage, or resolution. That includes:

- Human-readable risk scoring logic

- Justification for alert suppression or escalation

- Ability to backtrack and validate ML inputs

- Clear documentation of model updates and decision thresholds

In short: if your platform can’t explain a decision, it can’t defend it. And if it can’t defend it, it’s not audit-ready.

How IDYC360 Makes You Audit-Ready by Design

IDYC360 was built to help compliance teams meet regulatory expectations at scale, without scrambling before audits.

Here’s how we support full-spectrum audit readiness:

End-to-End Case Documentation

Every alert, override, and action is automatically logged and linked to a time-stamped case file—no manual tracking required.

Explainable AI Outputs

Risk scores and alert decisions come with clear rationale, input data, and logic flow—visible to analysts and regulators.

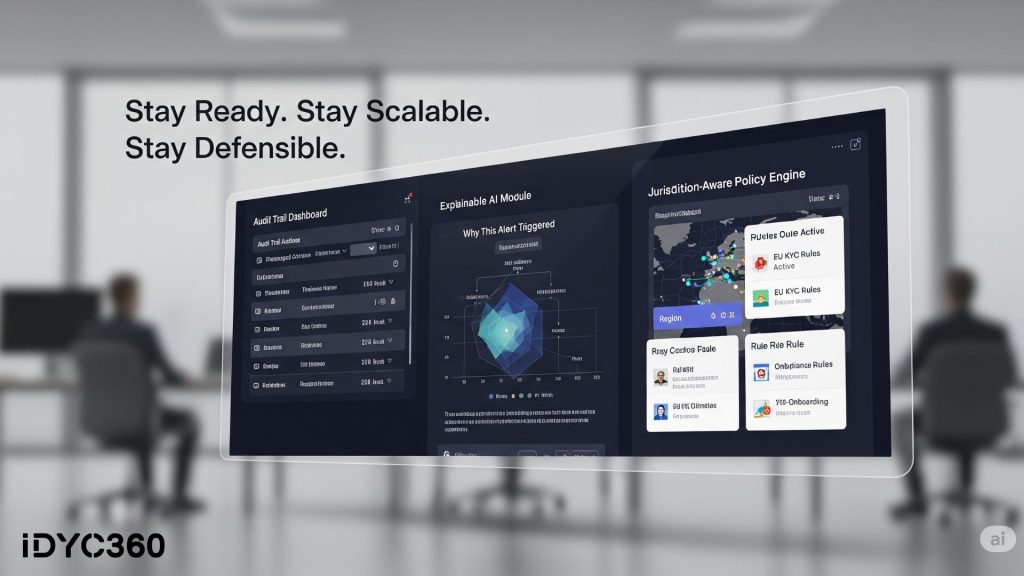

Centralized Policy Governance

Deploy uniform rules, risk models, and escalation paths across jurisdictions—with version history and change logs baked in.

Jurisdiction-Aware Compliance Flows

Configure onboarding, monitoring, and reporting workflows based on local regulatory requirements, with proof of alignment.

Audit Trail Dashboard

Access full activity logs across compliance teams—filterable by user, case, time, or alert type.

Real-Time Readiness

No more audit panic. Your system is always documentation-ready, logic-backed, and regulator-facing by default.

With IDYC360, you don’t prepare for audits. You’re always prepared.

Final Thoughts

Being audit-ready isn’t about checking a box—it’s about proving, every day, that your compliance program is designed to hold up under scrutiny.

Regulators in 2025 expect transparency, consistency, and control. Institutions that treat audit prep as a once-a-year scramble are already behind.

The future belongs to platforms that treat audit readiness as part of everyday operations and build for it now.

Ready to Stay

Compliant—Without Slowing Down?

Move at crypto speed without losing sight of your regulatory obligations.

With IDYC360, you can scale securely, onboard instantly, and monitor risk in real time—without the friction.