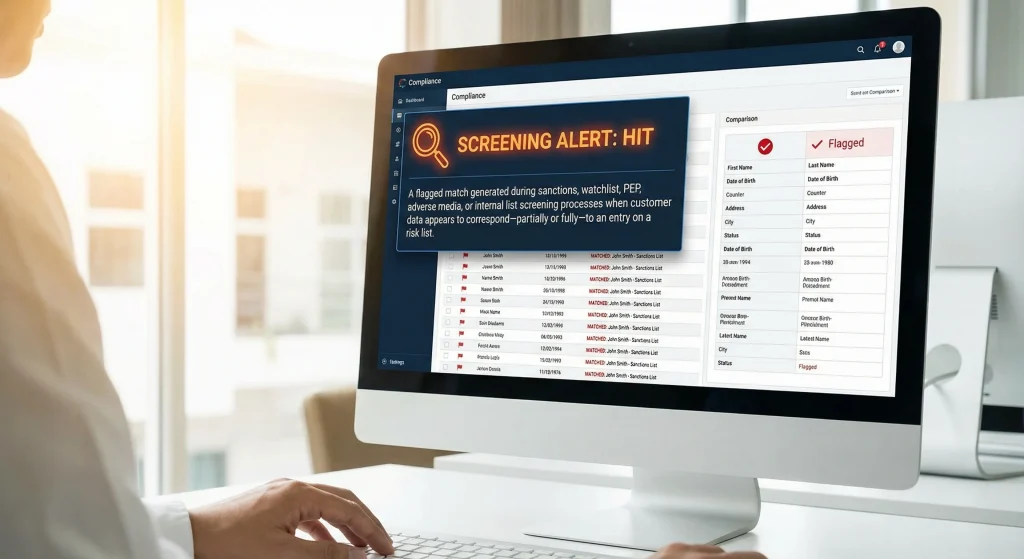

Hit (Screening Alert)

Definition

A Hit, commonly referred to as a Screening Alert, is a flagged match generated during sanctions, watchlist, PEP, adverse media, or internal list screening processes when customer data appears to correspond, partially or fully, to an entry on a risk list.

Screening systems compare names, identifiers, and related attributes against databases maintained by regulatory authorities and commercial intelligence providers.

When a potential match occurs, the system generates a Hit that requires review to determine whether it is a true match (true positive) or a false match (false positive).

In AML/CFT contexts, a Hit serves as an early-warning signal that a customer, transaction, or associated entity may pose elevated money laundering, terrorist financing, sanctions, or financial crime risk.

Institutions must investigate Hits promptly to ensure compliance with regulatory obligations, prevent prohibited transactions, and maintain risk-based controls.

Explanation

Screening is a foundational AML/CFT requirement, ensuring institutions do not conduct business with sanctioned persons, criminals, entities associated with terrorism, or individuals with high reputational, legal, or financial crime exposure.

When screening tools detect potential similarities between customer information and watchlist entries, they produce Hits for review.

Hits may result from several factors, including:

- Similar or identical names across global populations.

- Variations in spelling, transliteration, or character sets.

- Incomplete or outdated regulatory data.

- Inconsistent or missing identifiers.

Hits are not automatically indicative of wrongdoing. Instead, they represent potential risks that require human or advanced analytical review.

The ultimate objective is to determine whether a Hit corresponds to an actual match (true positive requiring mitigation or reporting) or a false positive (non-match requiring dismissal and documentation).

Different types of Hits may arise across onboarding, ongoing CDD, payments screening, trade finance, correspondent banking, or high-risk event triggers.

Institutions integrate rule-based logic, fuzzy matching algorithms, phonetic models, and machine learning to refine screening quality and reduce unnecessary alerts.

Hit in AML/CFT Frameworks

Hits play multiple roles across AML/CFT systems.

They drive decision-making and escalate controls during onboarding and ongoing monitoring.

Onboarding and KYC Reviews

Hits generated during KYC onboarding help institutions evaluate whether prospective customers:

- Pose sanctions exposure,

- Are involved in criminal or terrorist networks,

- Appear in adverse media reports,

- Hold political positions, increasing corruption or bribery risk.

