Adaptive Risk Intelligence for Capital Market Firms

Whether facilitating cross-border investments, managing funds, or delivering advisory services, firms must maintain real-time control over onboarding, transactional exposure, and compliance posture, without impeding operations or client experience.

IDYC360 brings dynamic compliance oversight to regulated investment environments.

Our platform continuously assesses risk, adapts to evolving regulatory expectations, and supports institution-specific workflows, enabling your firm to move faster, remain audit-ready, and mitigate exposure before it materializes.

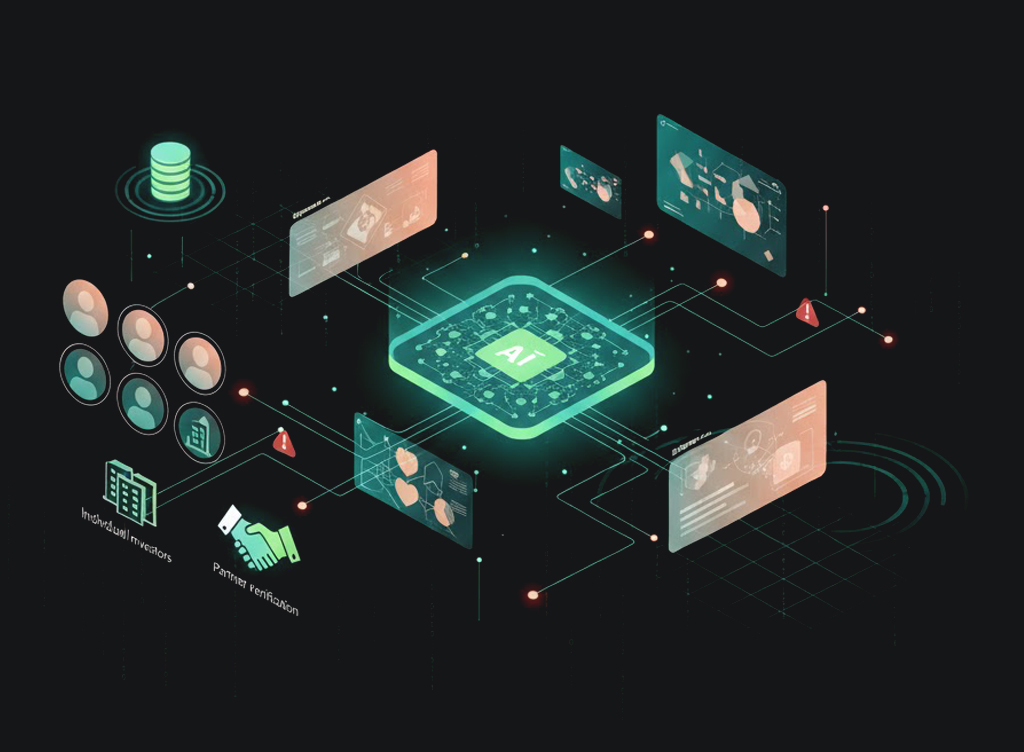

Investor & Partner Screening with Contextual Intelligence

Screen individual clients, corporate entities, and third-party partners using a global compliance dataset enriched with contextual insight. Go beyond simple matches—identify reputational and regulatory risks with clarity before engaging.

Ongoing Oversight of Fund & Transactional Activity

Monitor capital movements across portfolios, fund structures, and deal flows using machine learning models that flag transaction inconsistencies, outliers, and misuse, without overwhelming your compliance teams.

