SLP: Scottish Limited Partnership

Definition

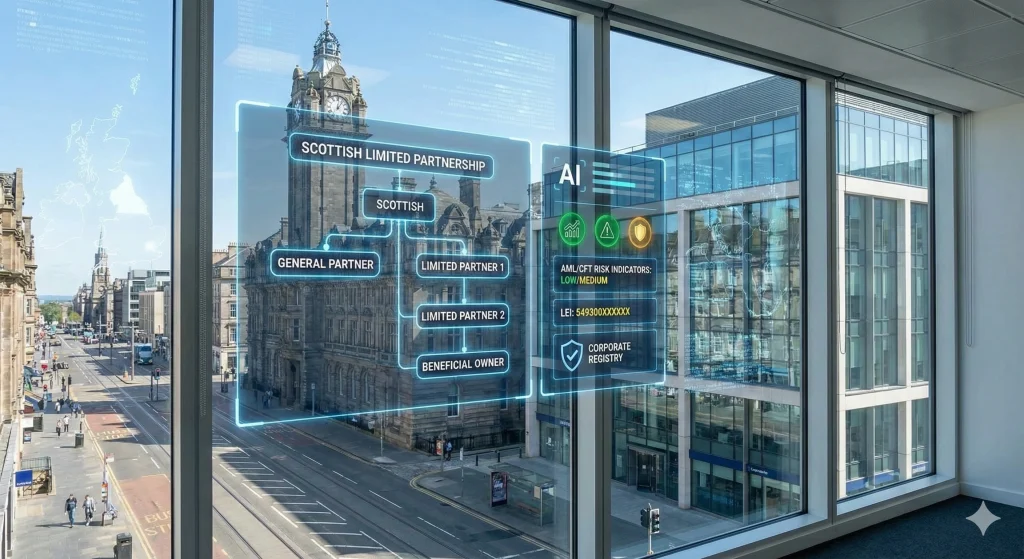

A Scottish Limited Partnership (SLP) is a form of limited partnership established under the laws of Scotland, governed primarily by the Limited Partnerships Act 1907 and subsequent UK regulations.

Unlike limited partnerships formed in other parts of the United Kingdom, an SLP has a distinct legal personality separate from its partners.

This unique characteristic allows the partnership itself to own assets, enter into contracts, and sue or be sued in its own name.

From an AML/CFT perspective, SLPs are considered higher-risk legal structures because they combine legal personality with historically low transparency, cross-border usability, and the potential for nominee arrangements.

These features have made SLPs vulnerable to misuse for money laundering, sanctions evasion, and complex international financial crime schemes.

Explanation

An SLP consists of at least one general partner and one or more limited partners.

The general partner manages the partnership and bears unlimited liability for its obligations, while limited partners contribute capital and have liability limited to their investment, provided they do not participate in management.

What distinguishes SLPs from similar UK partnership structures is their legal personhood.

This allows SLPs to open bank accounts, hold property, and transact independently of their partners.

Historically, SLPs were not required to disclose persons with significant control (PSC), which created opacity around beneficial ownership.

Although reforms have strengthened disclosure requirements, legacy risks and international misuse patterns continue to attract regulatory scrutiny.

SLPs have been used legitimately in private equity, investment funds, and joint ventures.

However, their international portability and perceived legitimacy within the UK legal system have also made them attractive vehicles for criminals seeking to obscure ownership, layer transactions, or distance illicit proceeds from predicate offences.

SLPs in AML/CFT Frameworks

SLPs are directly relevant to AML/CFT frameworks because they fall within the category of legal persons that can be exploited to disguise beneficial ownership and control.

Financial institutions onboarding SLPs must treat them as higher-risk entities and apply enhanced due diligence measures where appropriate.

Key AML/CFT considerations include:

- Verification of all partners, including corporate general or limited partners.

- Identification and verification of ultimate beneficial owners and persons with significant control.

- Assessment of cross-border ownership chains and foreign-linked partners.

- Understanding the commercial rationale for the SLP’s structure and activities.

- Ongoing monitoring for transactions inconsistent with the stated business purpose.

International bodies and national regulators have repeatedly cited SLPs as examples of legal arrangements requiring enhanced transparency and risk-based controls.

Key Components of a Scottish Limited Partnership

Legal Structure

An SLP typically includes:

- At least one general partner with unlimited liability.

- One or more limited partners whose liability is capped.

- Registration with the UK Registrar of Companies (Companies House).

- A partnership agreement defining rights, obligations, and profit-sharing arrangements.

- A registered office address in Scotland.

Legal Personality

The legal personality of an SLP enables it to:

- Own and transfer assets in its own name.

- Open and operate bank accounts.

- Enter into contracts independently.

- Continue existing despite changes in partnership composition.