Onboarding Hits determine whether accounts can be opened, require further investigation, or need risk-based restrictions.

Ongoing Monitoring

As customer data evolves and watchlists update, screening systems continue to generate Hits through periodic or real-time monitoring.

These signals help institutions detect emerging risks and apply:

- Enhanced due diligence,

- Restrictions on transactions,

- Account reviews,

- Escalated case management workflows.

Payments and Transaction Screening

Real-time transaction screening generates Hits when originators or beneficiaries match risk lists.

These Hits may trigger:

- Transaction blocks,

- Manual review,

- Escalation to sanctions teams,

- Filing of suspicious transaction reports (STRs) when warranted.

Sanctions Compliance

Sanctions screening Hits are highly sensitive and require rapid resolution.

Institutions must ensure that no sanctioned individual or entity receives financial services.

A sanctions-related Hit may result in:

- Immediate freeze or rejection of a transaction,

- Account blocking or reporting obligations,

- Escalation to regulatory authorities.

Trade Finance and Correspondent Banking

Screening Hits in trade or correspondent banking contexts require careful evaluation of:

- Vessel names,

- Corporate structures,

- Intermediary banks,

- Supply chain partners,

- Jurisdictional red flags.

These areas often produce complex multilayered Hits with high regulatory scrutiny.

Types of Hits

Screening systems generate multiple categories of Hits, each requiring distinct investigative approaches.

Positive Match (Confirmed Hit)

A confirmed match occurs when customer or transaction details fully align with a watchlist entry.

These require:

- Immediate mitigation actions,

- Potential filing of STRs,

- Transaction blocking or freezing,

- Enhanced risk classification.

False Positive

These Hits occur when the system flags a match due to name similarity or partial attribute overlap.

They require:

- Documentation,

- Rationale for dismissal,

- Continuous refinement of screening thresholds.

False Negative (Missed Hit)

This occurs when the system fails to detect a legitimate match, leading to regulatory and operational risk.

Causes may include:

- Data quality issues,

- Overly restrictive matching thresholds,

- Weak fuzzy matching capabilities.

Partial Matches

Partial Hits require additional investigation due to:

- Minor spelling differences,

- Variations in date or place of birth,

- Incomplete customer data.

Contextual or Linked Hits

These occur when associated persons or entities appear in watchlists, even if the customer is not explicitly listed.

Examples include:

- Family members of PEPs,

- Subsidiaries of sanctioned companies,

- Beneficial owners of high-risk entities.

Investigating Screening Hits

Investigators follow structured processes to review and disposition Hits.

A balanced mix of qualitative analysis and rule-driven evaluation enables accurate outcomes.

Initial Verification Steps

Investigators validate basic details:

- Customer name spelling and variations,

- Dates and places of birth,

- Nationality and residency,

- Beneficial ownership information,

- Corporate structure identifiers.

Deep-Dive Analysis

When initial checks remain inconclusive, additional steps include:

- Reviewing adverse media content,

- Checking third-party intelligence sources,

- Analysing historical customer behaviour,

- Examining corporate records or registry filings.

Risk-Based Decisioning

The investigator must classify the Hit as:

- A true positive,

- A false positive,

- A case requiring escalation to senior compliance teams.

Documentation and Audit Trail

AML regulations require transparent documentation that includes:

- Methodology used to dismiss or escalate the Hit,

- Evidence reviewed,

- Final rationale for disposition,

- Timing and workflow steps.

This ensures auditability and supports regulatory reviews.

Escalation Protocols

Certain Hits require escalation, especially those involving:

- Sanctions lists,

- Terrorism-related designations,

- High-risk jurisdiction exposure.

Escalation may involve senior management, legal teams, or sanctions specialists.

Examples of Hit (Screening Alert) Scenarios

Sanctions Screening Hit

A customer name matches an OFAC-listed individual with a similar spelling.

Side-by-side comparison of DOB and address clarifies it is a false positive.

PEP Match Hit

A customer shares the same name as a senior political leader. Investigation reveals they reside in a different jurisdiction with different identifiers.

