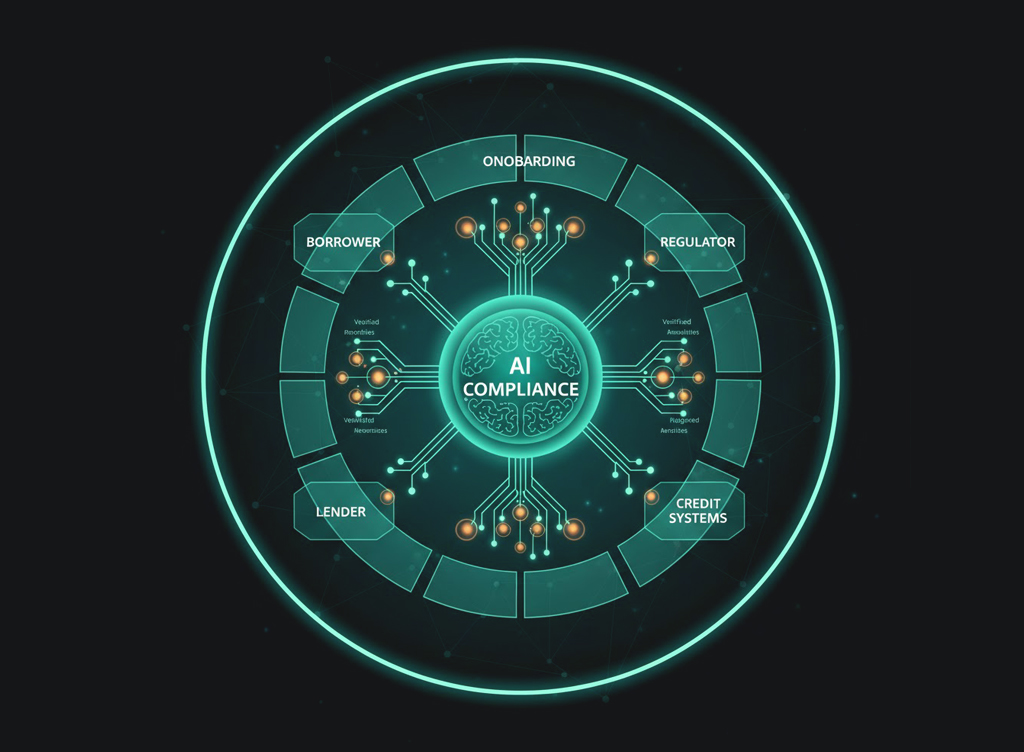

Compliance Built for Asset & Wealth Management

Asset and wealth management firms must uphold the highest standards of risk governance, often while managing sensitive, high-value client relationships across jurisdictions.

IDYC360 provides a purpose-built compliance infrastructure that empowers you to conduct deeper due diligence, screen complex ownership structures, and monitor ongoing client risk—all without disrupting client experience or portfolio performance.

KYC/KYB Screening & Identity Verification

Verify the legitimacy of borrowers—individuals or entities—during onboarding with instant checks against global sanctions, politically exposed persons (PEPs), relatives and close associates (RCAs), and adverse media databases.

Pre-Loan Risk Assessment & AML Checks

Go beyond credit scores. IDYC360 evaluates borrower profiles using real-time risk signals, including geographic exposure, entity structure, behavioral anomalies, and past compliance flags.

Ongoing Monitoring Across Loan Lifecycle

Stay alert to post-disbursement risk. Monitor borrower account activity, repayment schedules, and behavioral shifts in real time.

Global Sanctions & Watchlist Screening

Ensure continuous alignment with international compliance frameworks. IDYC360 screens customers, guarantors, co-applicants, and associated entities against over 1,500 global watchlists, including OFAC, HMT, EU, UN, and regional regulators, ensuring you meet jurisdictional requirements across consumer and commercial lending.

Configurable Workflows for Product-Specific Compliance

Different loan products carry different compliance risks. IDYC360 allows you to configure workflows for personal loans, mortgages, SME lines of credit, real estate lending, and BNPL, ensuring screening logic, alerts, and escalation paths match your lending models.

Seamless Integration into Lending Tech Stacks

Easily embed IDYC360 into your loan origination system (LOS), CRM, KYC/IDV providers, or decisioning engine using secure, flexible APIs—enabling real-time risk checks, automated workflows, and seamless compliance integration without disrupting your existing infrastructure.