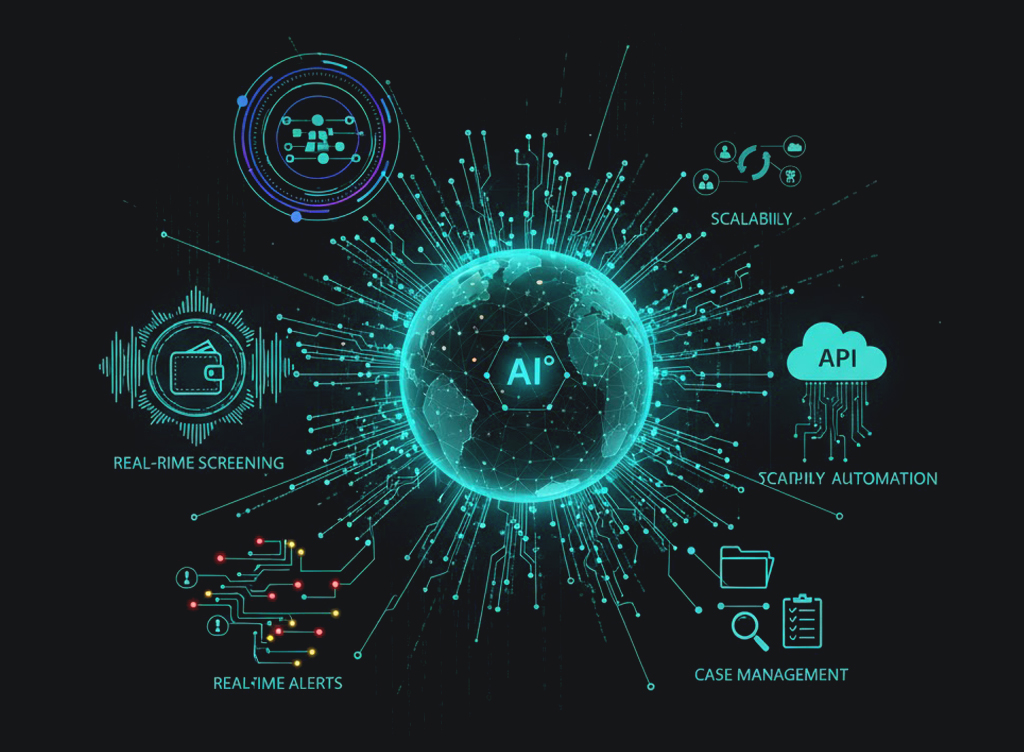

Key Capabilities for Crypto Platforms

Wallet Address Screening & Blockchain Intelligence

Monitor and screen cryptocurrency wallet addresses in real time for exposure to illicit activity. IDYC360 leverages blockchain intelligence to identify links to sanctioned entities, ransomware networks, darknet markets, and mixers, helping you assess counterparty risk before transactions occur.

AI-Based Transaction Risk Scoring

Go beyond simple flagging. Our AI models analyze behavioral patterns, transaction velocity, value fluctuations, and wallet movement across chains to detect suspicious activity, enabling early intervention and faster investigations with fewer false alerts.

KYC/KYB Screening & Enhanced Due Diligence

Verify individual and institutional users against a comprehensive set of global watchlists, PEPs, RCAs, and adverse media sources. Our configurable onboarding flows support compliance with KYC/AML requirements across user types and jurisdictions.

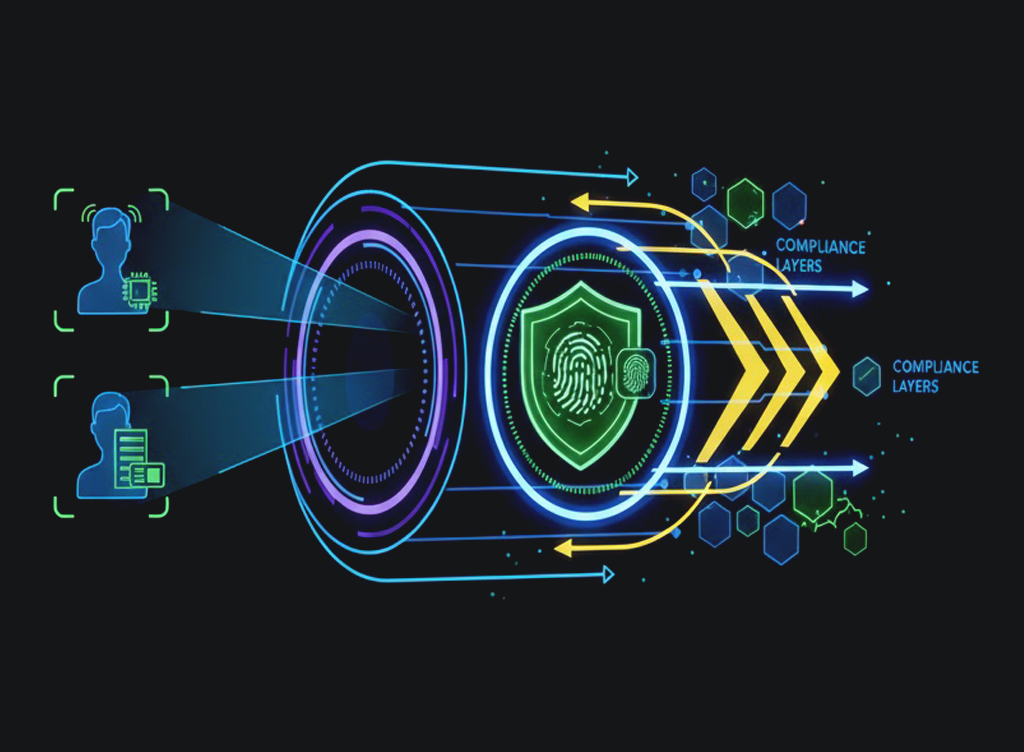

Multi-Jurisdictional Compliance Alignment

Stay ahead of changing crypto regulations. IDYC360 helps you align with international frameworks, including FATF Travel Rule, MiCA (EU), FinCEN (US), and FCA (UK). Our continuous regulatory sync ensures your policies are always up to date—without manual updates.

Accelerated Onboarding for Retail & Institutional Users

Balance speed and security with frictionless onboarding workflows. Real-time identity screening, dynamic risk scoring, and adaptive verification logic allow your platform to onboard high volumes of users without compromising compliance.

Continuous Monitoring & Instant Alerts

Don’t wait for a compliance audit to discover risk. IDYC360 provides real-time monitoring across wallet activity, user behavior, and ecosystem interactions, triggering instant alerts when high-risk indicators are detected.