This feature increases operational flexibility but also introduces AML/CFT risk where ownership and control are obscured.

Risks and Red Flags Associated With SLPs

SLPs have been linked to multiple high-profile money laundering and sanctions evasion cases.

Key risk factors include:

- Use of offshore or high-risk jurisdiction partners.

- Complex ownership chains involving shell companies.

- Nominee general partners with no real economic substance.

- Minimal physical presence or business activity in Scotland.

- Disproportionate transaction volumes relative to stated operations.

Indicative red flags include:

- Inability to clearly identify beneficial owners or controllers.

- Frequent changes in partners without clear justification.

- Banking activity is inconsistent with the declared business purpose.

- Use of professional intermediaries to distance owners from control.

- Transactions involving sanctioned jurisdictions or high-risk sectors.

Common Methods & Techniques of Misuse

Criminal networks may exploit SLPs using several typologies:

- Layering through international bank accounts, where the SLP acts as a pass-through entity.

- Use of nominee partners to obscure true ownership and control.

- Trade-based money laundering, using false invoicing between SLPs and offshore counterparties.

- Sanctions evasion, leveraging UK registration to lend credibility to illicit transactions.

- Integration of illicit proceeds through investments, loans, or inter-company transfers.

Because SLPs can operate internationally while maintaining a UK legal footprint, they are particularly attractive in cross-border laundering schemes.

Examples of SLP-Related Money Laundering Scenarios

Cross-Border Layering Scheme

An SLP with a general partner incorporated in a secrecy jurisdiction opens multiple bank accounts in Europe.

Illicit funds are transferred through these accounts under the guise of consulting fees, creating layers of transactions that obscure the origin of funds.

Trade-Based Money Laundering

An SLP is inserted into a trade chain between two related offshore companies.

Over-invoiced goods are routed through the SLP, enabling illicit value transfer disguised as legitimate trade payments.

Sanctions Circumvention

A sanctioned individual controls an SLP indirectly through nominee partners.

The SLP conducts international transactions using its UK registration to bypass enhanced scrutiny, routing funds to restricted jurisdictions.

Impact on Financial Institutions

Failure to appropriately manage SLP risk can lead to significant consequences:

- Regulatory penalties for inadequate customer due diligence.

- Reputational damage linked to facilitating opaque structures.

- Exposure to sanctions enforcement actions.

- Increased investigation and remediation costs.

- Termination of correspondent banking relationships.

Financial institutions are increasingly expected to demonstrate that they understand and actively mitigate risks associated with SLP clients.

Challenges in Detecting & Preventing SLP Abuse

Key challenges include:

- Complex ownership chains spanning multiple jurisdictions.

- Reliance on third-party intermediaries for formation and administration.

- Difficulty verifying foreign partners and controllers.

- Legacy SLPs formed before enhanced transparency rules.

- Limited economic footprint despite high transaction volumes.

Effective mitigation requires a combination of documentary verification, independent corroboration, and intelligence-led monitoring.

Regulatory Oversight & Governance

The UK has introduced reforms to address SLP misuse, including:

- Mandatory registration of persons with significant control.

- Enhanced information-sharing between Companies House, law enforcement, and regulated entities.

- Greater scrutiny of limited partnerships under economic crime legislation.

- Increased powers for authorities to query, remove, or correct inaccurate filings.

Despite these reforms, regulators continue to expect financial institutions to apply their own risk-based controls rather than relying solely on registry data.

Importance of Addressing SLP Risks in AML/CFT Compliance

Addressing SLP-related risks is essential for maintaining financial integrity and regulatory compliance.

Effective controls enable institutions to:

- Prevent misuse of UK legal structures for financial crime.

- Detect complex layering and cross-border laundering schemes.

- Meet enhanced due diligence expectations for high-risk legal persons.

- Protect reputational capital and correspondent relationships.

- Support national and international efforts to combat economic crime.

SLPs illustrate how legal form, jurisdictional credibility, and opacity can intersect to create elevated AML/CFT risk.

Institutions must therefore treat SLPs as inherently higher-risk structures requiring continuous scrutiny.

Related Terms

- Limited Partnership

- Beneficial Ownership

- Shell Company

- Nominee Director

- Trade-Based Money Laundering

- Sanctions Evasion

References

- UK Government – Guidance on Limited Partnerships and Scottish Limited Partnerships

- Companies House – People with Significant Control (PSC) requirements

- UK Economic Crime and Corporate Transparency Act – Overview and reforms

- Financial Action Task Force (FATF) – Guidance on Transparency and Beneficial Ownership

- National Crime Agency (UK) – Typologies on misuse of UK legal entities

Ready to Stay

Compliant—Without Slowing Down?

Move at crypto speed without losing sight of your regulatory obligations.

With IDYC360, you can scale securely, onboard instantly, and monitor risk in real time—without the friction.