Compliance Built for Asset & Wealth Management

Asset and wealth management firms must uphold the highest standards of risk governance, often while managing sensitive, high-value client relationships across jurisdictions.

IDYC360 provides a purpose-built compliance infrastructure that empowers you to conduct deeper due diligence, screen complex ownership structures, and monitor ongoing client risk—all without disrupting client experience or portfolio performance.

Enhanced Due Diligence (EDD) for High-Risk Clients

Perform deep, risk-based due diligence on high-net-worth individuals, politically exposed persons, and institutional clients. IDYC360 automates sanctions, PEP, RCA, and media screening with dynamic profiles that update as client exposure or risk changes.

UBO Discovery & Complex Ownership Screening

Uncover hidden ownership risks across multi-tiered corporate structures, offshore entities, and trusts. IDYC360 maps shareholder relationships, identifies beneficial owners, and flags indirect risks often missed in manual reviews.

Portfolio-Wide Transaction Surveillance

Monitor incoming and outgoing flows across managed portfolios, investment accounts, and client transactions. Our AI models are trained to identify suspicious behaviors specific to the wealth segment, minimizing false positives and ensuring fast, accurate decisions.

Global Sanctions & Watchlist Screening

Screen clients and connected parties against hundreds of international watchlists—including OFAC, HMT, EU, UN, and more—with ongoing monitoring that alerts your team when a client's risk profile changes post-onboarding.

Configurable Risk Scoring & Relationship Mapping

Build and apply custom risk models based on client tier, geography, asset class exposure, and relationship depth. Visual dashboards provide a clear view of linkages between individuals, entities, and third-party intermediaries.

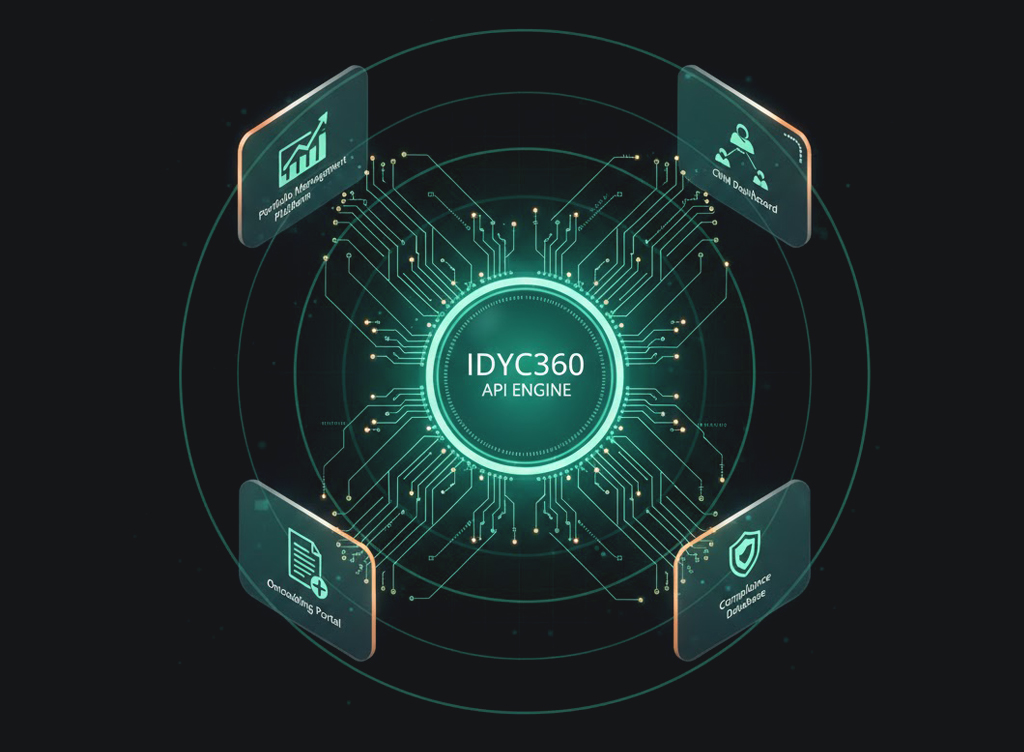

Seamless Integration Into Portfolio & CRM Systems

Connect IDYC360 with your existing wealth management platforms, onboarding portals, and CRMs via secure APIs. Streamline compliance processes across all departments—without added complexity or delays.