If your compliance team is drowning in alerts, you’re not alone.

Financial institutions, crypto platforms, and fintechs are seeing alert volumes spike, thanks to aggressive monitoring tools, regulatory pressures, and a rise in suspicious activity patterns. But here’s the problem: most alerts are false positives.

And when teams spend hours triaging low-value flags, the real threats slip by unnoticed.

This is alert fatigue, and it’s becoming one of the biggest operational risks in compliance

Fortunately, AI can help. But only if it’s done right.

What is Alert Fatigue & Why is it Dangerous?

Alert fatigue is exactly what it sounds like: a state of operational overload where analysts become desensitized to alerts due to excessive volume and poor signal quality.

Imagine receiving hundreds or even thousands of alerts per day. You know most are false positives, but each still needs to be reviewed, logged, and closed. Over time, this creates a dangerous cycle as:

- Analysts begin to ignore or shortcut alerts just to keep pace

- High-quality alerts are buried in noise and resolved too late

- Compliance costs balloon as teams grow, just to manage volume

- Actual risks go undetected, or are flagged when it’s already too late

Alert fatigue doesn’t just affect efficiency; it directly impacts your risk exposure. The more fatigued your team is, the more likely real threats will slip through the cracks.

Why Legacy Rule-Based Systems Make It Worse

Most alert systems still rely heavily on rigid, rules-based logic. These systems are designed to trigger alerts based on fixed parameters like:

- Transaction size thresholds

- Velocity rules (e.g., too many transactions in a short period)

- Country-based restrictions

- Keyword matches on sanctions or watchlists

While these controls are important, they’re inherently blunt. They don’t take into account behavioral patterns, context, or historical baselines. So even if a transaction is completely legitimate, it might still trigger an alert just because it fits a rule’s condition.

This generates a flood of unnecessary alerts that offer no real insight, forcing teams to waste hours chasing false positives while truly suspicious activity might remain undetected.

How AI Cuts Through The Noise

AI isn’t just about reducing the number of alerts; it’s about improving the quality of alerts. Instead of using fixed thresholds, AI-driven systems assess each transaction or entity in context.

Here’s how AI actively fights alert fatigue:

Behavioral Baselining

AI learns “what is” normal for each user, merchant, or entity. It then flags deviations, not just based on static thresholds, but based on personalized risk profiles.

Machine Learning Models

These models continuously learn from analyst decisions, helping refine future alert generation. If a certain pattern repeatedly turns out to be a false positive, the system can de-prioritize or suppress similar alerts going forward.

Entity Resolution

Many systems generate multiple alerts for the same underlying actor due to fragmented data. AI can merge these into a single case, reducing duplicate effort.

Natural Language Processing (NLP)

AI can analyse free-text data (e.g., adverse media, customer notes) to provide additional context, helping triage cases more accurately.

This shift from volume-based to intelligence-based alerting is how AI turns compliance from reactive triage into proactive risk management.

Human-in-the-Loop Still Matters

While AI plays a key role, human analysts remain essential. Why? Because context, intuition, and ethical judgment still matter in compliance.

That’s why the best systems adopt a human-in-the-loop approach, where:

- AI handles first-pass triage: Reducing noise, clustering similar cases, and prioritizing high-risk alerts

- Humans investigate escalations: Analysts review AI-prioritized cases with the full context already prepared, making their decision-making faster and more informed

- Analyst feedback improves the model: The system learns from human actions, creating a self-improving compliance loop.

This model doesn’t replace compliance teams; it augments them. With AI taking care of repetitive noise, human experts can focus on nuanced decision-making where it really counts.