Adverse Media Hit

Search results show a similar name involved in fraud cases. Further review demonstrates the customer’s occupation, age, and region do not match.

Corporate Screening Hit

A company appears similar to a sanctioned entity with almost identical trade names. Corporate registry searches confirm separate ownership and incorporation details.

Transaction Screening Hit

A payment screened in real time triggers a Hit due to the beneficiary name partially matching a UN sanctions entry. The transaction is temporarily held for review.

Vessel Or Shipping Hit

A vessel name resembles a designated vessel engaged in illicit maritime activity. IMO number verification confirms it is a different vessel.

Impact on Financial Institutions

Screening Hits influence operational, financial, and regulatory aspects of AML compliance.

Operational Burden

Excessive false positives increase workload for compliance teams, causing:

- Backlogs,

- Investigation delays,

- Resource inefficiencies.

Regulatory Exposure

Failure to identify true matches exposes institutions to:

- Enforcement penalties,

- Reputational damage,

- Supervisory restrictions,

- Mandatory remediation programmes.

Customer Experience Impact

Delays triggered by Hit investigations may impact:

- Account opening time,

- Transaction processing speed,

- Overall customer trust.

Risk Management Enhancement

Well-managed screening Hits improve institutional risk management by enabling early detection of:

- Fraud networks,

- Sanctions exposure,

- Criminal infiltration.

Data and System Dependence

Screening effectiveness relies on:

- Clean and consistent customer data,

- High-quality list sources,

- Timely system updates.

Challenges in Managing Screening Hits

High False Positive Rates

Name-matching challenges often generate excessive alerts, especially in regions with common surnames or transliteration issues.

Data Quality Limitations

Poor-quality customer data or missing identifiers undermine screening accuracy and lead to misclassification.

Regulatory Complexity

Global institutions must align with:

- Multiple jurisdictional lists,

- Overlapping sanctions regimes,

- Regional compliance expectations.

Technological Constraints

Older systems may lack:

- Fuzzy matching capabilities,

- AI-driven disambiguation,

- Cross-referencing intelligence layers.

Evolving Risk Landscapes

Frequent updates to sanctions lists, geopolitical events, and new criminal networks create dynamic screening environments requiring continuous adaptability.

Regulatory Oversight & Governance

Financial Action Task Force (FATF)

FATF mandates screening for sanctions, PEPs, and high-risk parties under its risk-based framework.

National Regulators

Authorities such as OFAC, HM Treasury, EU Council, and others enforce screening obligations and penalise failures.

Financial Intelligence Units (FIUs)

FIUs rely on STR filings triggered by true positive Hits linked to suspicious activities.

International Watchlist Providers

These include:

- UN Security Council Consolidated List,

- EU Restrictive Measures List,

- OFAC Sanctions Lists.

These sources form the core of screening databases.

Industry Standards Bodies

Organisations like the Wolfsberg Group publish best practices for screening governance and alert investigation.

Importance of Screening Hits in AML/CFT Compliance

Hits function as critical warning indicators within AML/CFT systems.

They alert institutions to potential exposure to:

- Sanctions violations,

- Criminal entities,

- High-risk individuals,

- Reputational harm.

Effective Hit management enables institutions to:

- Detect early warning signs,

- Prevent prohibited transactions,

- Mitigate systemic risk,

- Meet regulatory compliance obligations.

Integrating screening alerts within broader intelligence-led architectures, such as IDYC360’s intelligence-first AML framework, strengthens multilayered defences across onboarding, payments, and ongoing monitoring.

Related Terms

- Sanctions Screening

- Watchlist Filtering

- False Positive

- PEP Screening

- Adverse Media Screening

- Beneficial Ownership

- Risk-Based Monitoring

References

- FATF – International Standards and Guidance

- OFAC Sanctions Lists

- UN Security Council Consolidated List

- EU Sanctions and Restrictive Measures

Ready to Stay

Compliant—Without Slowing Down?

Move at crypto speed without losing sight of your regulatory obligations.

With IDYC360, you can scale securely, onboard instantly, and monitor risk in real time—without the friction.