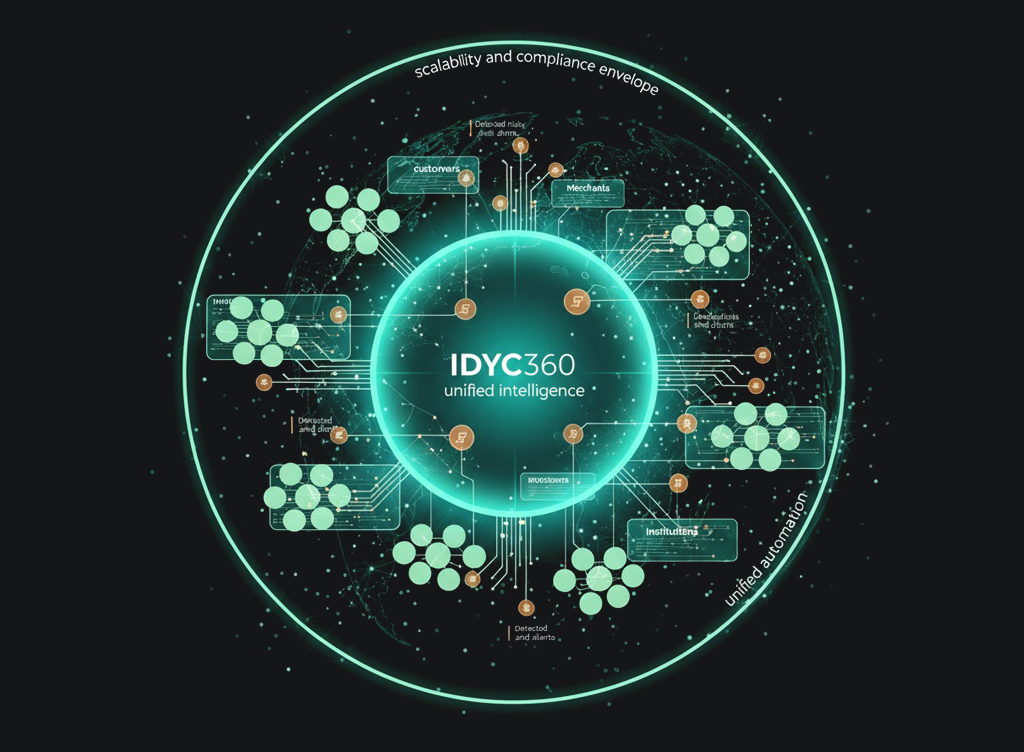

Full-Spectrum Compliance for High-Velocity Platforms

IDYC360 equips your platform with comprehensive compliance capabilities that work seamlessly in the background, delivering real-time risk detection, configurable automation, and global regulatory alignment, without disrupting the speed of your payment flows.

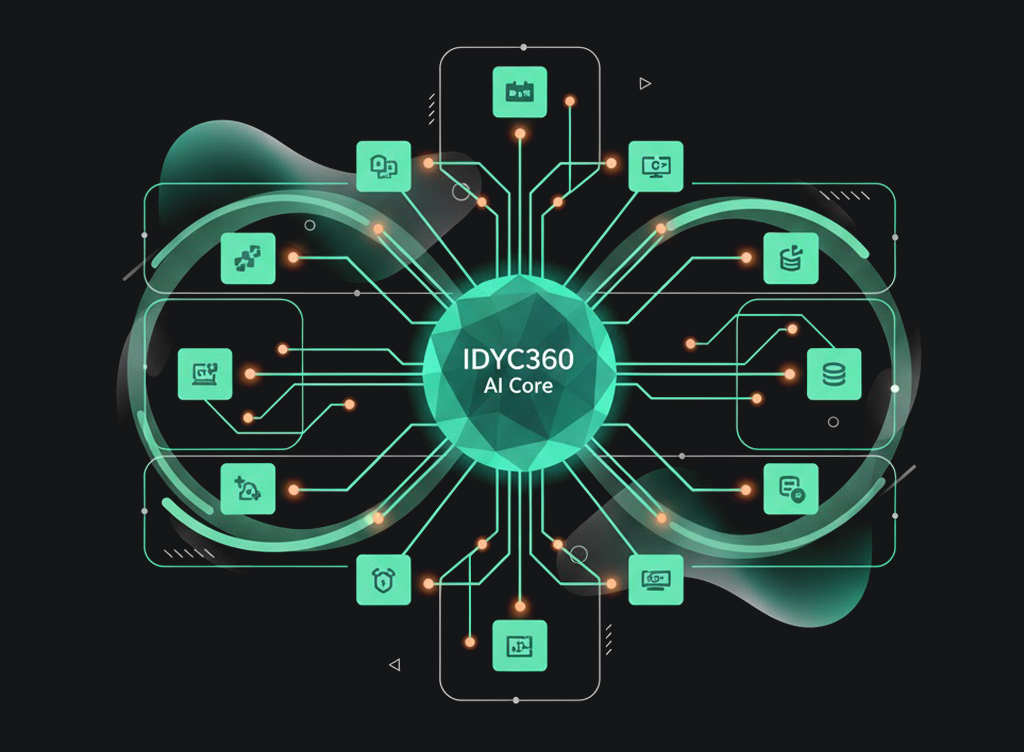

Merchant & Customer Due Diligence (KYC/KYB)

Onboard individuals and businesses with confidence through automated identity verification, real-time sanctions screening, and dynamic risk profiling—minimizing onboarding friction while staying fully compliant with AML mandates.

Cross-Border Sanctions & Watchlist Screening

Continuously screen customers, merchants, and counterparties against over 1,500 global watchlists, including OFAC, HMT, UN, and EU lists. Stay protected against sanctioned entity exposure at every transaction and lifecycle touchpoint.

Real-Time Transaction Monitoring & Anomaly Detection

Monitor transactions for irregular patterns such as velocity fraud, synthetic identities, transaction splitting, or unusual geo-behavior. AI models adapt to your platform’s specific risk environment, triggering precise, real-time alerts.

Dynamic Risk Scoring & Configurable Rules

Fine-tune compliance logic with rules that reflect your operational needs. Assign custom thresholds, set alert escalation paths, and apply different controls based on geography, merchant type, payment method, or risk category.

Adverse Media & Reputational Risk Checks

Detect potential reputational threats early by screening users and merchants against real-time global news sources and structured media intelligence. Avoid doing business with entities linked to fraud, financial crime, or brand-damaging behavior.

Flexible API Integration for Instant Deployment

Integrate IDYC360 effortlessly into your existing payment stack—from onboarding flows to core payment processing systems—via robust, secure APIs. Go live quickly and scale efficiently without disrupting operations or customer experience.