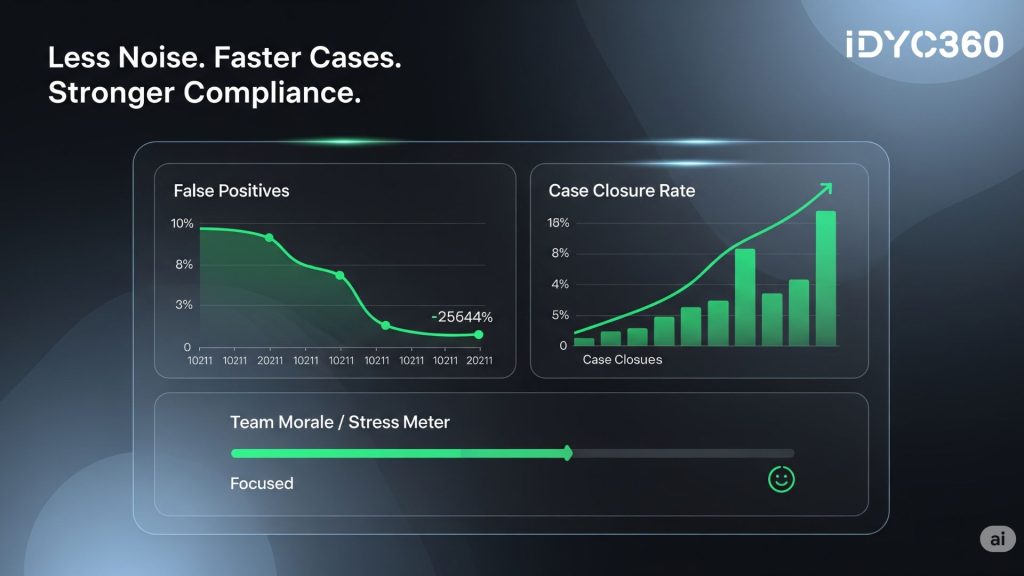

Measuring Success: What Good Looks Like

Deploying AI to fight alert fatigue isn’t just about adoption; it’s about results.

Here’s what success should look like in a well-optimized AI-powered compliance ecosystem:

- Significant reduction in false positives (typically by 40 to 70%)

- Faster alert resolution times. From hours to minutes in many cases

- Improved case closure rates with fewer escalations

- Higher team morale and retention, thanks to reduced cognitive overload

- Better visibility into real risk, leading to more effective reporting and fewer regulatory gaps

When done right, AI doesn’t just make compliance faster; it makes it smarter, leaner, and far more resilient under pressure.

How IDYC360 Helps You Beat Alert Fatigue with AI

At IDYC360, we understand the burden alert fatigue places on fast-scaling compliance teams. Our AI-driven platform is engineered to give you clarity, not chaos.

Here’s how we help you break free from alert fatigue:

Precision-First Alert Generation

Our AI models are trained to generate fewer but far more relevant alerts. We suppress low-risk noise and elevate high-risk anomalies automatically

Continuous Learning from Analyst Feedback

Every decision your analysts make is fed back into the system, fine-tuning detection logic and reducing unnecessary repetition

Dynamic Behavioral Modelling

We don’t use one-size-fits-all thresholds. Instead, we build behavioral baselines per entity, so alerts only trigger when behavior truly deviates from the norm

Entity & Context Fusion

We use advanced entity resolution to collapse duplicate alerts and provide a unified, 360-degree view of customer or merchant activity, giving your team the full picture from the start

Integrated Case Management with AI Scoring

Our platform assigns risk scores to each alert using AI models, so your analysts know where to start, what to prioritize, and where to dig deeper

With IDYC360, your compliance function becomes proactive, targeted, and exponentially more efficient.

Final Thoughts

Alert fatigue isn’t just a side effect of compliance operations; it’s a sign that your risk management system needs a serious upgrade.

As platforms scale and threats evolve, relying on brute-force triage simply doesn’t cut it anymore.

By embracing AI, you give your compliance team the tools they need to respond faster, smarter, and with greater precision.

The result? Lower costs, better decisions, and stronger regulatory posture.

Ready to Stay

Compliant—Without Slowing Down?

Move at crypto speed without losing sight of your regulatory obligations.

With IDYC360, you can scale securely, onboard instantly, and monitor risk in real time—without the friction.