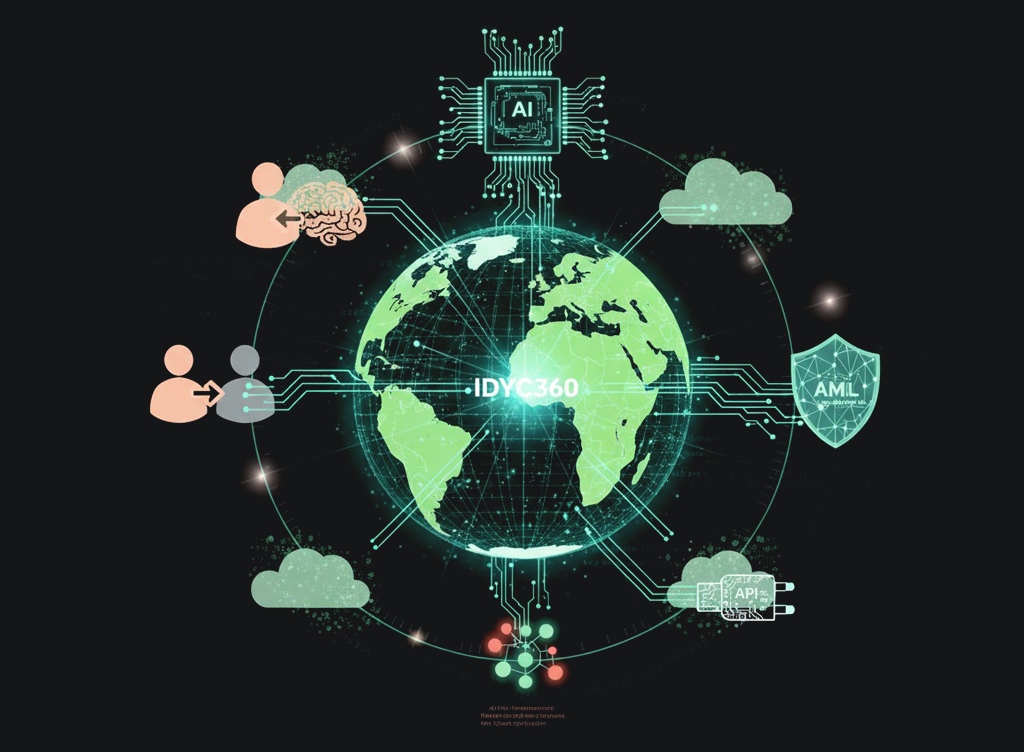

Smart Compliance for Remittance Platforms

Remittance businesses operate across borders, currencies, and regulatory regimes, making them a prime target for financial crime, sanctions violations, and AML non-compliance.

IDYC360 equips remittance providers with comprehensive, AI-powered compliance capabilities that work behind the scenes to protect every transaction, verify every party, and ensure your business stays aligned with global regulations, without slowing transfers or increasing friction for end users.

