What IDYC360 Delivers for Online Trading Risk Management

Behavioral Trade Monitoring & Risk Analytics

IDYC360 continuously analyzes user trading behavior across equity, derivatives, crypto, and hybrid asset classes. Our platform uses pattern recognition and AI models to flag suspicious activity such as front-running, layering, spoofing, wash trading, and unauthorized access. Alerts are generated in real time, enabling proactive mitigation before risks escalate.

Sanctions, PEPs & RCA Screening

Protect your trading environment by screening clients and partners against global sanctions lists and politically exposed persons (PEPs) databases. Our system checks against OFAC, UN, HMT, EU, and other high-risk lists, while also screening for RCAs (Relatives and Close Associates), both at onboarding and continuously during the client lifecycle.

Adverse Media & Reputational Intelligence

Our platform aggregates data from thousands of global sources to identify negative media coverage linked to your clients or associates. Whether it’s financial fraud, regulatory violations, or political exposure, you’ll receive timely alerts, enabling you to take action before reputational damage or compliance breaches occur.

Configurable Risk Rules for Multi-Asset Models

Trading platforms operate across multiple asset types and regulatory frameworks. IDYC360 allows full customization of risk rules, screening depth, and alert thresholds based on user profile, asset class, geographic region, and trading activity, supporting flexible compliance for complex business models.

Audit-Ready Alert Management & Case Workflows

Our centralized compliance dashboard empowers analysts to investigate alerts, assign cases, document outcomes, and export regulator-ready reports. With full traceability and time-stamped logs, your organization is always prepared for audits or regulatory inquiries, without added overhead.

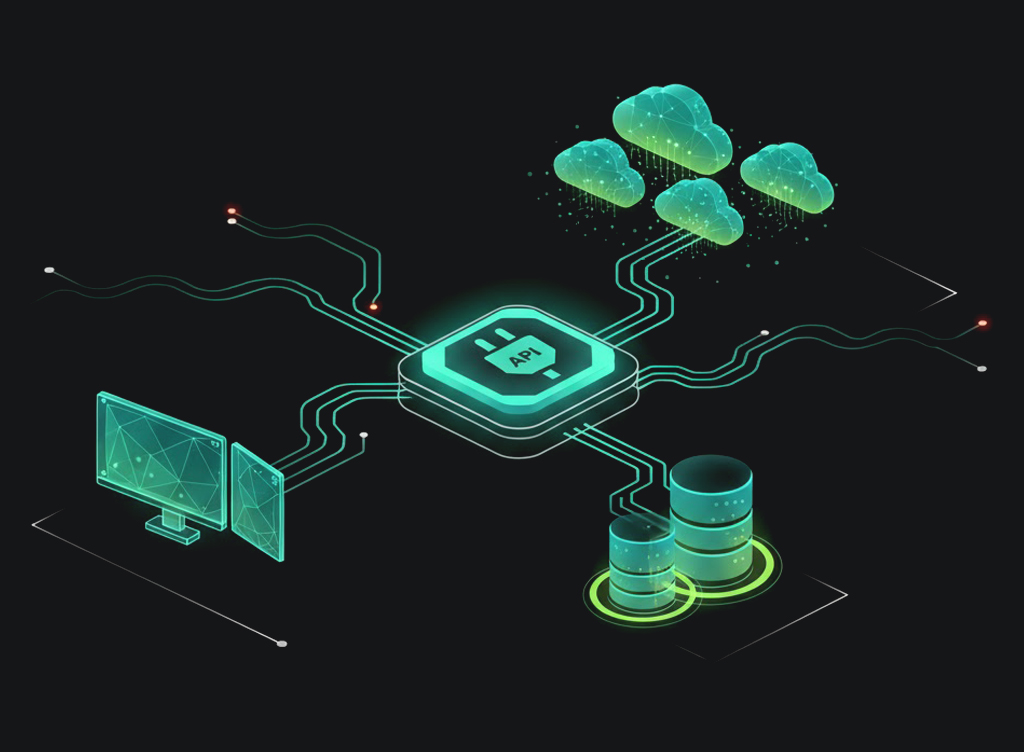

API-Based Integration with Trading Infrastructure

Whether you're running a proprietary trading platform, third-party OMS, or mobile trading app, IDYC360 integrates seamlessly via secure, RESTful APIs. This ensures real-time compliance enforcement without compromising latency, user experience, or trading performance.