In the fast-paced world of fintech and crypto, compliance teams are laser-focused on ticking the essential boxes: KYC checks, sanctions screening, and transaction monitoring.

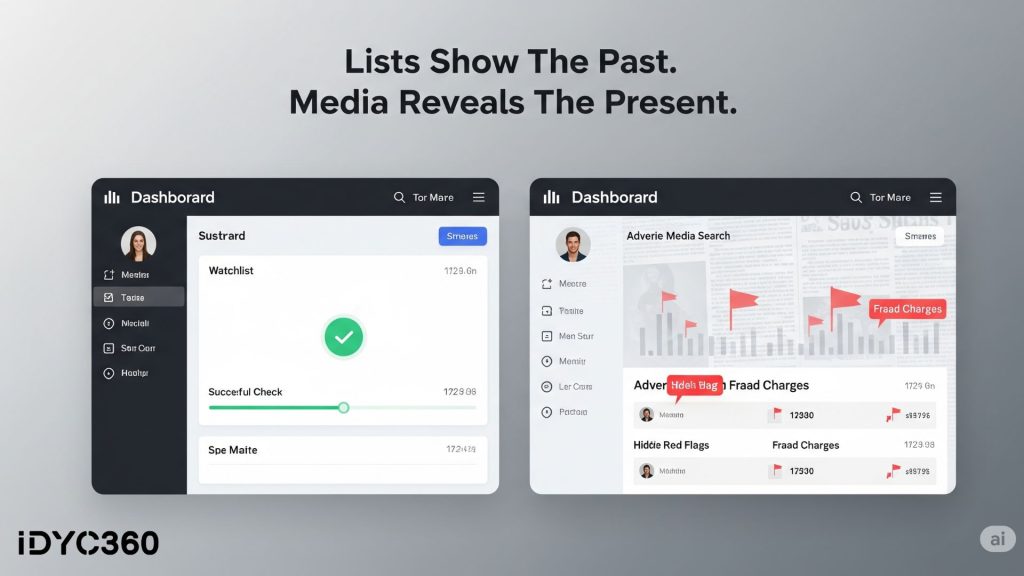

But what if the biggest threat to your platform isn’t on a government watchlist? What if it’s hiding in plain sight, buried in a news article, a court filing, or a blog post?

This is the blind spot that legacy compliance frameworks often miss, and it’s where adverse media screening becomes non-negotiable.

Skipping adverse media checks is no longer a calculated risk; it’s an open invitation for reputational damage and regulatory scrutiny.

In an era where a single negative headline can erode trust and invite millions in fines, relying solely on traditional watchlists is like navigating a minefield with an outdated map.

It’s time to look beyond the basics and understand why smart, continuous adverse media screening is the key to building a truly resilient compliance program.

What Exactly is Adverse Media Screening?

Adverse media screening, sometimes called negative news screening, is the process of checking a customer, whether an individual or a business, against a wide range of public information sources for any association with negative events or illicit activities.

Think of it as a deep-dive background check that goes far beyond standard government-issued lists.

This isn’t just about looking for sensational headlines. Effective screening scours global news outlets, legal databases, and other publicly available sources for credible information linking a client to risks like:

- Financial crimes such as fraud, money laundering, or bribery.

- Ties to terrorism financing or organized crime.

- Sanctions violations or affiliations with sanctioned entities.

- Ethical issues, corruption, or significant litigation that could pose a reputational threat.

While a customer might not appear on an official sanctions list today, adverse media can reveal credible allegations or investigations that signal future risk, making it an essential early warning system.

Beyond the Watchlist: Why Standard Checks Aren’t Enough

Traditional AML programs are built on a foundation of list-based screening. You check names against sanctions lists, PEP (Politically Exposed Person) databases, and other official watchlists.

While essential, this approach is fundamentally reactive. Lists are updated only after a person or entity has been officially designated, often long after the risky behavior has occurred.

Adverse media screening fills this critical gap by providing a proactive layer of risk intelligence. It helps you answer crucial questions that watchlists can’t:

- Is my customer currently under investigation for financial fraud?

- Has my corporate client been accused of using shell companies for illicit purposes?