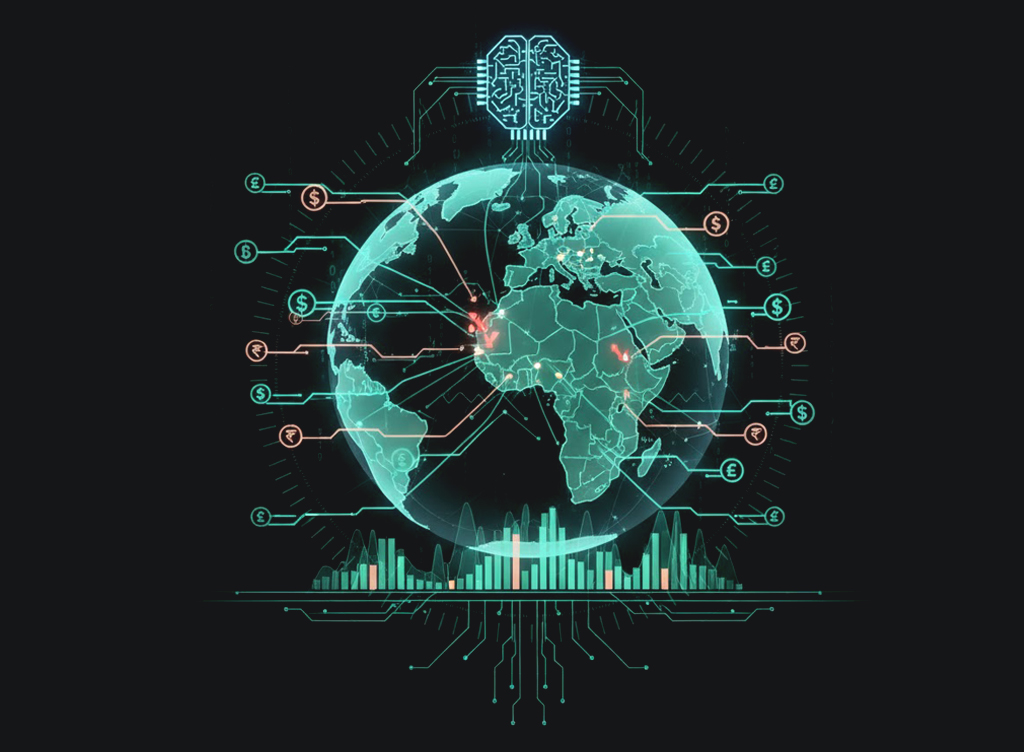

Sender & Receiver Screening with Global Risk Intelligence

Instantly verify both ends of the transaction—senders and recipients—against international sanctions lists, PEP databases, and adverse media. Our global coverage ensures that no high-risk party goes unnoticed, no matter the corridor.

Real-Time Transaction Monitoring Across Borders

Detect suspicious behavior as it happens. Our models analyze transaction timing, flow frequency, value structuring, and unusual sender/receiver patterns across corridors, delivering high-precision alerts in real time.

Sanctions Compliance Across Multiple Jurisdictions

IDYC360 ensures that your business remains compliant with evolving global sanctions obligations, from OFAC and HMT to EU, UN, and local regulatory bodies, supporting both pre- and post-transaction screening.

Configurable Rules by Corridor, Value & Velocity

Different corridors carry different risks. IDYC360 lets you create tailored compliance rules based on destination countries, customer segments, transaction amounts, or frequency, helping you detect threats without overblocking low-risk transfers.

Audit-Ready Reporting & Regulator Traceability

Maintain total auditability with detailed logs, action histories, and exportable compliance reports. Stay fully prepared for regulatory reviews, internal audits, or enforcement requests with a few clicks.

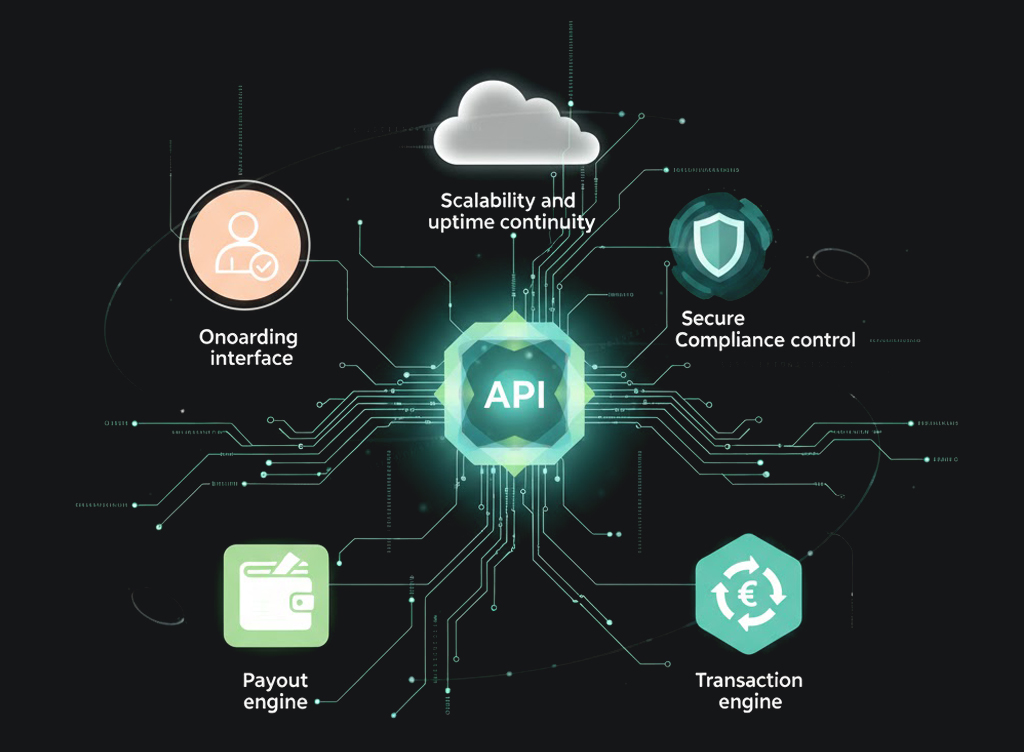

Seamless Integration into Remittance Workflows

Our API-first architecture integrates effortlessly with your existing onboarding, payout, and transaction engines. Deploy compliance controls without disrupting service uptime or customer experience.