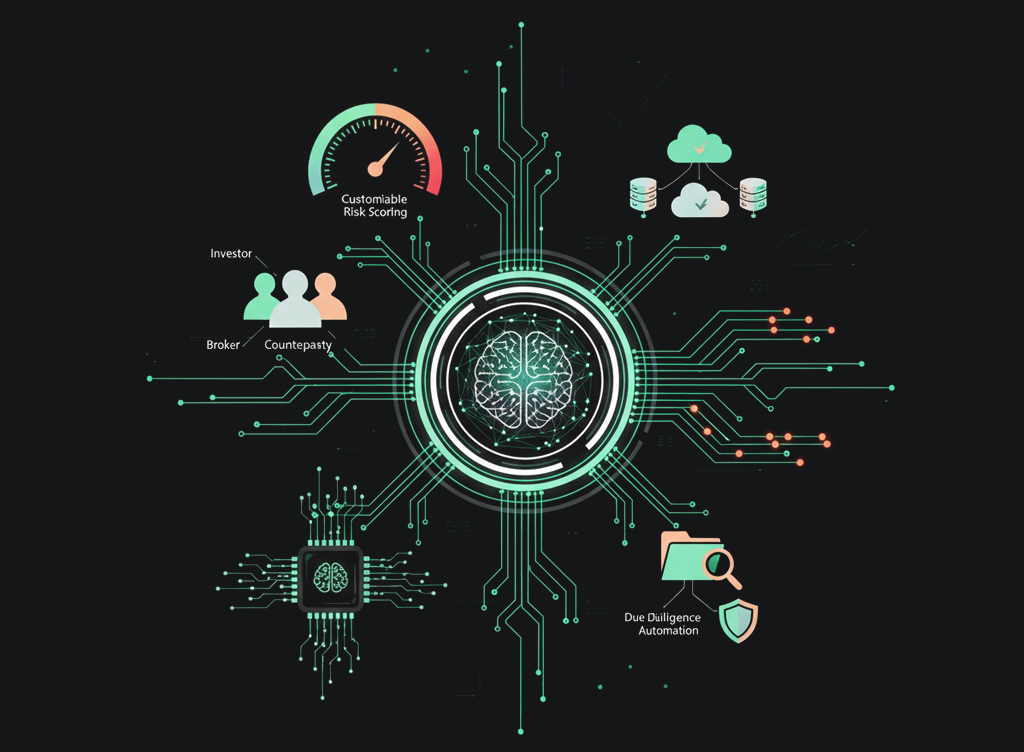

Tiered Due Diligence for Complex Client Segments

Implement flexible due diligence frameworks that adjust to client categories—whether institutional investors, family offices, or private placement vehicles. Configure risk scoring and documentation depth by entity complexity or jurisdiction.

Cross-Border Regulatory Compliance Alignment

Stay aligned with dynamic global standards, from “Markets in Financial Instruments Directive II’ (MiFID II) and “Essential Services Maintenance Act” (ESMA) in Europe to SEC, AMLD, and FATF across regions. IDYC360 ensures that compliance logic reflects local enforcement priorities, risk factors, and thresholds.