- Is this new high-net-worth individual associated with known criminal networks, even if they haven’t been convicted?

Without this context, you’re only seeing part of the risk picture. Criminals are adept at operating in the gray areas of the financial system, staying off official lists for as long as possible.

Adverse media is often the first place their activities come to light, giving you the chance to mitigate risk before it escalates into a full-blown compliance failure.

The High Stakes of Neglect: Reputational & Regulatory Fallout

In 2025, regulatory bodies are tightening their expectations, making it clear that a culture of compliance is not optional. The EU’s new AML Authority (AMLA) and ongoing reforms in the U.S. signal a global shift toward more comprehensive, risk-based due diligence, and adverse media screening is a key component of that.

Ignoring adverse media exposes your platform to two significant dangers:

Regulatory Penalties

Regulators increasingly view the failure to act on publicly available negative information as a serious compliance lapse. If a customer you onboarded is later implicated in a major financial crime that was reported in the news, you’ll have to answer why your due diligence process missed it. This can lead to steep fines and consent orders.

Reputational Damage

Trust is the bedrock of the financial industry. Onboarding a client who later becomes the subject of a public scandal—for fraud, corruption, or other illicit activities—can permanently damage your brand’s reputation. The fallout can be even more costly than regulatory fines, leading to lost customers, strained partnerships, and a public perception that your platform is a haven for bad actors.

Taming the Data Deluge with Smart Technology

One of the biggest historical challenges of adverse media screening is the sheer volume of information. Manually sifting through global news sources is impractical and generates an overwhelming number of false positives.

This is where modern technology transforms the process from a burden into a strategic advantage.

AI and machine learning are revolutionizing adverse media screening by:

- Filtering out the noise: AI-powered systems can distinguish between a person with a similar name and the actual subject of a negative news story, drastically reducing false positives.

- Providing contextual analysis: Advanced algorithms can assess the credibility of a source and the severity of the negative information, helping compliance teams prioritize alerts.

- Enabling continuous, real-time monitoring: Instead of a one-time check at onboarding, technology allows for ongoing monitoring, alerting you instantly if a customer’s risk profile changes.

This technology-driven approach allows your team to move away from a “wide net” and instead “fish with a spear,” focusing only on the risks that truly matter.

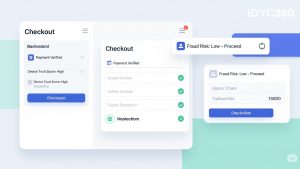

How IDYC360 Fortifies Your Defenses with Real-Time Intelligence

Relying on outdated, manual screening processes in today’s digital-first world leaves your platform exposed. IDYC360’s AI-powered compliance platform integrates seamlessly, real-time adverse media screening directly into your workflow, turning a complex challenge into a powerful defense.

- Eliminate Blind Spots: Our platform continuously scans thousands of global news and data sources, ensuring you have a complete and up-to-the-minute view of customer risk, far beyond what watchlists can provide.

- Drastically Reduce False Positives: Leverage our sophisticated AI to filter out irrelevant noise and focus your team’s attention on credible, high-risk alerts, saving valuable time and resources.

- Automate Ongoing Monitoring: Move beyond static onboarding checks with our automated, real-time monitoring. Receive instant alerts when a customer’s risk profile changes, allowing you to act decisively.

- Seamlessly Integrate into Your Workflow: With our flexible API, you can easily embed our powerful screening capabilities into your existing onboarding and compliance systems for a frictionless experience.

Final Thoughts

Adverse media screening is no longer an optional add-on; it’s a core component of any modern, effective AML/CFT program.

By looking beyond traditional watchlists, you not only protect your organization from regulatory penalties and reputational harm but also gain a deeper understanding of your customer base.

In the competitive landscape of fintech and crypto, trust and security are key differentiators.

Embracing a proactive, technology-driven approach to adverse media screening demonstrates a commitment to integrity that resonates with regulators, partners, and customers alike.

It’s time to close the gap in your risk framework and turn compliance into a source of confidence and strength.

Ready to Stay

Compliant—Without Slowing Down?

Move at crypto speed without losing sight of your regulatory obligations.

With IDYC360, you can scale securely, onboard instantly, and monitor risk in real time—without the friction.