Built for Banking. Trusted for Compliance.

Built for modern banking demands and trusted by compliance teams worldwide, our platform delivers seamless AML, sanctions, and fraud prevention across jurisdictions. Reduce false positives, accelerate onboarding, and stay audit-ready—without compromising security, scalability, or customer experience. Purpose-built for institutions navigating rapid change, regulatory pressure, and financial crime complexity.

AI-Powered Transaction Fraud Detection

Detect suspicious transactions instantly with machine learning models trained on banking-specific fraud patterns. Prevent financial crime before it escalates.

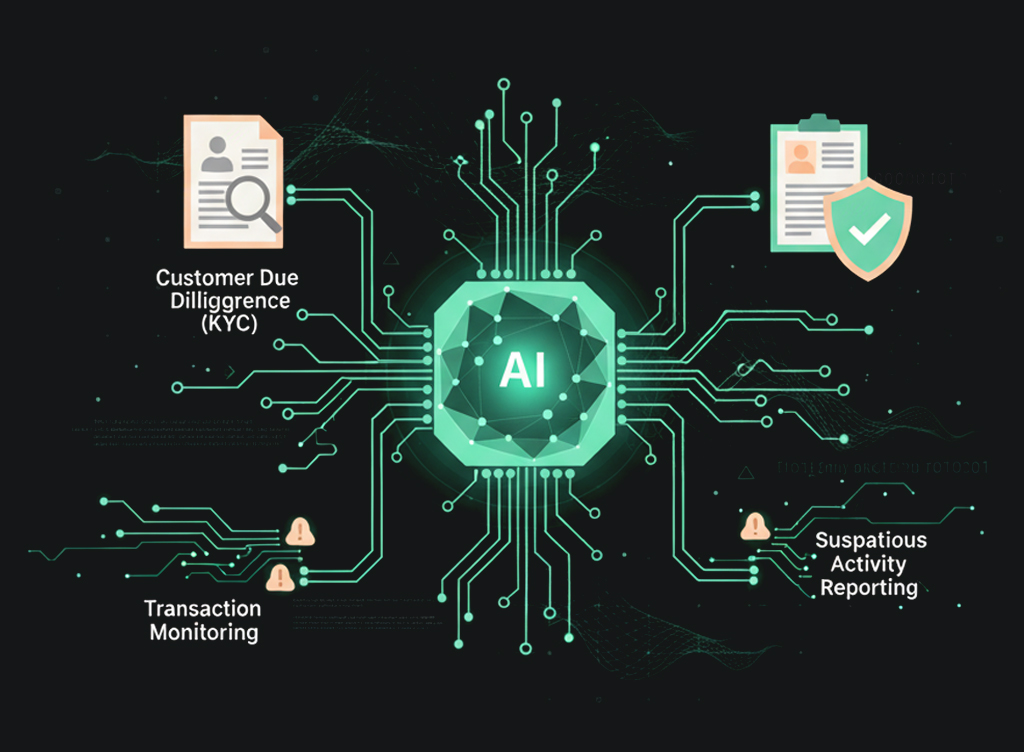

End-to-End AML Automation

Automate critical AML processes, including customer due diligence, transaction monitoring, and suspicious activity reporting. Reduce manual effort while improving decision accuracy across the compliance lifecycle.

Real-Time Sanctions & Watchlist Screening

Continuously screen individuals and entities against global and regional watchlists—OFAC, UN, HMT, EU, and more. Receive instant alerts when a match is detected, keeping your institution audit-ready at all times.

PEPs, RCAs & Adverse Media Risk Detection

Identify high-risk clients and politically sensitive entities through contextual screening of PEPs, their close associates, and adverse media sources—all updated in real time.

Accelerated Customer Onboarding

Reduce onboarding time with real-time identity screening, configurable workflows, and instant decision-making. Meet KYC requirements without slowing customer acquisition.

Audit-Ready Reporting & Case Management

Maintain transparent records with automated logs, detailed case histories, and downloadable reports. Improve team productivity and meet regulatory audit demands with ease.