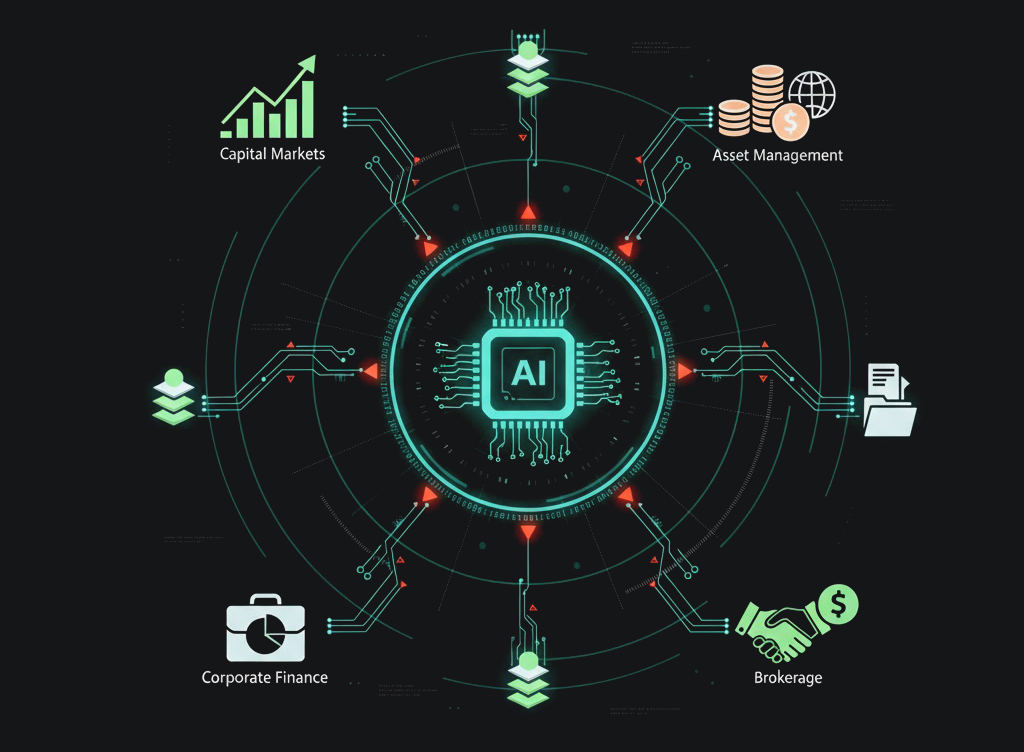

Purpose-Built Workflows for Investment Operations

Design and deploy workflows tailored to your business model—be it capital markets, discretionary asset management, corporate finance, or brokerage. Control escalation triggers, review checkpoints, and reporting obligations per service line.

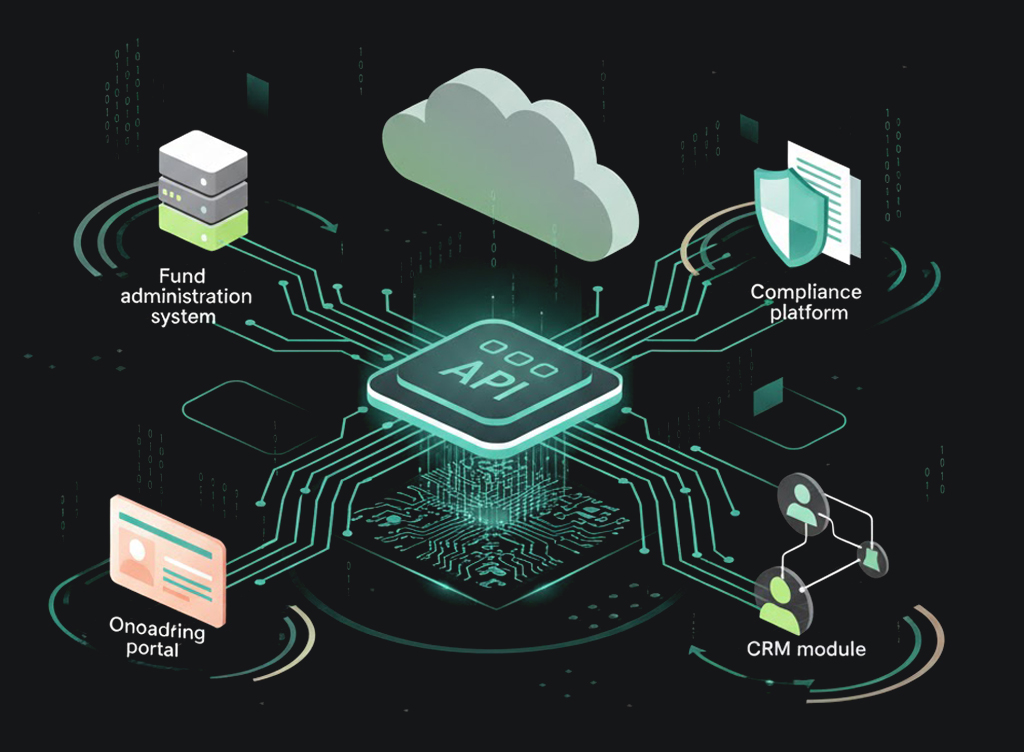

Low-Disruption Integration Across Investment Tech Stacks

Integrate seamlessly with fund administration software, client onboarding portals, CRMs, or internal compliance platforms. IDYC360’s modular APIs ensure real-time enforcement and data flow without disrupting existing workflows.